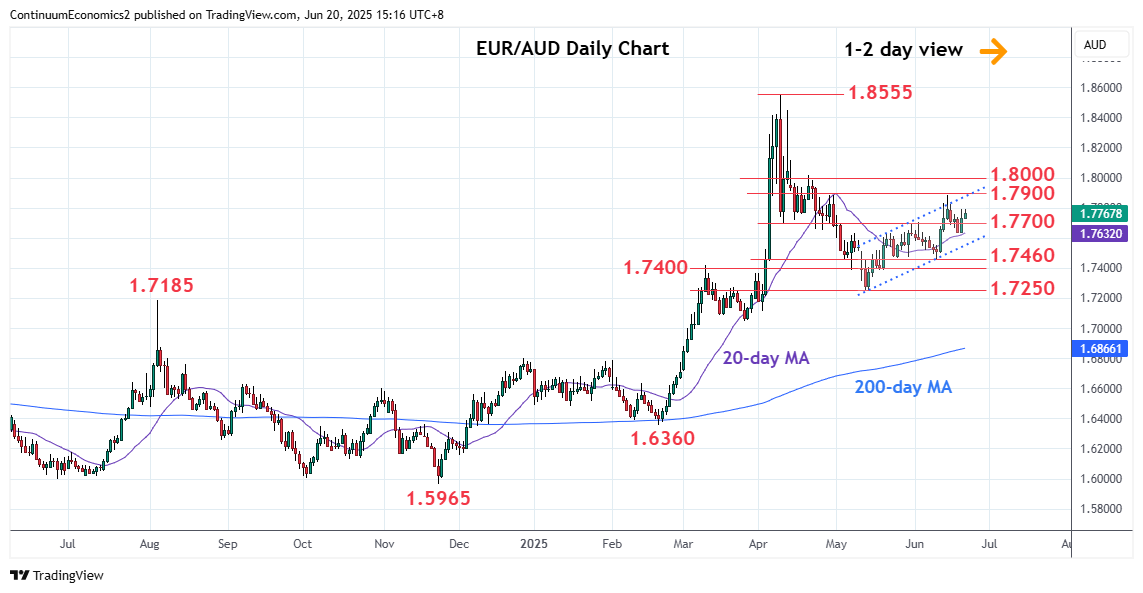

Remains within the channel from the 1.7250 May low as prices extend choppy gains to retrace the April/May losses

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.8055 | * | 61.8% Apr/May fall | S1 | 1.7700 | * | congestion | |

| R3 | 1.8000 | ** | figure, congestion | S2 | 1.7600 | * | congestion | |

| R2 | 1.7900 | ** | 50% Apr/May fall | S3 | 1.7460 | ** | 10 Jun low | |

| R1 | 1.7800 | * | congestion | S4 | 1.7400 | * | congestion |

Asterisk denotes strength of level

07:25 GMT - Remains within the channel from the 1.7250 May low as prices extend choppy gains to retrace the April/May losses. Positive daily studies suggest scope for retest of the 1.7900, congestion and 50% Fibonacci level. Clearance here will open up room to the strong resistance at 1.8000. Corrective gains are expected to give way to renewed selling pressure later. Would take break of support at the 1.7700/1.7600 congestion area to open up room for retest of strong support at 1.7460/1.7400 area. Below this will return focus to 1.7250 May low and see room to extend losses from the April YTD high at 1.8555.