Published: 2025-05-15T10:16:11.000Z

Chart USD Index DXY Update: Cautious trade - studies under pressure

Senior Technical Strategist

-

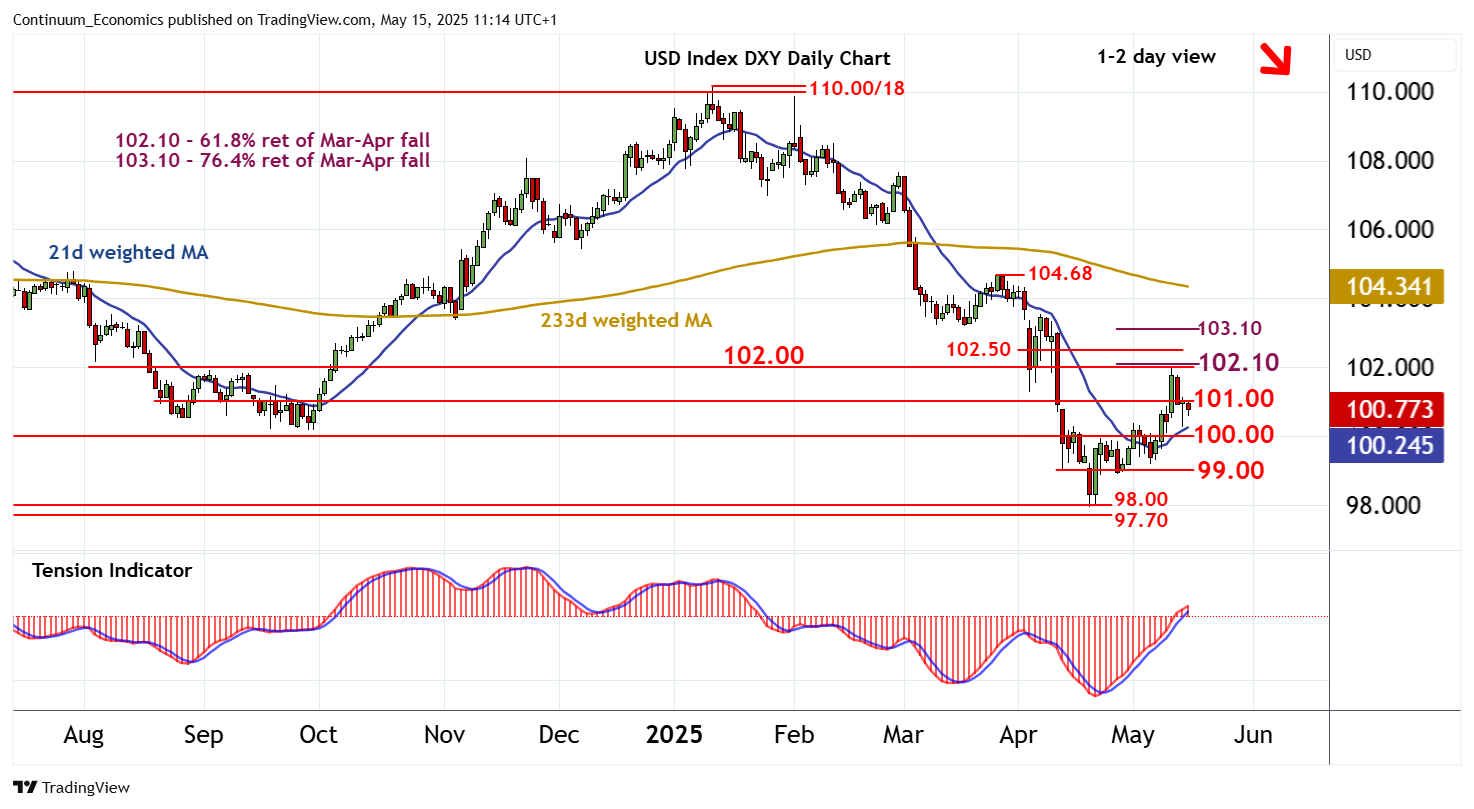

Little change, as prices extend cautious trade beneath resistance at 101.00

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 102.50 | * | congestion | S1 | 100.00 | ** | congestion | |

| R3 | 102.10 | ** | 61.8% ret of Mar-Apr fall | S2 | 99.00 | break level | ||

| R2 | 102.00 | ** | break level | S3 | 98.00 | * | congestion | |

| R1 | 101.00 | * | break level | S4 | 97.70 | * | early-Mar 22 (w) low |

Asterisk denotes strength of level

10:45 BST - Little change, as prices extend cautious trade beneath resistance at 101.00. Intraday studies are turning down and daily stochastics are also under pressure, highlighting room for a move down to congestion support at 100.00. But the rising daily Tension Indicator and improving weekly charts are expected to limit any initial break in renewed consolidation above support at 99.00. Meanwhile, a close above 101.00 would help to stabilise price action. But a further close above 102.00/10 is needed to turn sentiment positive once again and extend April gains, initially to congestion around 102.50.