Edged up from test of the 1.3385 Fibonacci level to consolidate above the 1.3400 level

| Level | Comment | Level | Comment | ||||

|---|---|---|---|---|---|---|---|

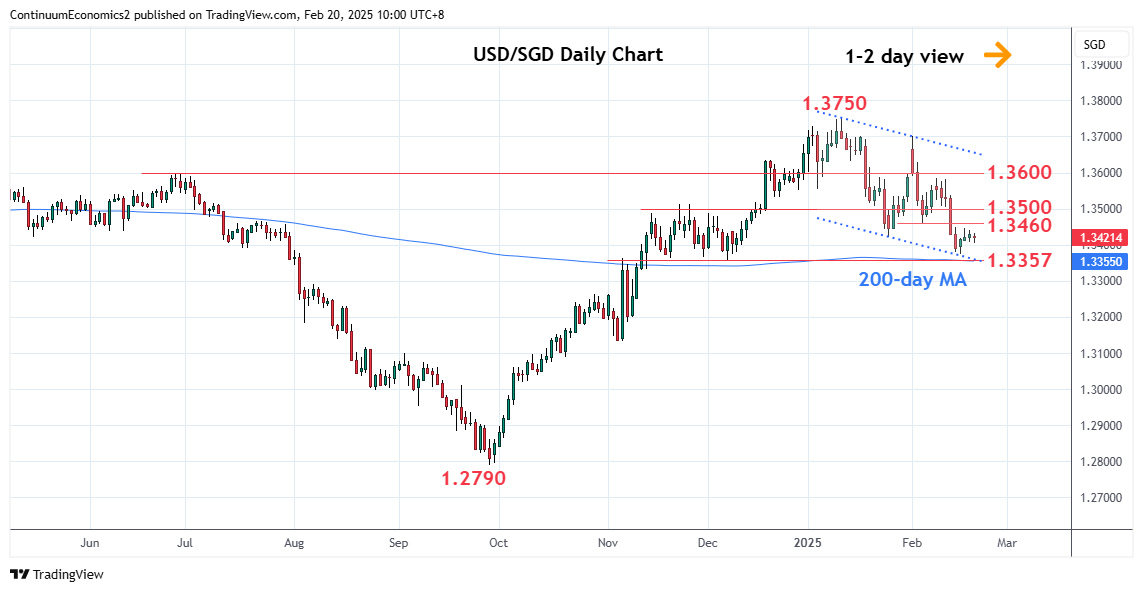

| R4 | 1.3635 | * | 18 Dec high | S1 | 1.3385 | * | 38.2% Sep/Jan rally |

| R3 | 1.3585 | ** | 10 Feb high | S2 | 1.3357 | ** | Dec low, 200-day MA |

| R2 | 1.3500 | * | congestion | S3 | 1.3300 | * | congestion |

| R1 | 1.3460 | * | 5 Feb low | S4 | 1.3270 | * | 50% Sep/Jan rally |

Asterisk denotes strength of level

02:05 GMT - Edged up from test of the 1.3385 Fibonacci level to consolidate above the 1.3400 level as prices unwind oversold intraday and daily studies. Bounce see resistance at the 1.3420/60 recent lows which is expected to cap. Break here, if seen, will open up room for stronger recovery within the bear channel from the January high to the 1.3500 congestion. Gains are seen corrective and expected to give way to fresh selling pressure later. Break of the 1.3385 and 1.3357 support will open up deeper pullback to the 1.3300/1.3270, congestion and 50% Fibonacci level.