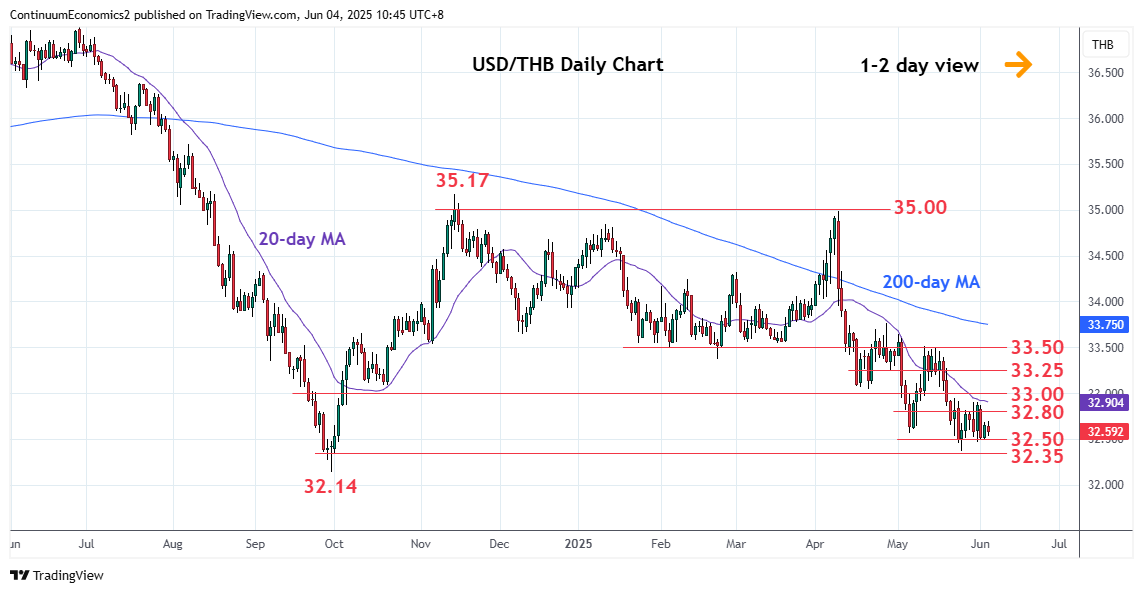

Lower in range, as prices extend consolidation below the 32.80 bounce high

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 33.50 | ** | congestion, 38.2% | S1 | 32.50 | * | congestion | |

| R3 | 33.25 | * | congestion | S2 | 32.37 | ** | 26 May YTD low | |

| R2 | 33.00/05 | * | congestion, Apr low | S3 | 32.14 | ** | Sep 2024 year low | |

| R1 | 32.80/90 | * | congestion, 29 May high | S4 | 32.08 | ** | Feb 2022 year low |

Asterisk denotes strength of level

02:50 GMT - Lower in range, as prices extend consolidation below the 32.80 bounce high. Would take break above resistance at 32.80/90 area to ease the downside pressure and clear the way for stronger corrective bounce to retrace losses from April high towards 33.00/25 congestion. Clearance, if seen, will open up room to strong resistance at 33.50, congestion and 38.2% Fibonacci level. Meanwhile, support at 32.50 congestion and 32.37 lows underpin. Below these will extend losses from the November/April highs and see room to the critical 32.14/32.08, 2024/2022 year lows.