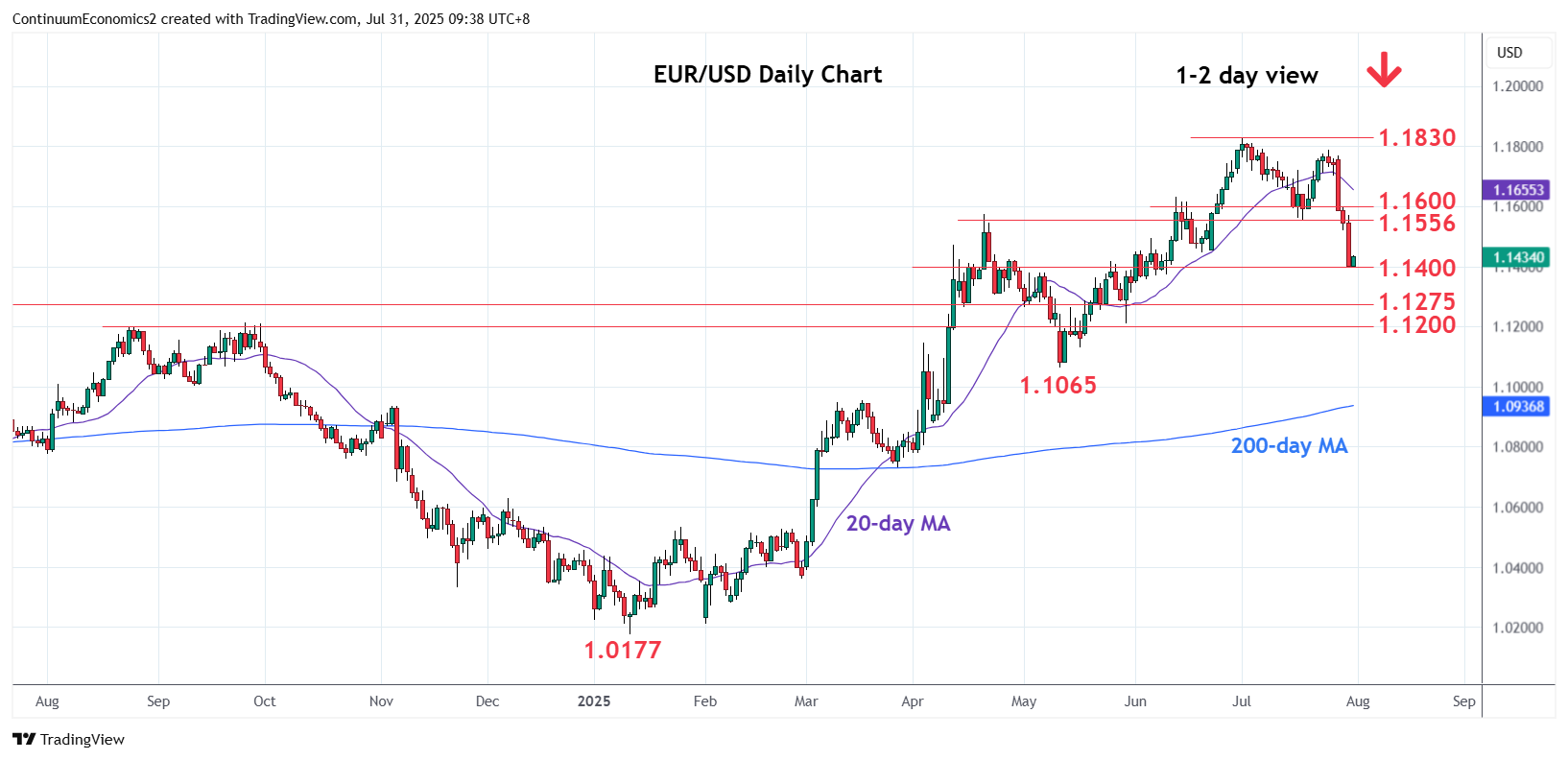

Steadied at the 1.1400 level as prices consolidate sharp losses this week and unwind oversold intraday studies

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.1700 | * | congestion | S1 | 1.1400 | * | congestion | |

| 14 | 1.1600 | * | congestion | S2 | 1.1300 | * | congestion | |

| R2 | 1.1556 | ** | 17 Jul low | S3 | 1.1275 | ** | 2023 year high | |

| R1 | 1.1500 | * | congestion | S4 | 1.1215/00 | ** | 2024 year highs, 38.2% |

Asterisk denotes strength of level

01:45 GMT - Steadied at the 1.1400 level as prices consolidate sharp losses this week and unwind oversold intraday studies. However, negative daily and weekly studies suggest consolidation giving way to selling pressure later. Lower will see room for deeper pullback to retrace the January/July rally and see room to 1.1300 congestion. Below this will turn focus to 1.1275/1.1200 support. Meanwhile, resistance is lowered to 1.1500 level which is expected to cap. Only above here will see room for stronger bounce to previous low at 1.1556.