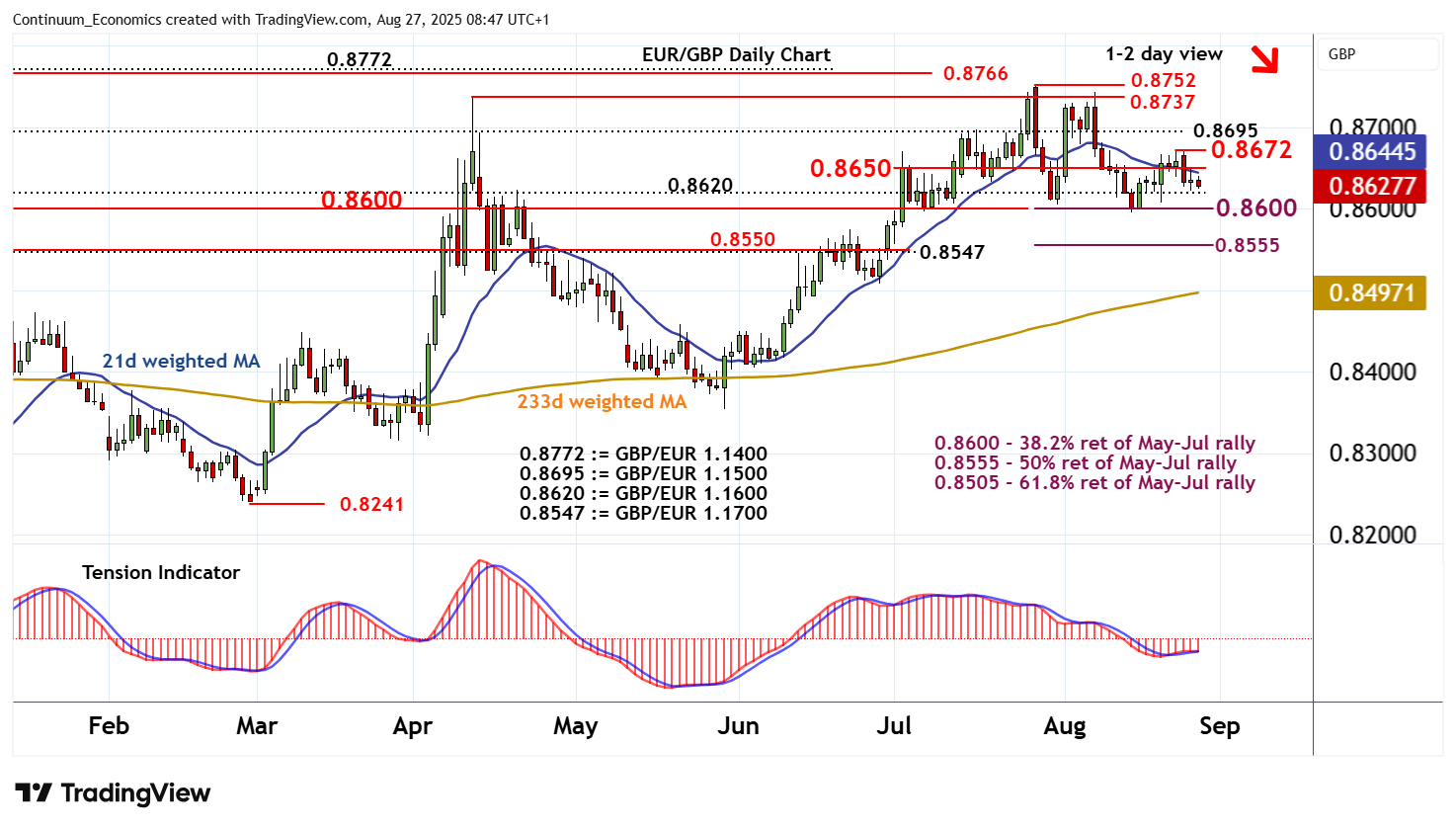

Chart EUR/GBP Update: Consolidating - studies under pressure

Little change, as prices extend cautious trade within the 0.8620/50 range

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8737 | ** | 11 Apr (m) high | S1 | 0.8620 | * | GBP/EUR 1.1600 | |

| R3 | 0.8695 | ** | GBP/EUR 1.1500 | S2 | 0.8600 | ** | cong, 38.2% ret | |

| R2 | 0.8672 | * | 22 Aug (w) high | S3 | 0.8555 | ** | 50% ret of May-Jul rally | |

| R1 | 0.8650 | ** | congestion | S4 | 0.8547/50 | ** | GBP/EUR 1.1700; cong |

Asterisk denotes strength of level

08:40 BST - Little change, as prices extend cautious trade within the 0.8620/50 range. Intraday studies are under pressure and daily readings have turned bearish, highlighting room for a break below support at 0.8620, (GBP/EUR 1.1600). Focus will then turn to strong support at 0.8600, where oversold intraday studies could prompt short-term reactions. Broader weekly charts are also negative, pointing to room for a later break below 0.8600 and confirmation of a near-term top in place at the 0.8752 current year high of 28 July. Late-July losses will then target the 0.8555 Fibonacci retracement. Meanwhile, resistance remains at congestion around 0.8650 and should cap any immediate tests higher