Published: 2025-08-18T10:16:03.000Z

Chart EUR/CHF Update: Consolidating - background studies continue to rise

Senior Technical Strategist

-

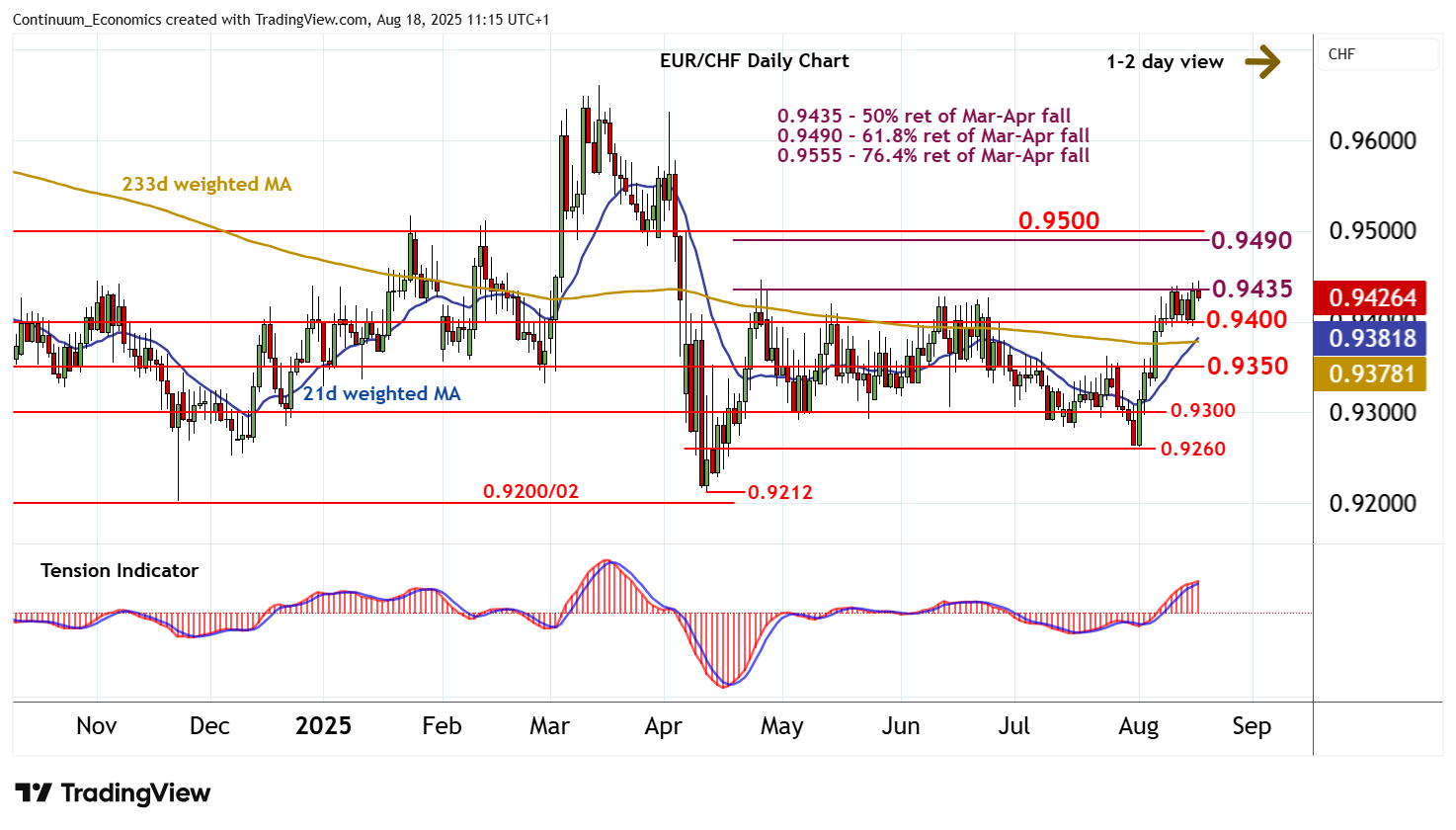

The test of critical resistance at the 0.9435 Fibonacci retracement is giving way to a pullback

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.9550/55 | ** | cong; 76.4% ret | S1 | 0.9400 | * | congestion | |

| R3 | 0.9500 | * | congestion | S2 | 0.9350 | ** | congestion | |

| R2 | 0.9490/00 | ** | 61.8% ret; congestion | S3 | 0.9300 | ** | congestion | |

| R1 | 0.9435 | * | 50% ret of Mar-Apr fall | S4 | 0.9260 | break level |

Asterisk denotes strength of level

11:05 BST - The test of critical resistance at the 0.9435 Fibonacci retracement is giving way to a pullback, as overbought intraday studies unwind, with prices currently trading around 0.9425. Overbought daily stochastics are also unwinding, suggesting room for a drift lower towards congestion support at 0.9400. But the rising daily Tension Indicator and positive weekly charts are expected to limit any tests in renewed buying interest/consolidation. Following cautious trade, fresh gains are looked for. However, a close above 0.9435 is needed to turn sentiment positive and extend April gains towards strong resistance at 0.9490/00.