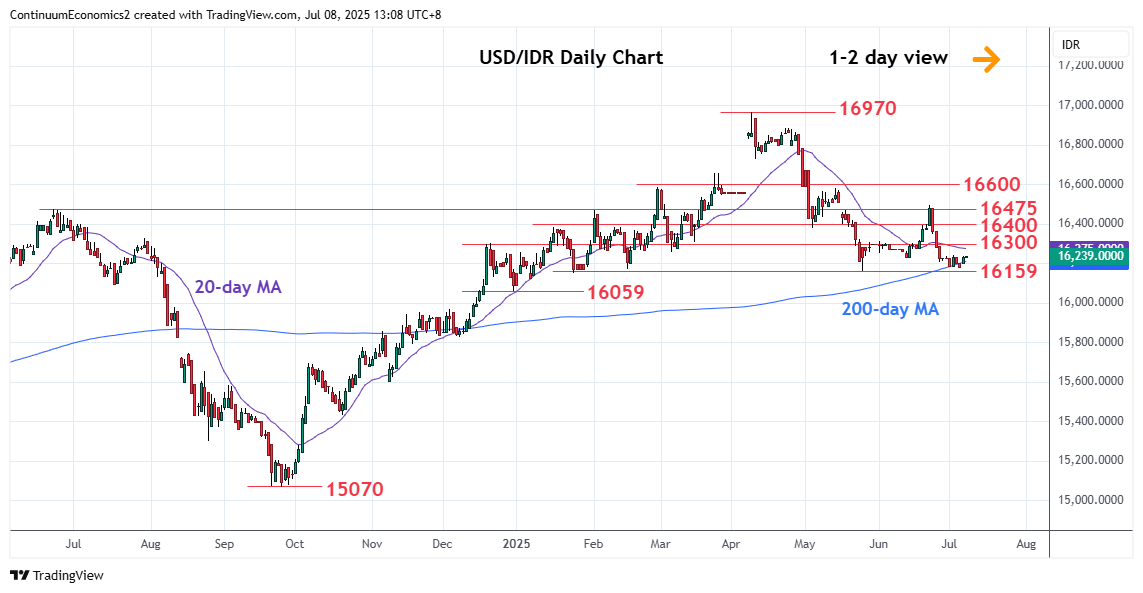

Ranging around the 16200 level as prices consolidate losses from the 16495, June high

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 16584 | ** | 14 May high | S1 | 16159 | ** | May low | |

| R3 | 16495 | ** | Jun high | S2 | 16059 | * | 31 Dec low | |

| R2 | 16400 | * | congestion | S3 | 16000 | * | 50% Sep/Apr rally | |

| R1 | 16300 | * | congestion | S4 | 15970 | * | 4 Dec high |

Asterisk denotes strength of level

05:15 GMT - Ranging around the 16200 level as prices consolidate losses from the 16495, June high. Daily studies have turned up from oversold areas but gains are likely to remain limited with resistance at the 16300/16400 congestion area expected to cap and sustain losses from the 16495 high. Corrective bounce is expected to give way to renewed selling pressure later, break of the 16159 May low will confirm a top in place at the 16970 April high and further retrace the September/April rally. Lower will see extension to 16059 support then the 16000 level and 50% Fibonacci level.