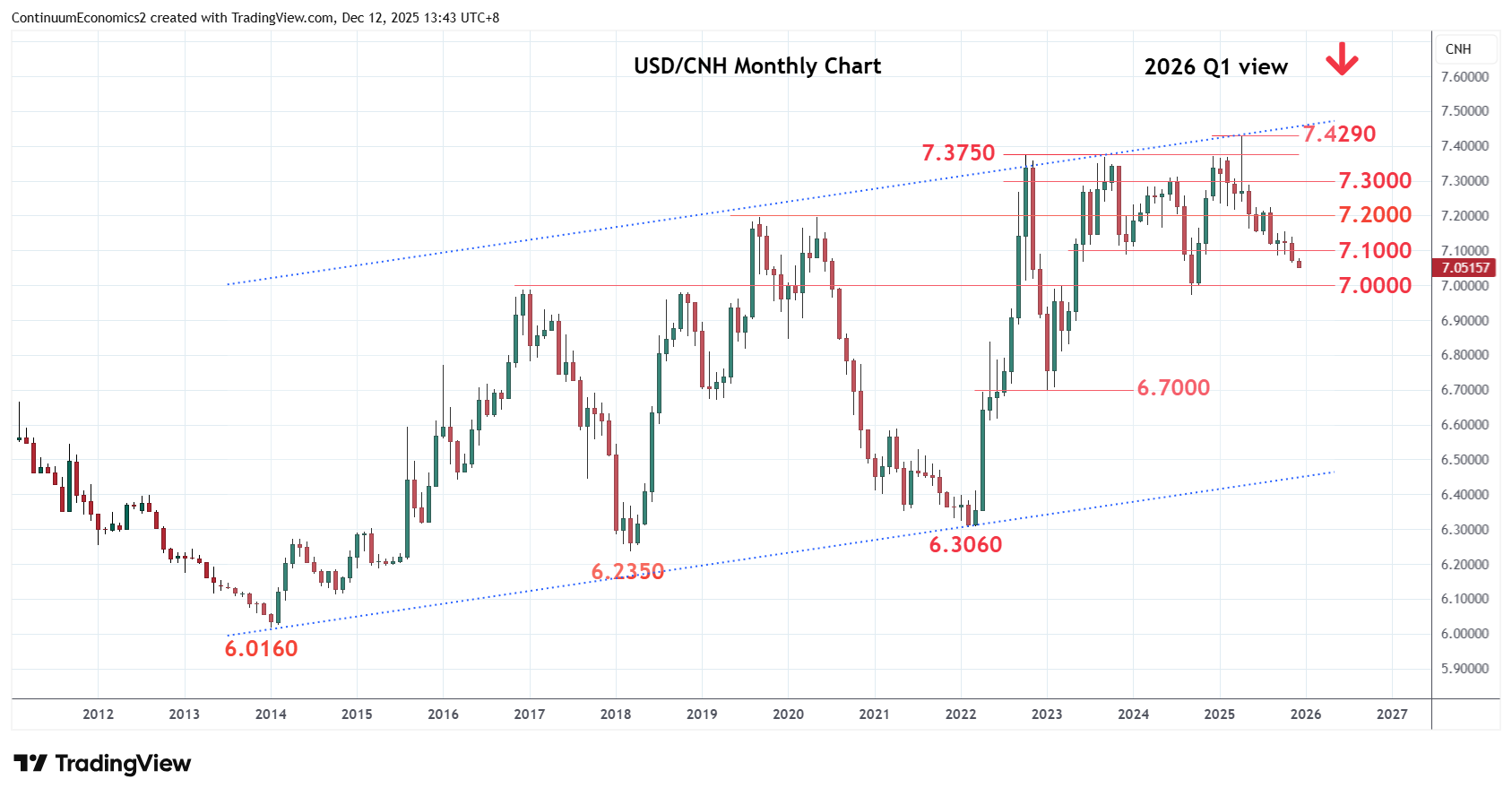

Chartbook: Chart USD/CNH: Extending losses

Turned lower from test of the 7.1500 resistance at the start of Q4 as consolidation above the 7.1000 level gave way to renewed selling pressure.

Turned lower from test of the 7.1500 resistance at the start of Q4 as consolidation above the 7.1000 level gave way to renewed selling pressure.

Break of the 7.1000 level extend losses from the April spike high at 7.4290 to retrace gains from the 2023 year low and shift focus to the 7.0000 psychological level. Would expect reaction at the latter but a later break will see room for extension to the strong support at the 6.9770/6.9710, 61.8% Fibonacci level and September 2024 year low. Below this will further extend losses to the 6.9500 and 6.9000 congestion area.

Meanwhile, congestion at the 7.1000/7.1200 area now turned resistance is expected to cap and contain corrective bounce. Break above these, if seen, will open up room for stronger corrective bounce to strong resistance at the 7.1500 level.