Chartbook: Chart EUR/USD: Balanced at 2025 year highs - September 2022 gains expected to resume

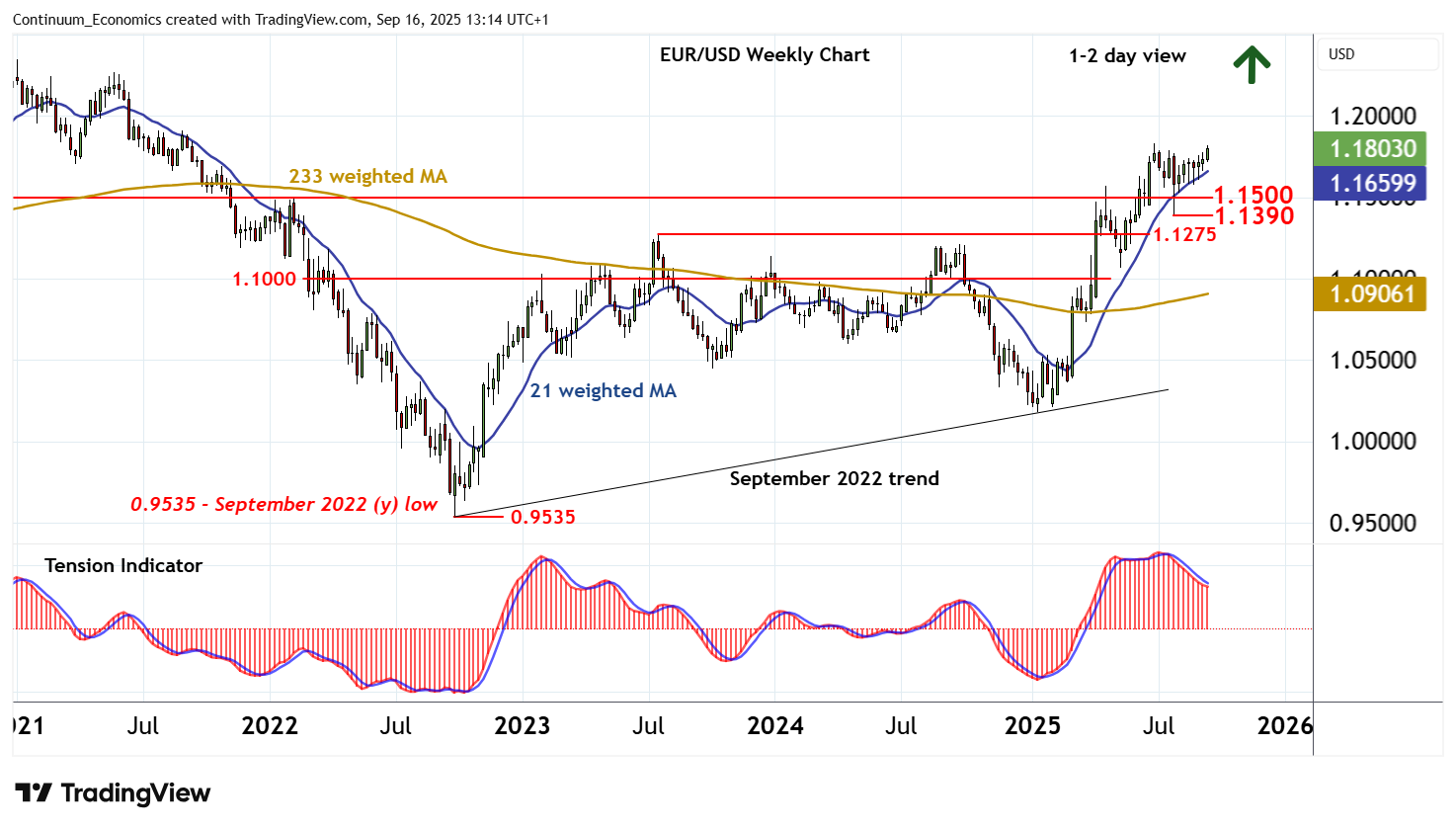

The anticipated break above 1.1500 has posted a fresh 2025 year high at 1.1830

The anticipated break above 1.1500 has posted a fresh 2025 year high at 1.1830,

before settling into fresh consolidation.

