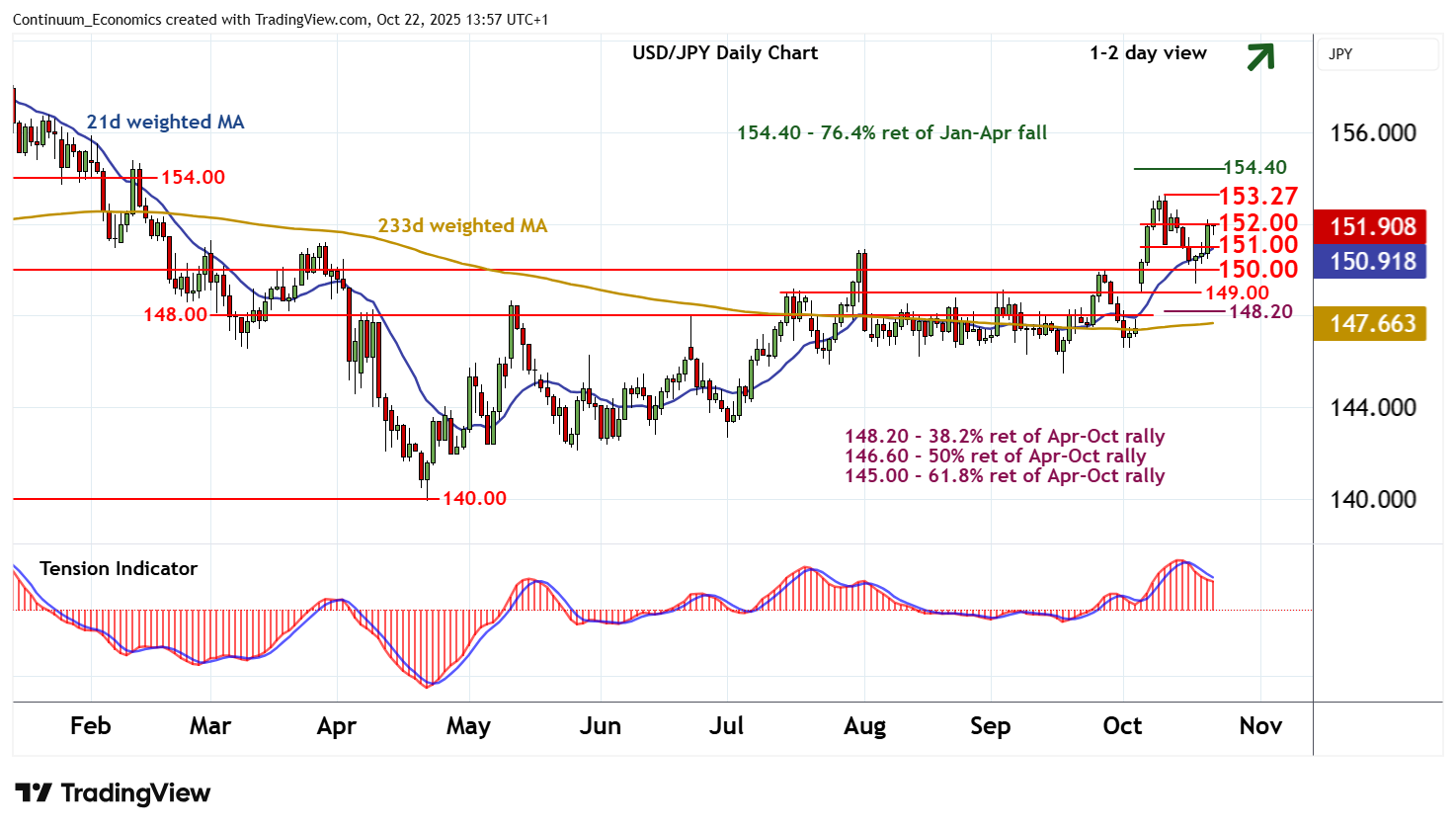

Chart USD/JPY Update: Consolidating - background studies improving

Little change, as mixed intraday studies and the falling daily Tension Indicator keep near-term sentiment cautious

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 154.40 | ** | 76.4% ret of Jan-Apr fall | S1 | 151.00 | break level | ||

| R3 | 154.00 | ** | congestion | S2 | 150.00 | ** | congestion | |

| R2 | 153.27 | ** | 10 Oct YTD high | S3 | 149.37 | 17 Oct (w) low | ||

| R1 | 152.00 | congestion | S4 | 149.00 | * | congestion |

Asterisk denotes strength of level

13:45 BST - Little change, as mixed intraday studies and the falling daily Tension Indicator keep near-term sentiment cautious and prompt consolidation beneath congestion resistance at 152.00. However, daily stochastics have ticked higher and broader weekly charts are improving, highlighting room for a later break and extension of recent gains towards strong resistance at the 153.27 current year high of 10 October. A further close above here would turn sentiment positive and confirm continuation of April gains towards the 154.40 Fibonacci retracement. Meanwhile, support remains at 151.00. A close beneath here, if seen, would help to stabilise price action and prompt consolidation above congestion around 150.00.