Published: 2025-03-18T11:59:29.000Z

Chartbook: Chart EUR/CHF: Turning away from significant lows as studies show improvement

Senior Technical Strategist

3

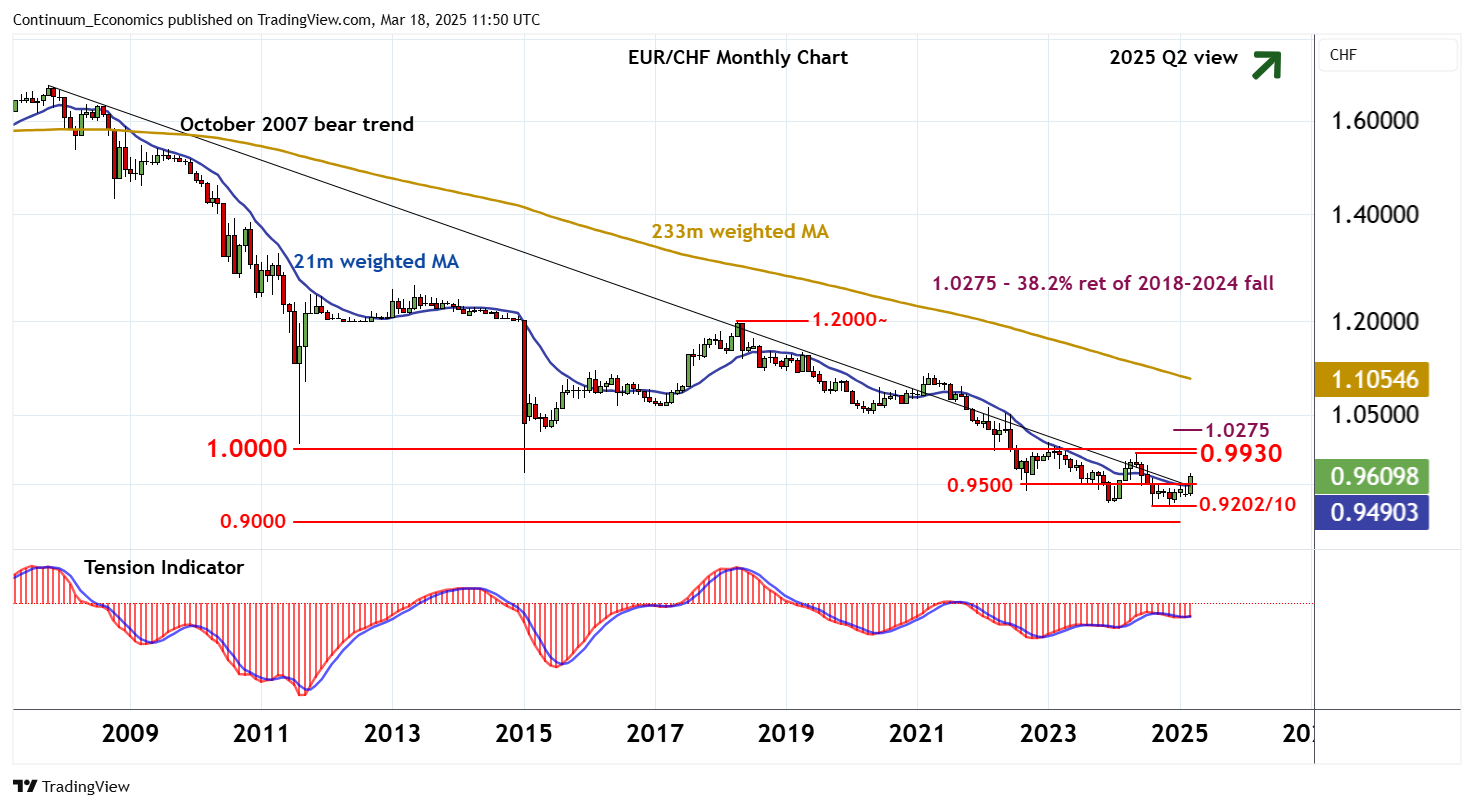

Consolidation above critical support at the 0.9202/10 all-time lows from August-November 2024 is giving way to a bounce

Consolidation above critical support at the 0.9202/10 all-time lows from August-November 2024 is giving way to a bounce,

with prices breaking above the 2007 falling trendline and previous resistance at 0.9500.

Monthly stochastics are improving and the monthly Tension Indicator is also rising, highlighting a more constructive tone and potential for further strength into the coming weeks.

A monthly close above 0.9500 would further improve sentiment and complete a multi-month accumulation base above 0.9202/10, with focus then turning to critical resistance at the 0.9930 year high of May 2024 and psychological resistance at 1.0000.

Already overbought weekly stochastics could limit any initial tests in consolidation, before a close above here extends gains towards the 1.0275 Fibonacci retracement.

Meanwhile, support is at congestion around 0.9500,

and extends to further congestion around 0.9350.

A break back into here would turn sentiment neutral and delay bullish development, as prices then settle into consolidation.

Further losses, however, would add weight to sentiment and put focus back on critical support at 0.9202/10, where positive longer-term charts should prompt renewed buying interest.