Published: 2025-12-16T00:34:13.000Z

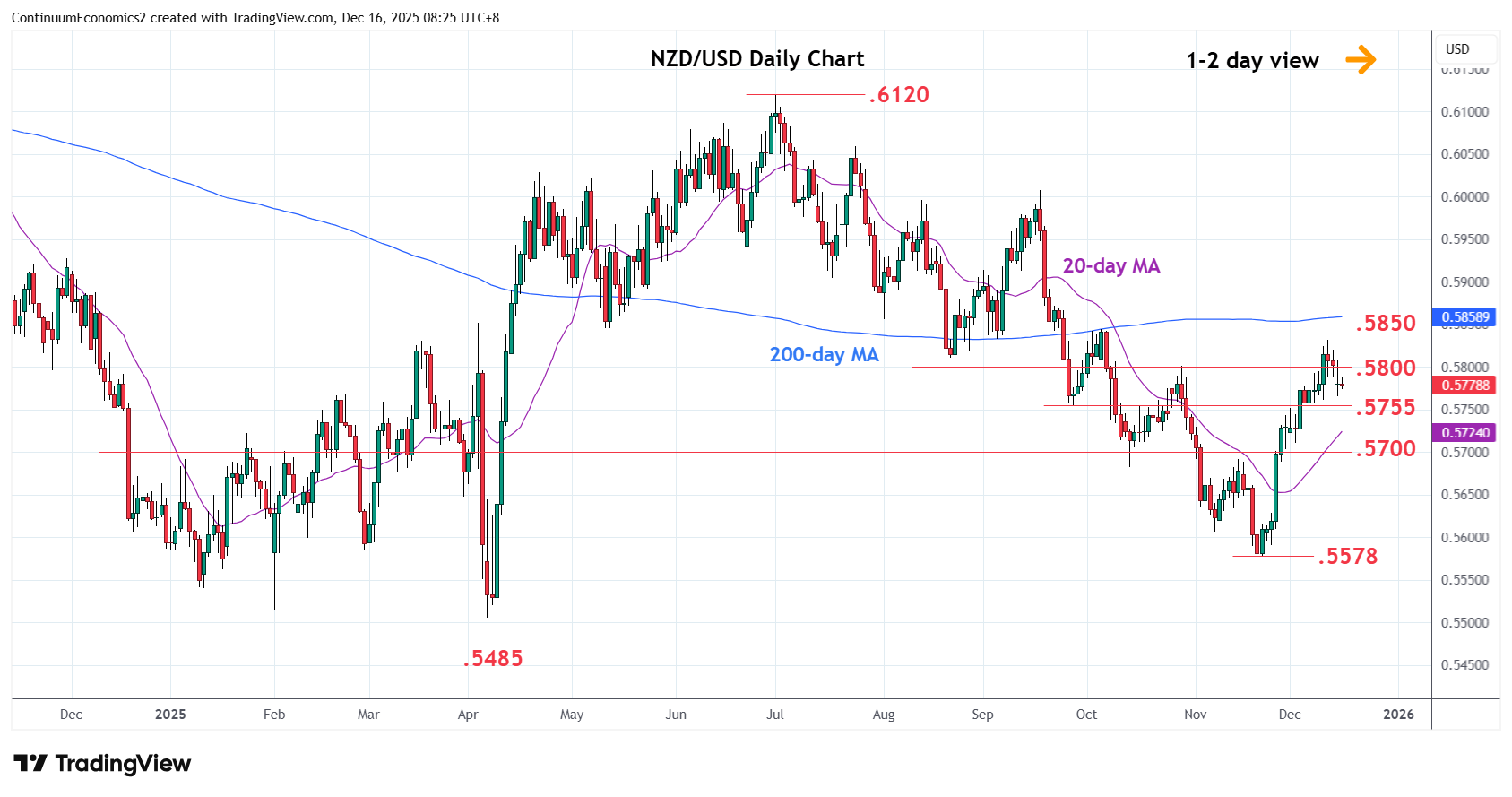

Chart NZD/USD Update: Leaning lower in consolidation

1

Leaning lower from the .5830 high as prices consolidate raly from the .5578, November low

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | .5950 | * | congestion | S1 | .5755/50 | * | Sep low, congestion | |

| R3 | .5910 | * | 61.8% Jul/Nov fall | S2 | .5700/.5682 | ** | congestion, Oct low | |

| R2 | .5850/55 | ** | 50%, 1 Aug low | S3 | .5650 | * | congestion | |

| R1 | .5830 | * | 11 Dec high | S4 | .5606 | 7 Nov low |

Asterisk denotes strength of level

00:25 GMT - Leaning lower from the .5830 high as prices consolidate rally from the .5578, November low. Daily studies are unwinding overbought readings and suggest room to extend corrective pullback to support at .5755/50 congestion. Break here will see potential for deeper correction to the .5700 level. Corrective pullback are expected to give way to renewed buying interest later. Above the .5830 high will see room to strong resistance at the .5850/55, 50% Fibonacci level and 1st August low. Break will extend gains to retrace losses from the .6120 July high to the .5910, 61.8% Fibonacci level.