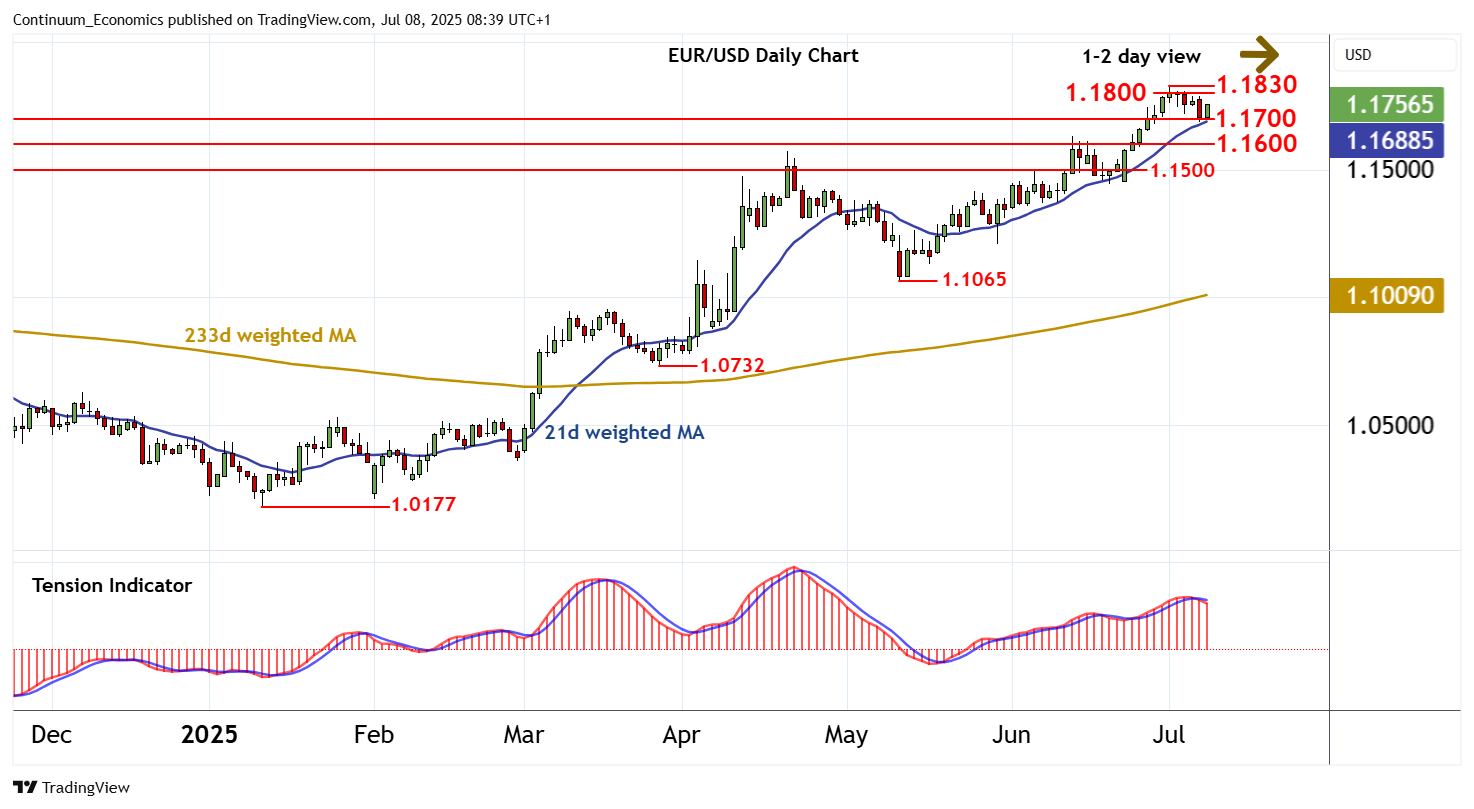

Chart EUR/USD Update: Immediate gains capped in range

Cautious trade around congestion support at 1.1700 is giving way to a minor bounce

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.2000/20 | ** | cong; 38.2% ret of 2008-2022 fall | S1 | 1.1700 | * | congestion | |

| R3 | 1.1900 | * | congestion | S2 | 1.1600 | * | congestion | |

| R2 | 1.1830 | ** | 1 Jul YTD high | S3 | 1.1500 | * | congestion | |

| R1 | 1.1800 | * | congestion | S4 | 1.1446 | * | 19 Jun (w) low |

*Asterisk denotes strength of level

08:30 BST - Cautious trade around congestion support at 1.1700 is giving way to a minor bounce, as intraday studies turn higher, with prices currently balanced around 1.1755. Continuation towards congestion resistance at 1.1800 cannot be ruled out, but negative daily readings are expected to limit any initial tests in consolidation. In the coming sessions, further consolidation is highlighted, before rising weekly charts and positive longer-term readings prompt a break. However, a close above the 1.1830 current year high of 1 July is needed to turn sentiment positive once again and extend broad September 2022 gains towards further congestion around 1.1900. Meanwhile, any tests below 1.1700 should meet fresh buying interest towards further congestion around 1.1600.