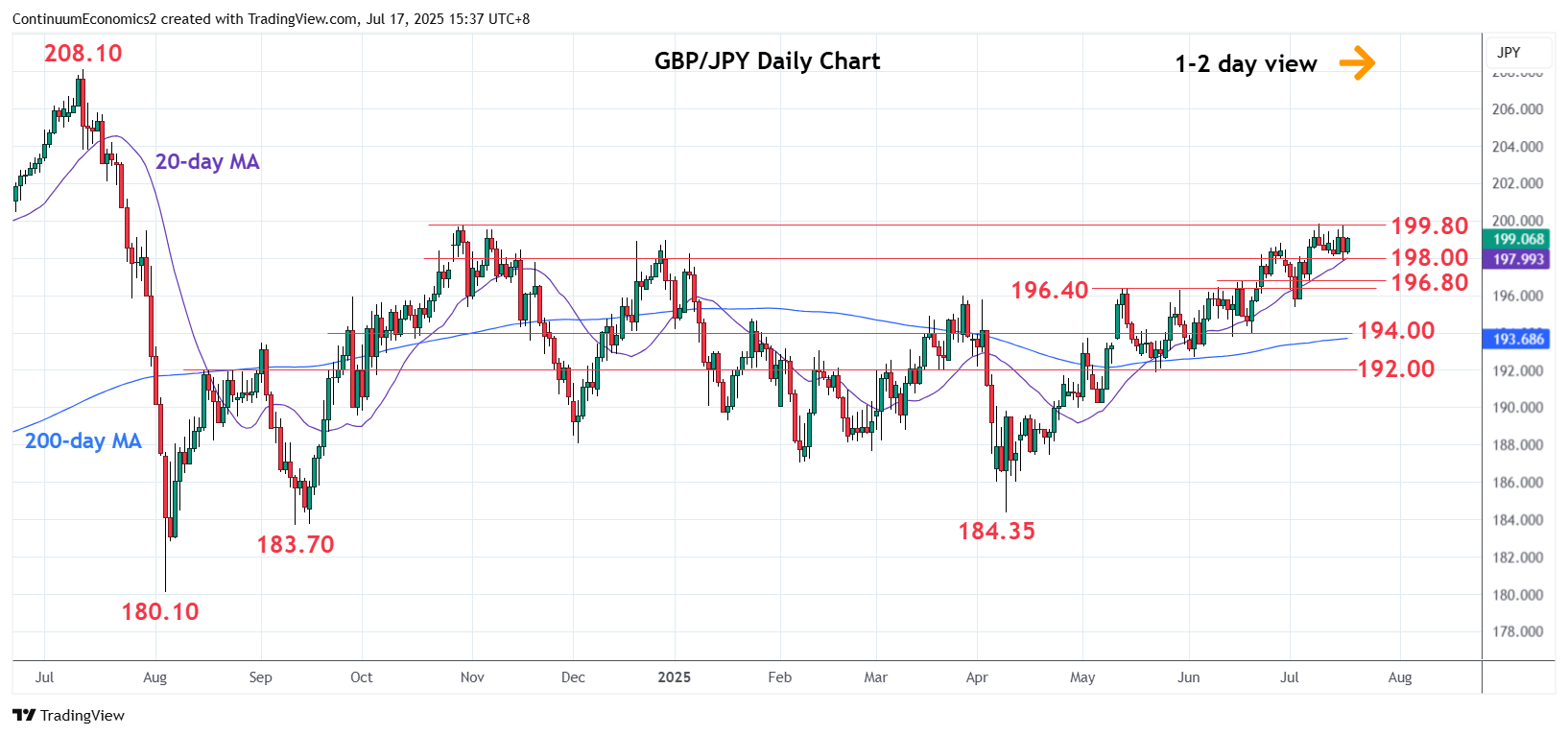

Extending consolidation below the 199.80, October 2024 and current year highs

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 203.80 | * | 12 Jul 2024 low | S1 | 198.00 | * | congestion | |

| R3 | 201.50 | * | 76.4% Jul/Aug 2024 fall | S2 | 196.80 | * | congestion | |

| R2 | 200.70 | * | May 2024 high | S3 | 196.40 | ** | May high | |

| R1 | 199.80 | ** | Oct high | S4 | 195.35 | ** | 2 Jul low |

Asterisk denotes strength of level

07:45 GMT - Extending consolidation below the 199.80, October 2024 and current year highs. Prices are unwinding the overbought daily studies and see risk for pullback to retrace strong gains from the 184.35, April YTD low. Break of support at 198.00 congestion will open up deeper pullback to strong support at the 196.80/196.40, congestion and May high. Meanwhile, resistance at 199.80 high is expected to cap. Break here will further retrace the sharp July/August 2024 losses and see room to 200.70 resistance then 201.50, 76.4% Fibonacci level.