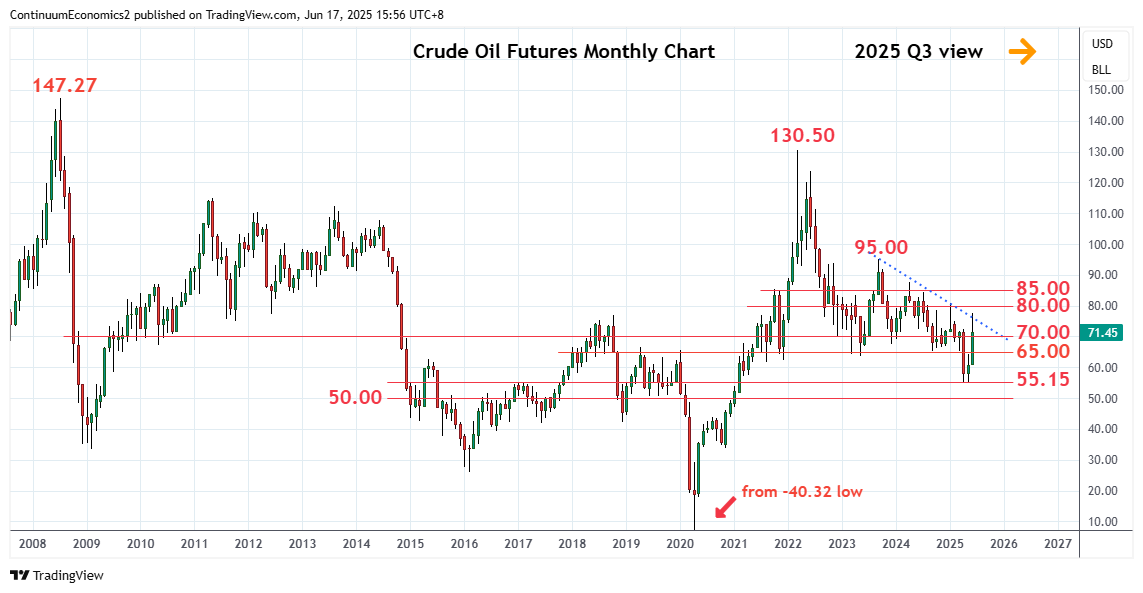

Chartbook: US Chart Crude Oil Futures: Rebound correcting 2023/2025 losses

Break of the 64.00/65.00 congestion has given way to sharp break through 72.00 to reach towards the 78.00 level.

Volatile trade at the start of Q2 saw sharp losses from the 72.00 level reaching fresh 4-year low 55.15. Consolidation above the latter has since given way to sharp break of resistance at the 64.00/65.00 congestion and the 72.00 level to reach towards the 78.00 level.

Bullish momentum highlights room for stronger gains in volatile trade going forward. Above the 78.00 level will see room for stronger gains to retrace losses from the September 2023 high to the 80.00 figure and 61.8% Fibonacci retracement. Would expected reaction here but a later clearance cannot be ruled out. Higher will see room for stronger correction to 84.50/85.00 resistance which is expected to cap. Corrective gains are expeted to give way to renewed selling pressure later.

Meanwhile, support is raised to the 70.00/68.00 congestion area. Would take break here to open up room for deeper pullback to strong support at 65.30/65.00, the 2024 year low. Close below this will return focus to the downside and see room to retest the 60.00 level and the 55.15 low.