Published: 2025-07-31T13:43:08.000Z

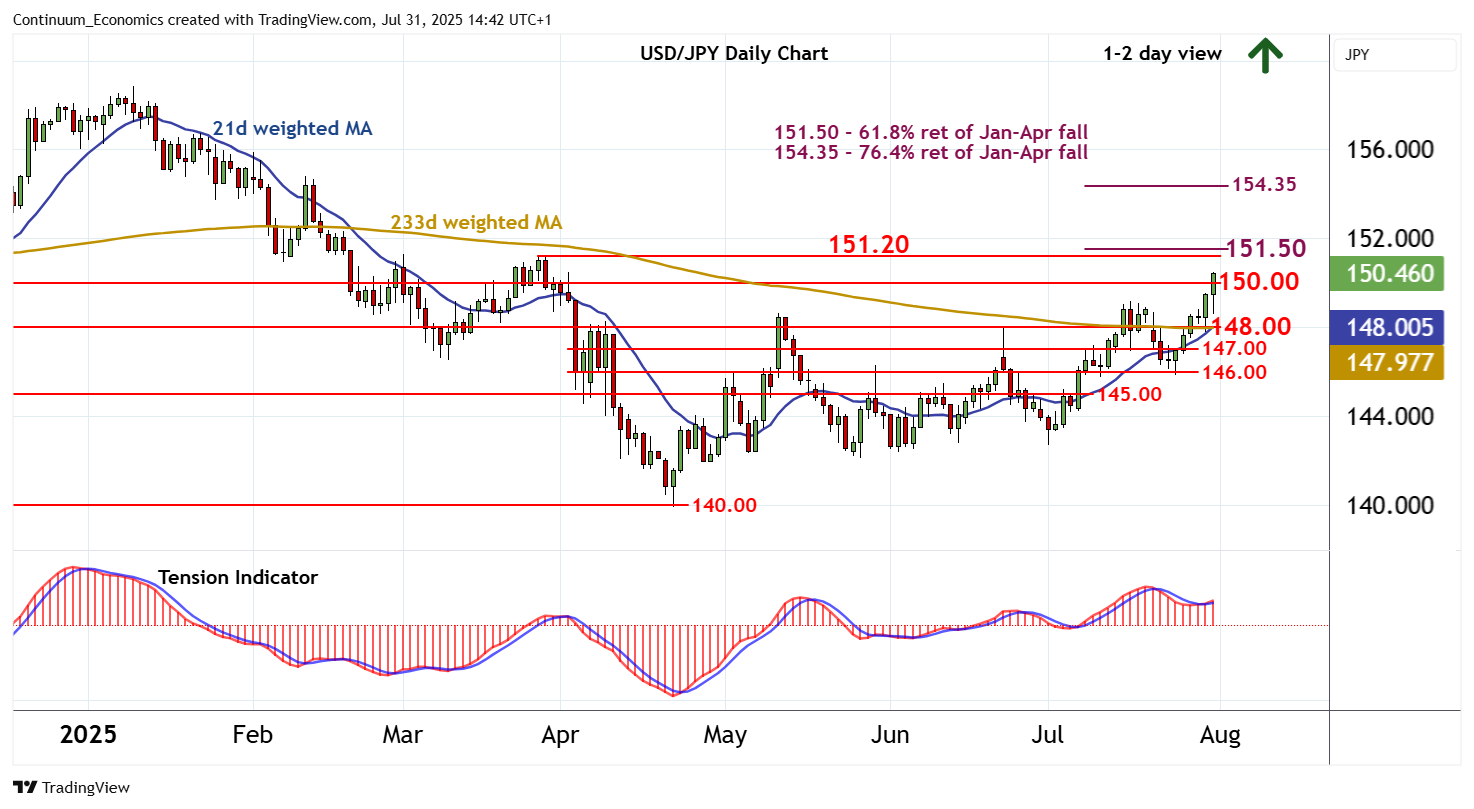

Chart USD/JPY Update: Extending April gains

Senior Technical Strategist

-

Anticipated gains have broken above 150.00 in both USD- and JPY-driven trade

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 153.15 | 14 Feb high | S1 | 150.00 | ** | congestion | ||

| R3 | 152.00 | * | break level | S2 | 148.00 | ** | break level | |

| R2 | 151.50 | ** | 61.8% ret of Jan-Apr fall | S3 | 147.00 | congestion | ||

| R1 | 151.20 | ** | 28 Mar (w) high | S4 | 146.00 | * | break level |

Asterisk denotes strength of level

14:25 BST - Anticipated gains have broken above 150.00 in both USD- and JPY-driven trade, with prices currently trading around 150.40. Intraday studies have ticked higher and daily readings continue to rise, highlighting room for continuation of April gains. Focus is turning to the 151.20 weekly high of 28 March. But flat overbought weekly stochastics are expected to limit any initial break in consolidation/profit-taking towards the 151.50 Fibonacci retracement. Meanwhile, a close back below congestion support at 150.00, if seen, will turn sentiment neutral and prompt consolidation above 148.00.