Limited on probes above the 149.00 level as prices unwind the overbought intraday and daily studies

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

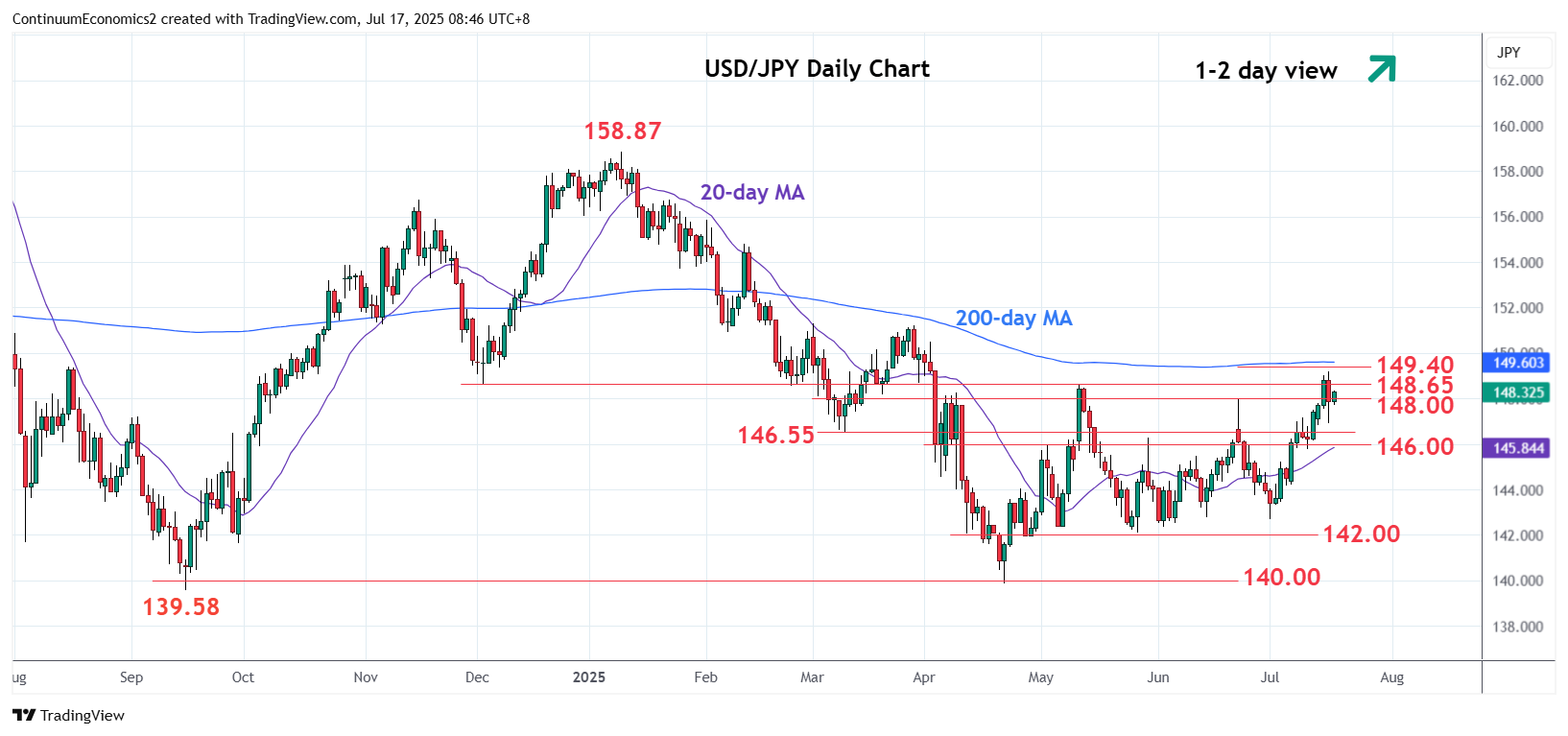

| R4 | 150.48 | * | Apr high | S1 | 148.00 | * | Jun high | |

| R3 | 150.00 | ** | figure, congestion | S2 | 147.00 | congestion | ||

| R2 | 149.40 | * | 50% Jan/Apr fall | S3 | 146.55/00 | ** | Mar low, congestion | |

| R1 | 149.00 | congestion | S4 | 145.20/00 | * | 3 Jul high, congestion |

Asterisk denotes strength of level

00:50 GMT - Limited on probes above the 149.00 level as prices unwind the overbought intraday and daily studies. Pullback see prices consolidating rally from the 142.68 low with support lowered to 147.00 congestion then the 146.55/146.00 area which is expected to underpin. Break here will fade the upside pressure and open up room for deeper retracement of the July gains. Weekly studies remains positive and suggest room for further gains cannot be ruled out. Above the 149.00 level will see room to the 149.40, 50% Fibonacci level, then the 150.00 figure.