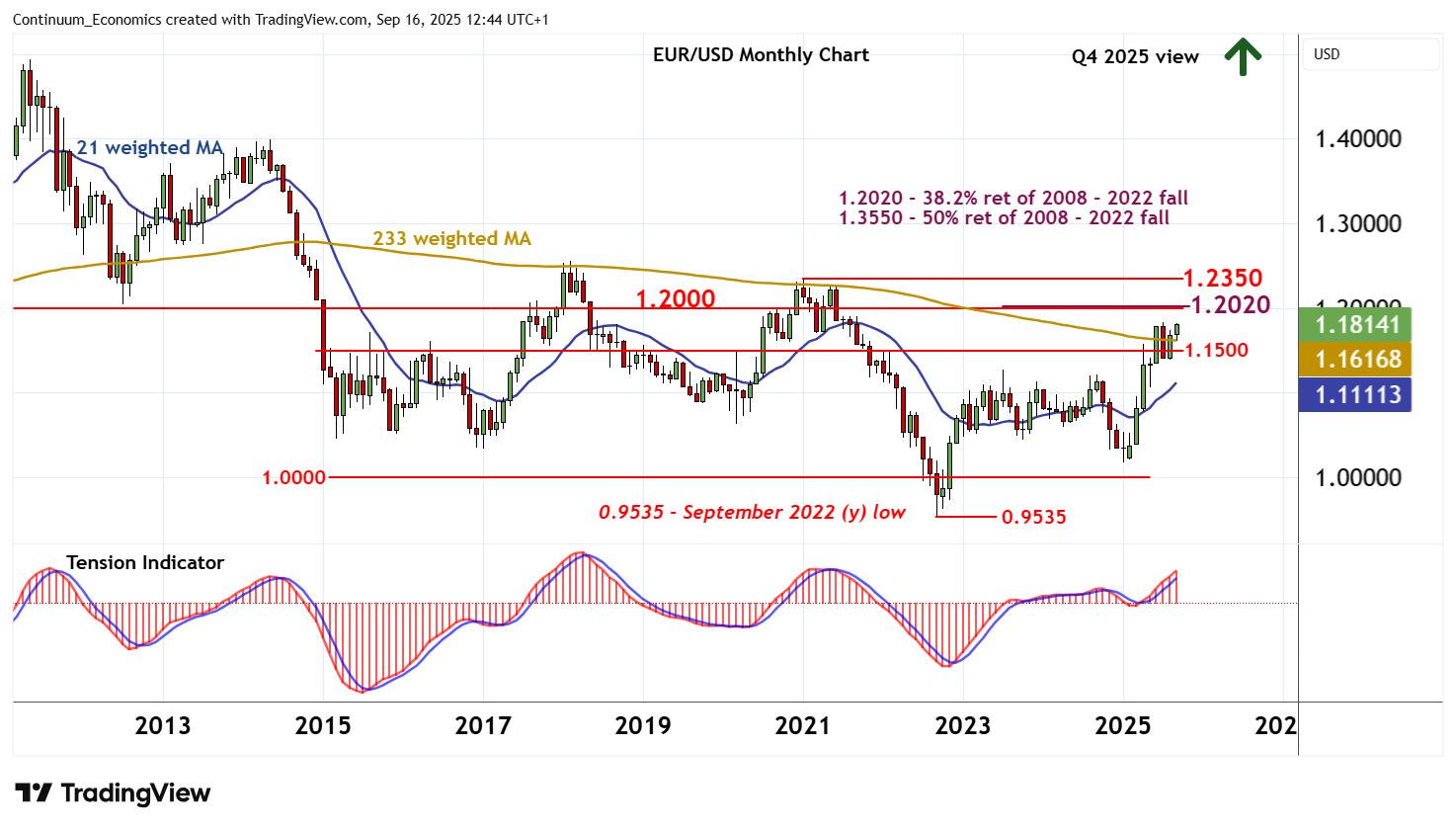

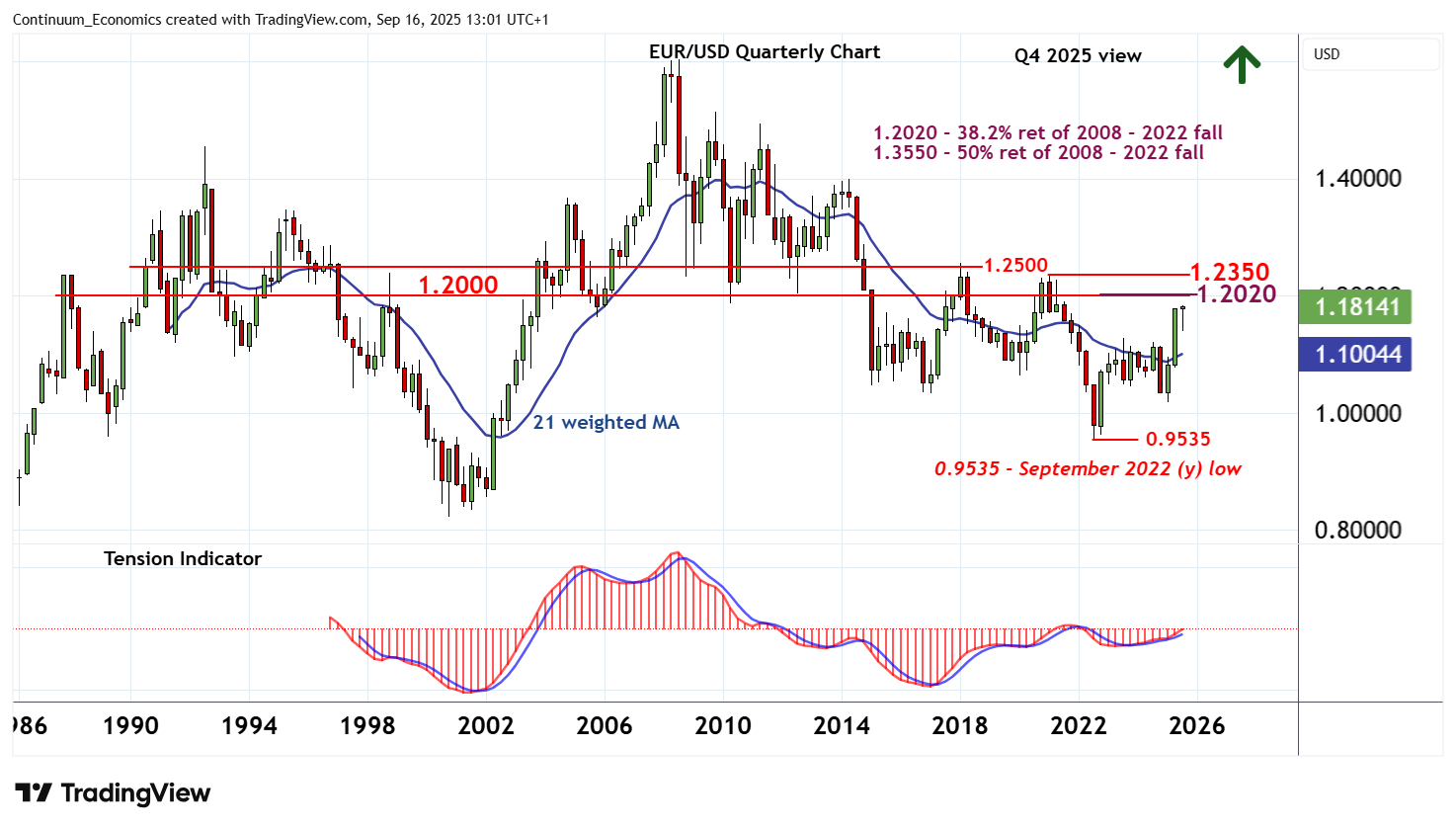

Overbought monthly stochastics are unwinding, suggesting room for further consolidation. But the rising monthly Tension Indicator is expected to prompt a later break and extend gains from the 0.9535 multi-year low of September 2022.

Focus will then turn to strong resistance at congestion around 1.2000 and the 1.2020 multi-year Fibonacci retracement. However, already overbought monthly stochastics could limit any immediate tests in consolidation, before improving longer-term readings prompt a break

towards the 1.2350 year high of January 2021.

Meanwhile, support is at congestion around 1.1500 and extends to the 1.1390 monthly low of 1 August.

Mixed/positive weekly charts are expected to limit any immediate corrective pullback to consolidation above here.

A break, however, will add weight to sentiment and delay higher levels, as increased selling interest initially opens up a test of the 1.1275 monthly high of July 2023.