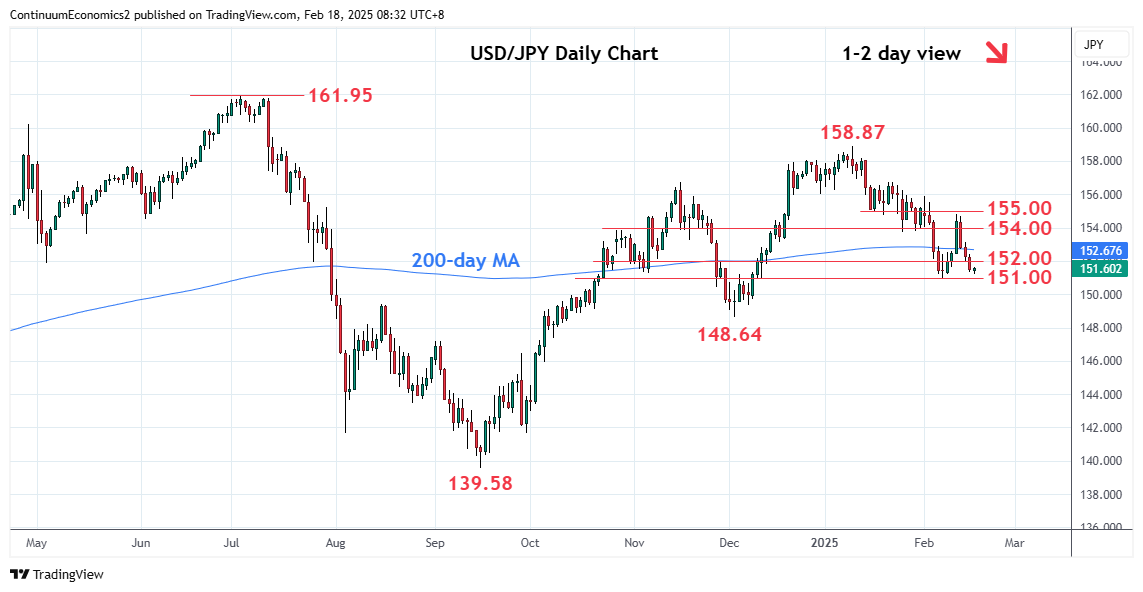

Just shy of the 151.00 level as prices consolidate steep drop from the 154.80 high of last week

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 154.80/00 | ** | 12 Feb high, congestion | S1 | 151.00/93 | ** | congestion, 7 Feb YTD low | |

| R3 | 154.00 | * | congestion | S2 | 150.45 | * | 27 Nov low | |

| R2 | 152.70 | * | 200-day MA | S3 | 150.00 | * | congestion | |

| R1 | 152.00 | * | figure | S4 | 149.20 | * | 50% Sep/Jan rally |

Asterisk denotes strength of level

00:40 GMT - Just shy of the 151.00 level as prices consolidate steep drop from the 154.80 high of last week and unwind the oversold intraday studies. Bearish structure keeps pressure on the downside and break here will extend losses from the January high and see room to minor support at 150.45 then the 150.00 figure. Below this will shift focus to the 148.64 low of December. Meanwhile, resistance is lowered to the 152.00 level and regaining this will open up room for stronger bounce to the 152.70/153.00, 200-day MA and congestion area which is expected to cap.