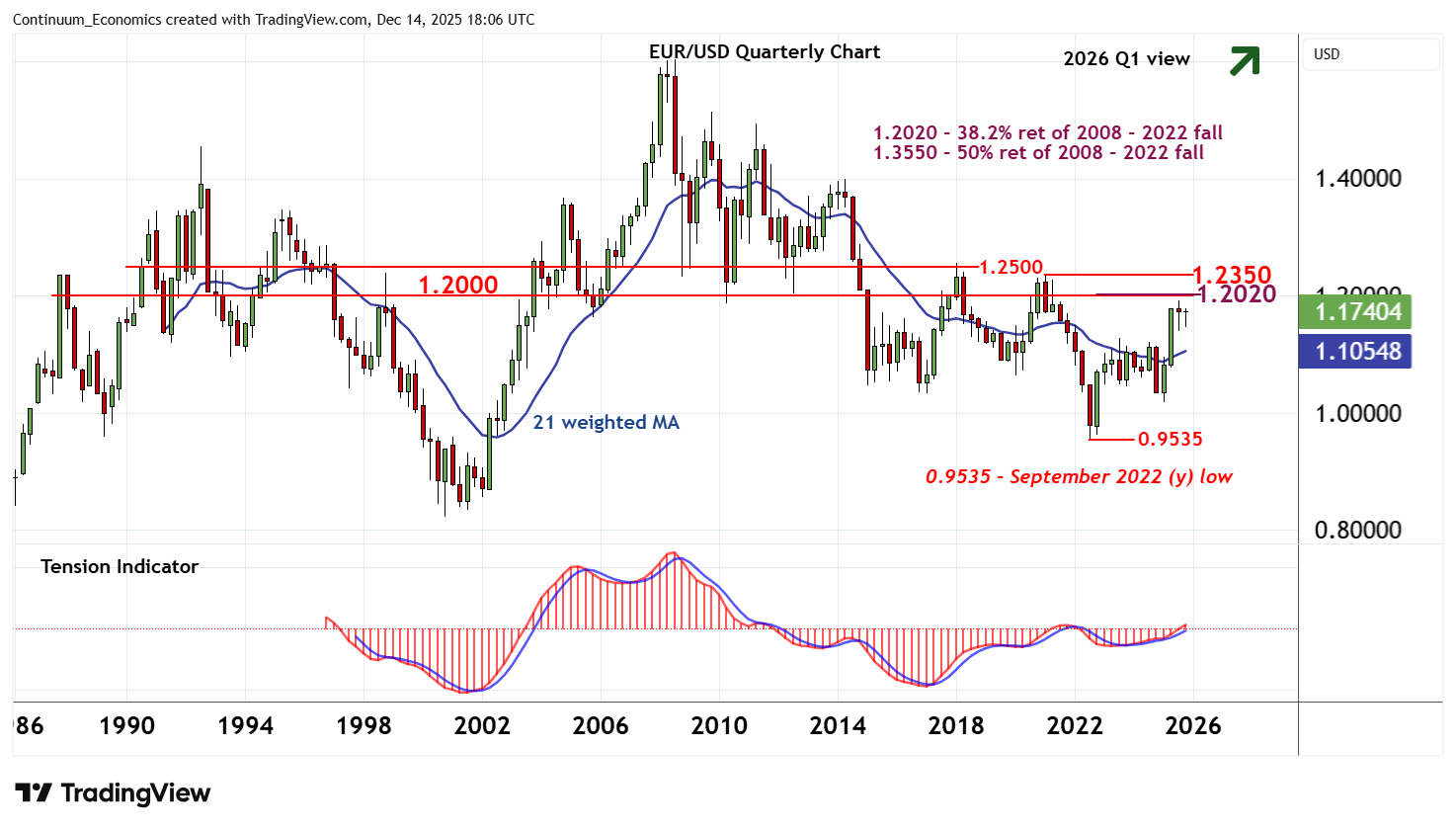

Chartbook: Chart EUR/USD: Extending consolidation - September 2022 gains expected to resume

Little change, as prices extend anticipated consolidation following the posting of a fresh 2025 year high around 1.1920

Little change, as prices extend anticipated consolidation following the posting of a fresh 2025 year high around 1.1920.

Overbought monthly stochastics continue to unwind, suggesting room for further consolidation. But the rising monthly Tension Indicator is expected to prompt fresh buying interest and extend gains from the 0.9535 multi-year low of September 2022.

A break above 1.1920 will open up strong resistance at congestion around 1.2000 and the 1.2020 multi-year Fibonacci retracement. However, already overstretched monthly stochastics could limit any immediate tests in consolidation, before improving longer-term readings prompt a break

towards the 1.2350 year high of January 2021.

Meanwhile, support remains at congestion around 1.1500 and extends to the 1.1390 monthly low of 1 August.

Mixed/positive weekly charts are expected to limit any immediate corrective pullback to renewed consolidation above here.

A break, however, will add weight to sentiment and delay higher levels, as increased selling interest initially opens up a test of the 1.1275 monthly high of July 2023.