Published: 2025-04-14T07:42:17.000Z

Chart EUR/USD Update: Choppy trade - studies continue to rise

Senior Technical Strategist

-

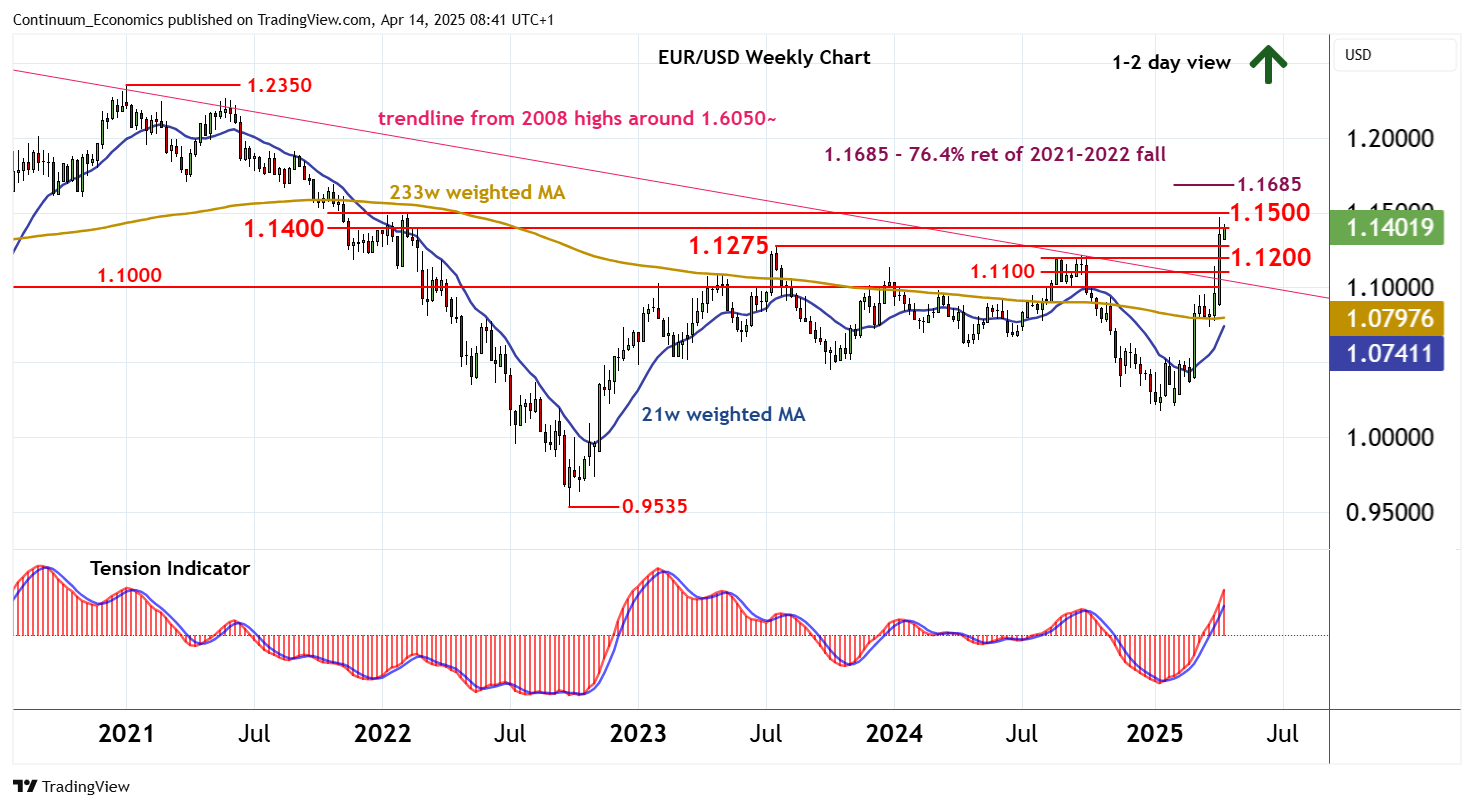

Anticipated gains have posted a fresh 2025 year high around 1.1474

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.1600 | congestion | S1 | 1.1275 | ** | July 2023 (y) high | ||

| 14 | 1.1500 | ** | break level | S2 | 1.1200 | ** | congestion | |

| R2 | 1.1474 | * | 11 Apr YTD high | S3 | 1.1100 | * | break level | |

| R1 | 1.1400 | * | congestion | S4 | 1.1000 | * | congestion |

Asterisk denotes strength of level

08:35 BST - Anticipated gains have posted a fresh 2025 year high around 1.1474, before giving way to volatile trade just beneath congestion resistance at 1.1400. Intraday studies are mixed, suggesting further choppy trade beneath here, before rising daily readings and positive weekly charts prompt continuation of September 2022 gains. A break above 1.1400 will open up 1.1474, ahead of resistance at 1.1500. Beyond here is the 1.1685 Fibonacci retracement. Meanwhile, support remains at the 1.1275 year high of July 2023 and extends to congestion around 1.1200. A break beneath this range, if seen, will turn sentiment neutral and prompt consolidation above support at the 1.1100 break level.