Published: 2025-08-22T00:44:35.000Z

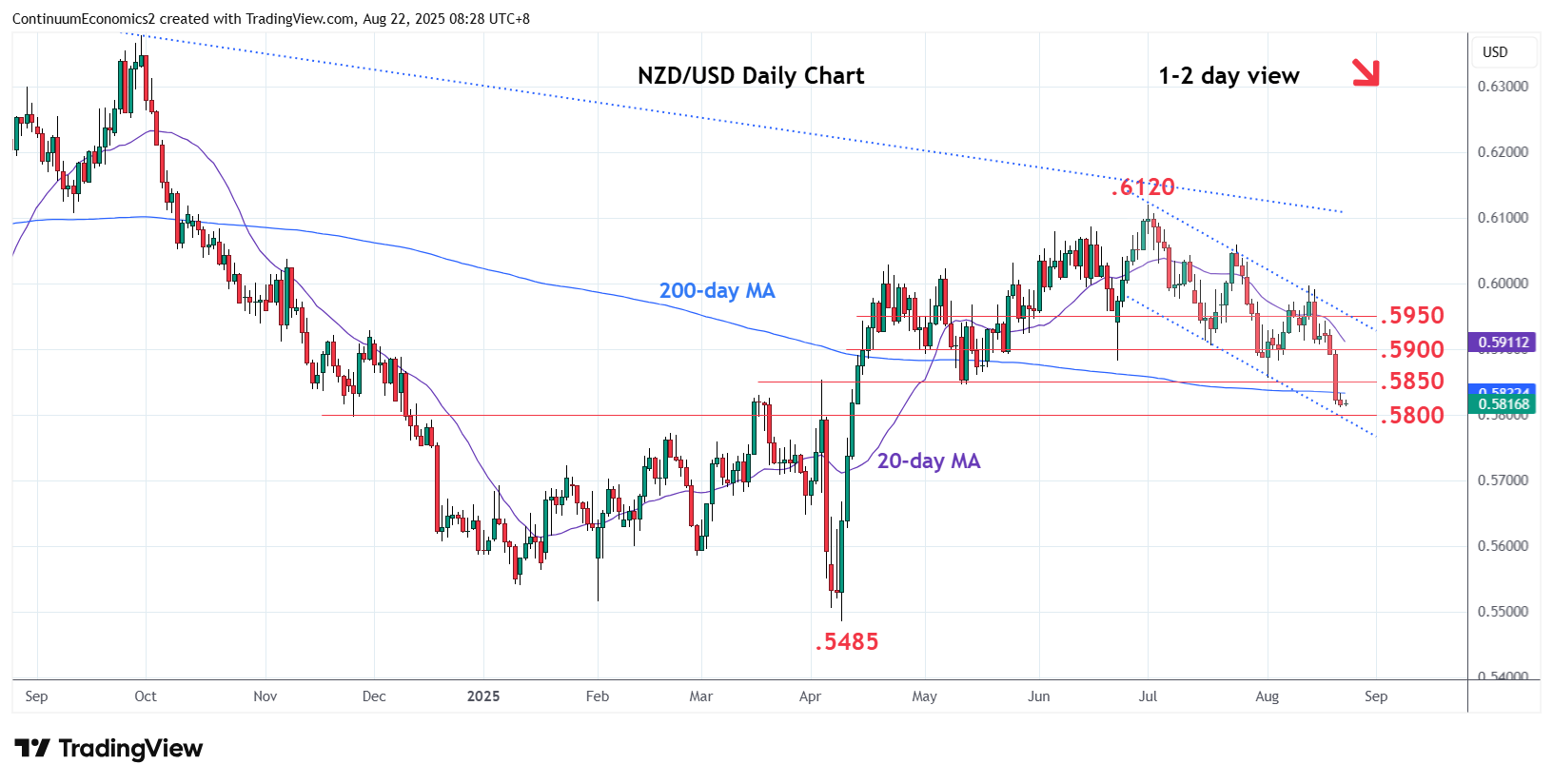

Chart NZD/USD Update: Consolidating above .5800 support

0

-

Break of strong support at .5850/.5845 further extend losses from the .5995 high of last week within the equidistant channel from the .6120, July high

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | .5995 | ** | 13 Aug high | S1 | .5800 | * | congestion, 50% | |

| R3 | .5950 | * | congestion | S2 | .5772 | * | Feb high | |

| R2 | .5900 | * | congestion | S3 | .5730 | * | 61.8% Apr/Jul rally | |

| R1 | .5850/55 | * | congestion, 1 Aug low | S4 | .5700 | * | congestion |

Asterisk denotes strength of level

00:35 GMT - Break of strong support at .5850/.5845 further extend losses from the .5995 high of last week within the equidistant channel from the .6120, July current year high. Prices has since stabilised at the .5810 low to unwind oversold intraday studies while stretched daily studies suggest further losses likely to prove limited with support at the .5800 congestion and lower channel. Meanwhile, resistance is lowered to the .5950/55 congestion area and 1 Aug low. Regaining this will open up room for stronger bounce to .5900 level.