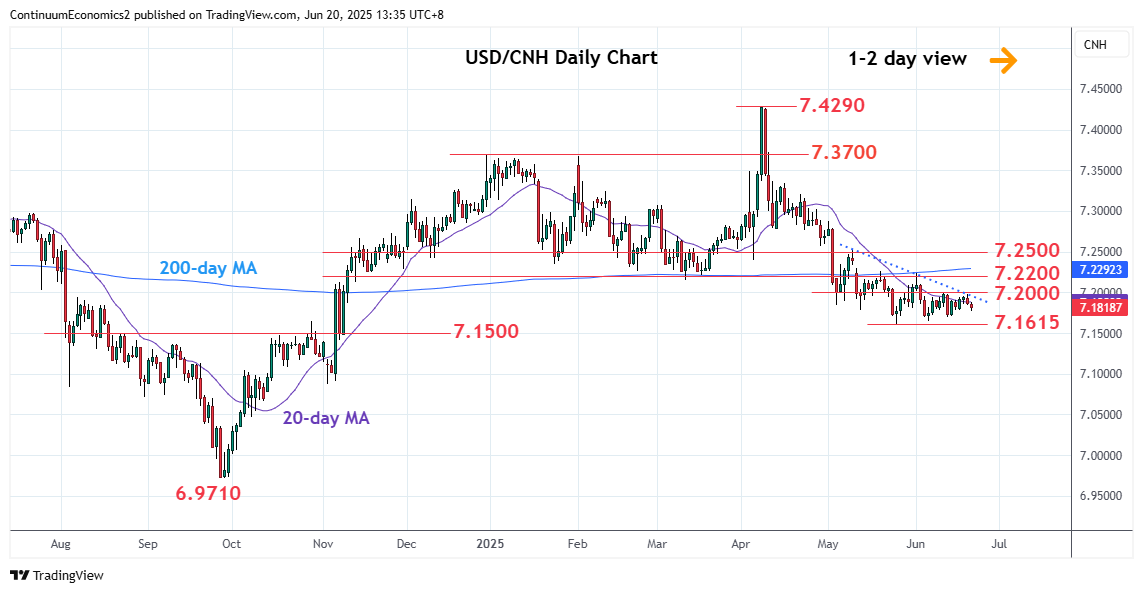

Settled back from test of the May trendline as prices extend consolidation below resistance at the 7.2000 congestion

| Level | Imp | Comment | Level | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 7.2635 | * | 38.2% Apr/May fall | S1 | 7.1700 | * | 12 Jun low | |

| R3 | 7.2500 | * | congestion | S2 | 7.1615 | ** | 26 May YTD low | |

| R2 | 7.2200 | ** | congestion | S3 | 7.1500 | * | Oct high | |

| R1 | 7.2000 | * | congestion | S4 | 7.1460 | * | 61.8% Sep/Apr rally |

Asterisk denotes strength of level

05:40 GMT - Settled back from test of the May trendline as prices extend consolidation below resistance at the 7.2000 congestion. Daily studies have turned lower from overbought areas and suggest risk for pullback to retest the 7.1700 and 7.1615 lows. Below these will see deeper pullback to retrace the September/April rally and see room to support at 7.1500 October high and 7.1460, 61.8% Fibonacci level. Meanwhile, resistance at the 7.2000 congestion is expected to cap. Clearance here is needed to ease the downside pressure and see room for stronger corrective bounce to 7.2200 resistance.