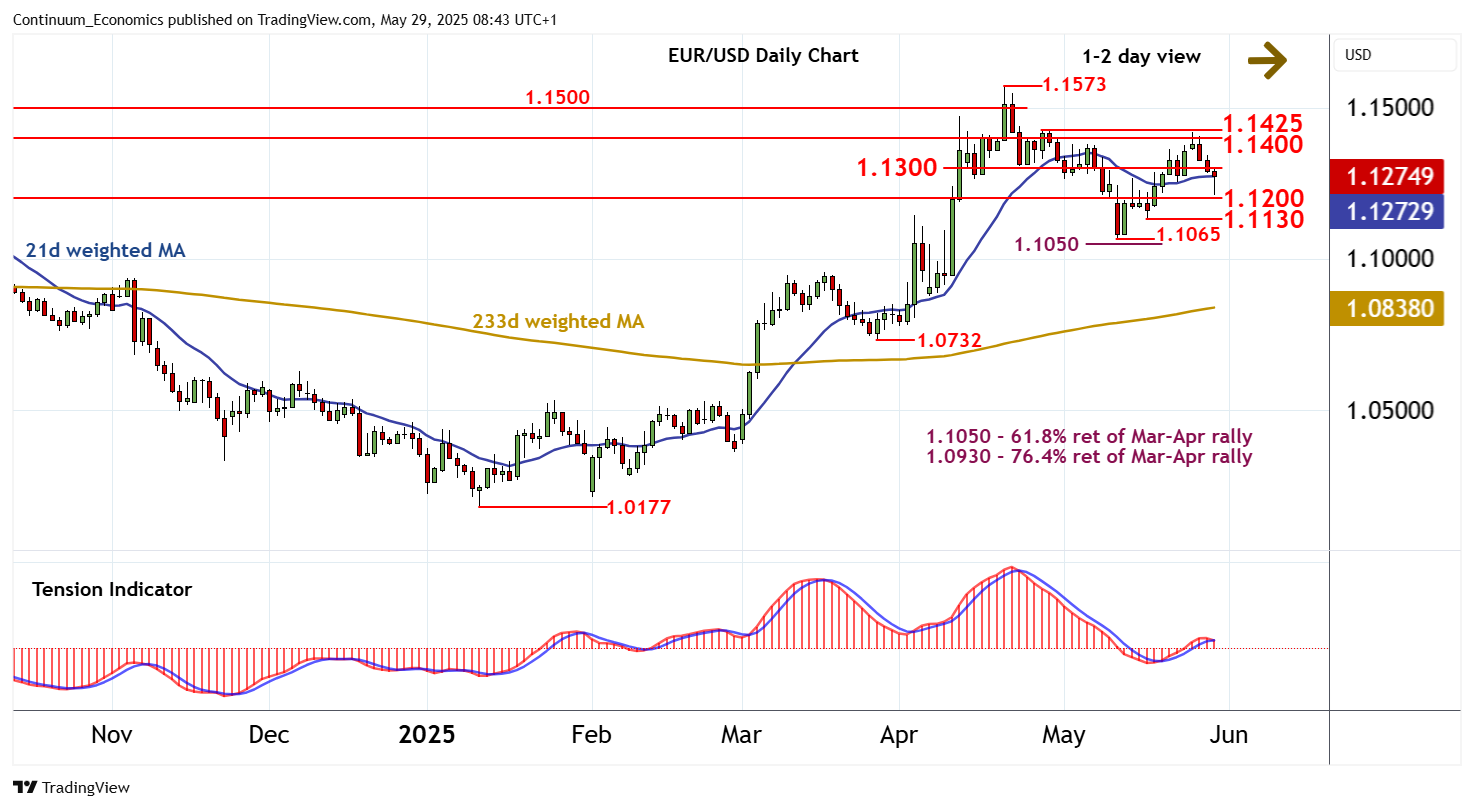

Chart EUR/USD Update: Limited tests higher

Anticipated losses have extended

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.1500 | * | congestion | S1 | 1.1200 | * | congestion | |

| 14 | 1.1425 | ** | 28 Apr (w) high | S2 | 1.1130 | * | 16 May low | |

| R2 | 1.1400 | * | congestion | S3 | 1.1065 | ** | 12 May (w) low | |

| R1 | 1.1300 | * | break level | S4 | 1.1050 | ** | 61.8% ret of Mar-Apr rally |

*Asterisk denotes strength of level

08:35 BST - Anticipated losses have extended, with prices bouncing sharply from just above congestion support at 1.1200. Oversold intraday studies are unwinding, highlighting room for a test of resistance at 1.1300. But unwinding overbought daily stochastics and the deteriorating daily Tension Indicator are expected to prompt renewed selling interest towards here. In the coming sessions, cautious trade is expected to give way to fresh losses. A later break below 1.1200 will add weight to sentiment and open up the 1.1130 low of 16 May. However, mixed weekly charts are expected to limit any deeper losses in consolidation above critical support at the 1.1050 Fibonacci retracement and the 1.1065 weekly low of 12 May. Meanwhile, a close back above 1.1300 would help to stabilise price action and prompt consolidation beneath 1.1400/25.