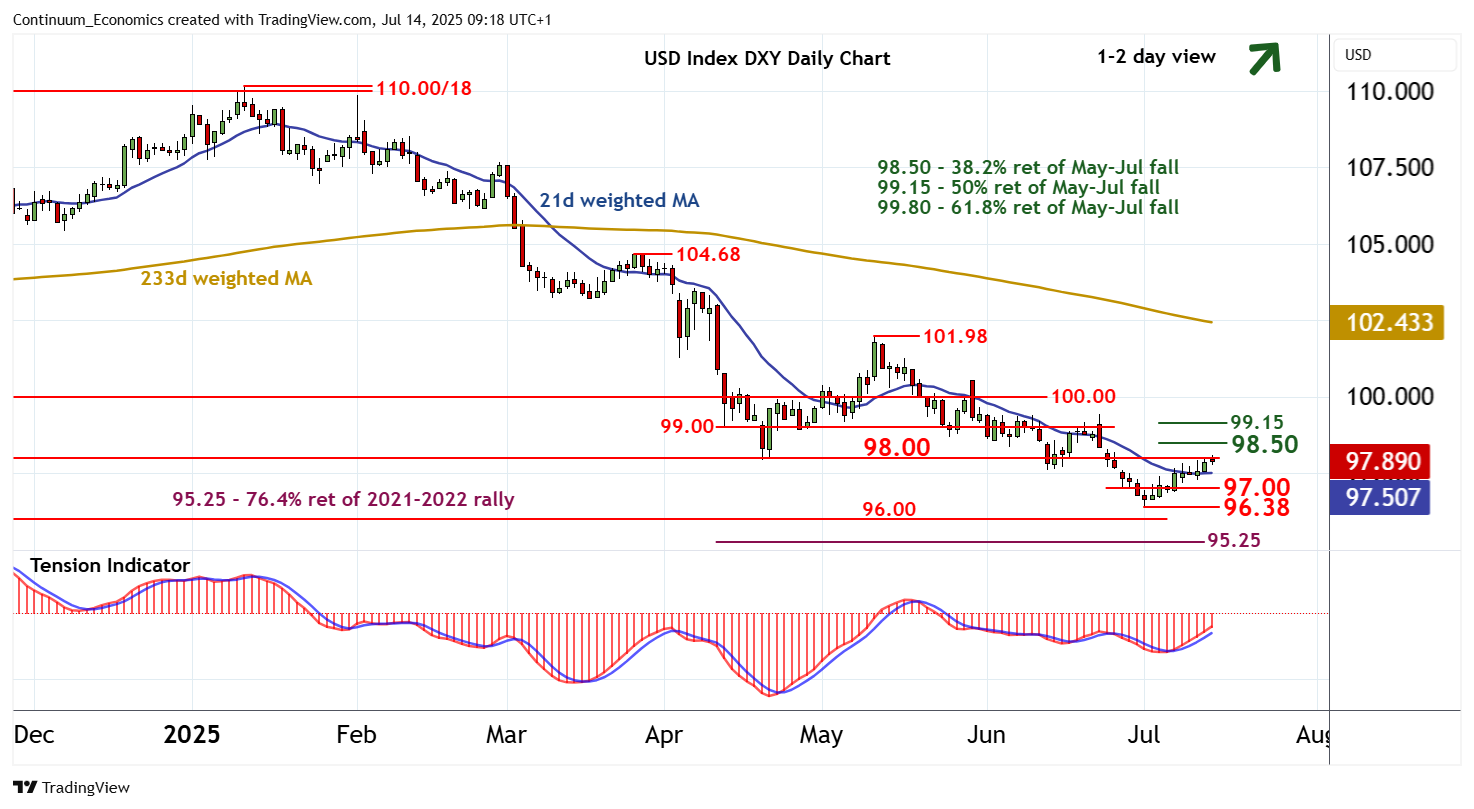

Chart USD Index DXY Update: Edging higher

Little change, as prices extend pressure on congestion resistance at 98.00

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 99.15 | ** | 50% ret of May-Jul fall | S1 | 97.00 | * | congestion | |

| R3 | 99.00 | break level | S2 | 96.50 | * | congestion | ||

| R2 | 98.50 | * | 38.2% ret of May-Jul fall | S3 | 96.38 | * | 1 Jul YTD low | |

| R1 | 98.00 | * | congestion | S4 | 96.00 | ** | congestion |

Asterisk denotes strength of level

09:00 BST - Little change, as prices extend pressure on congestion resistance at 98.00. Intraday studies are flat, suggesting potential for further consolidation around here. However, daily readings continue to rise and broader weekly charts are turning up, suggesting room for further strength in the coming sessions. A break above here will improve price action and extend July gains towards the 98.50 Fibonacci retracement. Beyond here is 99.00/15, but already overbought daily stochastics could limit any initial tests of this range in fresh consolidation. Meanwhile, support remains down to congestion around 97.00 and should underpin any immediate setbacks.