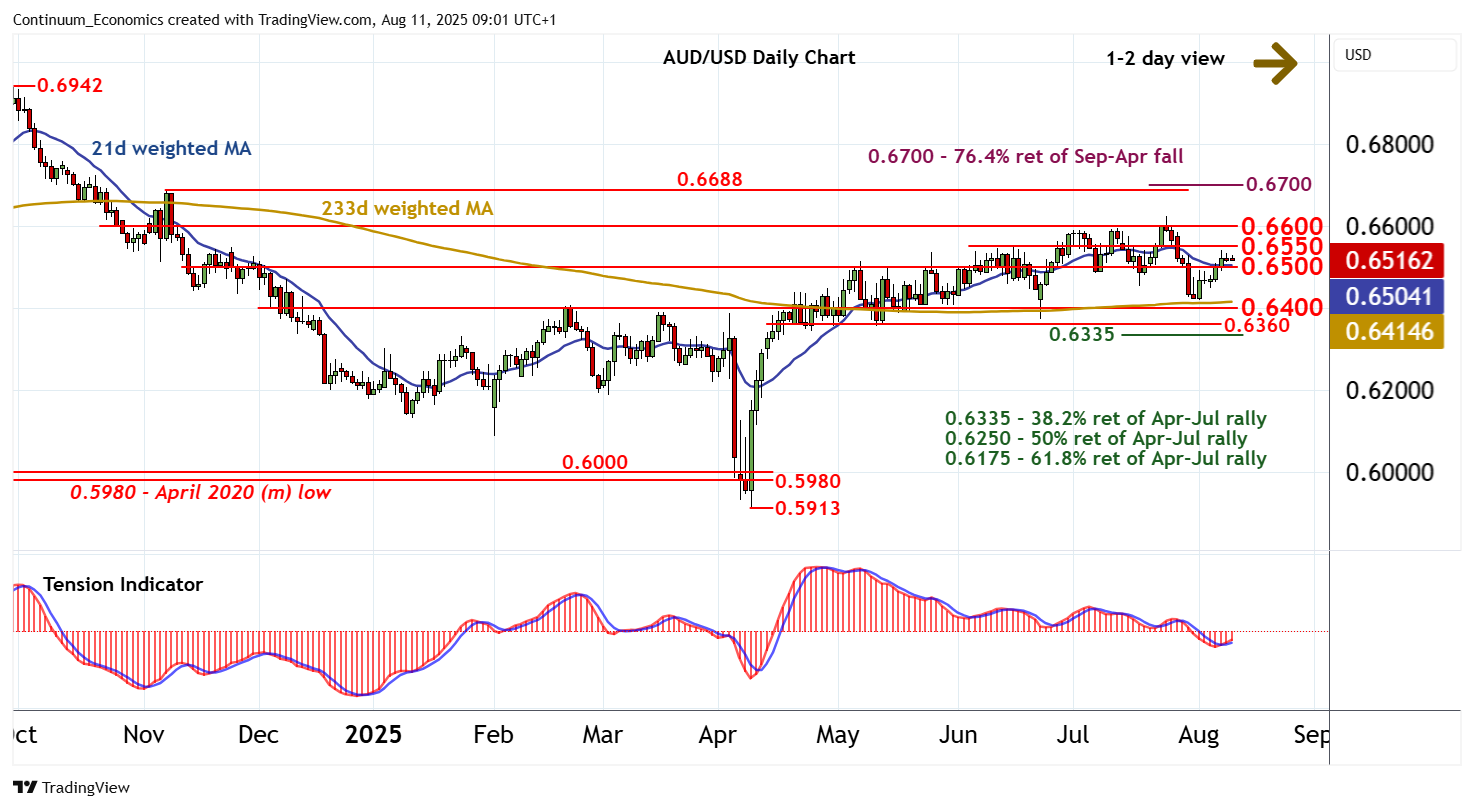

Chart AUD/USD Update: Drifting lower in range

Still little change, as prices extend cautious trade around 0.6515

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.6688 | * | 7 Nov (m) high | S1 | 0.6500 | * | congestion | |

| R3 | 0.6625 | 24 Jul YTD high | S2 | 0.6400 | * | break level | ||

| R2 | 0.6600 | ** | congestion | S3 | 0.6360 | ** | break level | |

| R1 | 0.6550 | * | congestion | S4 | 0.6335 | ** | 38.2% ret of Apr-Jul rally |

Asterisk denotes strength of level

08:55 BST - Still little change, as prices extend cautious trade around 0.6515. Intraday studies are under pressure, highlighting potential for a drift down to congestion support at 0.6500. But rising daily readings are expected to limit any initial tests in fresh consolidation, before negative weekly charts prompt a break. A later break beneath here will add weight to sentiment and open up 0.6400. However, a close below 0.6360 is needed to turn sentiment negative and confirm a near-term top in place around 0.6600, as July losses then extend initially towards the 0.6335 Fibonacci retracement. Meanwhile, resistance remains at congestion around 0.6550 and extends to further congestion around 0.6600. This range should cap any immediate tests higher.