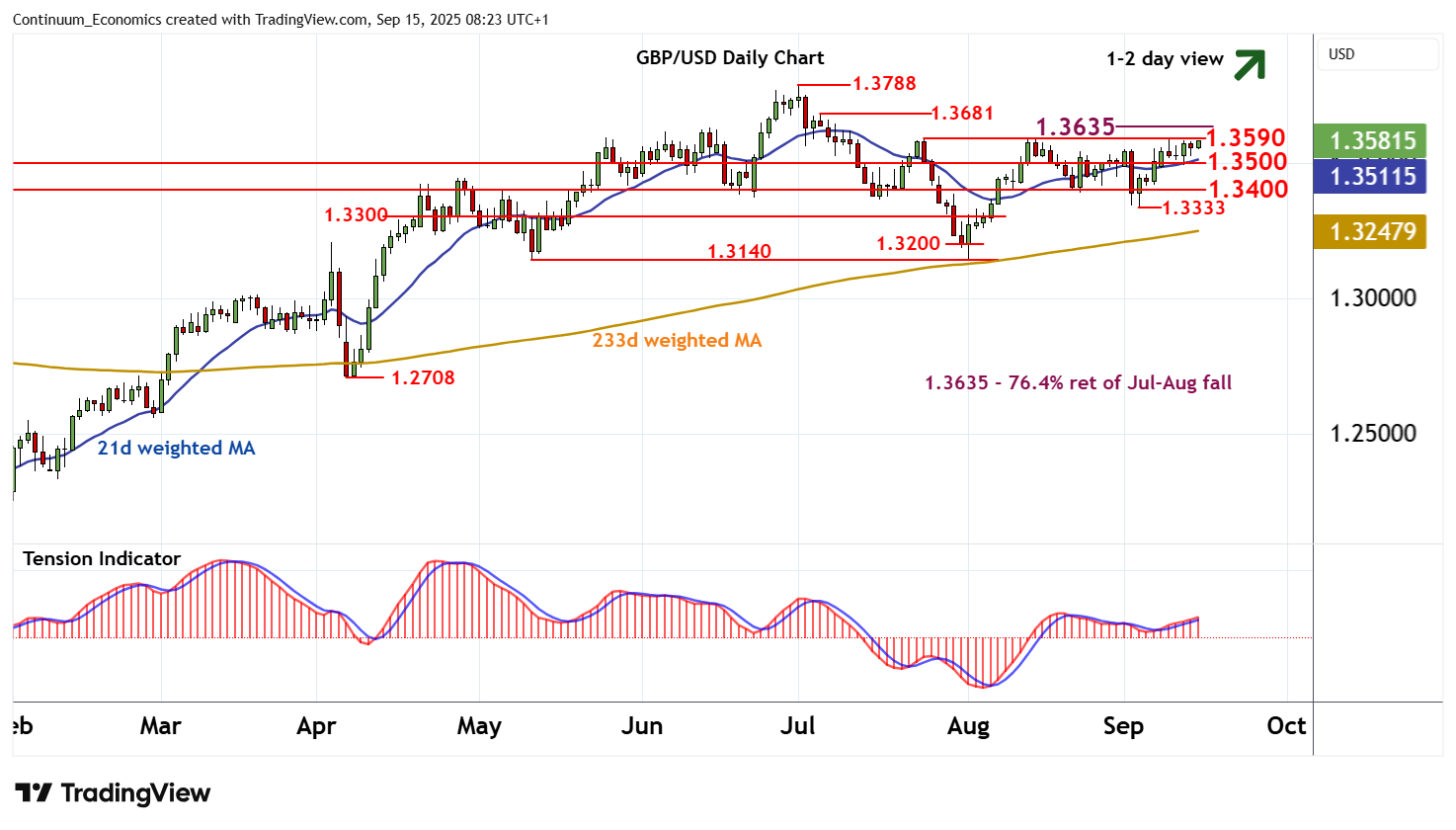

Chart GBP/USD Update: Balanced at range highs - studies improving

Little change, as mixed intraday studies keep near-term sentiment cautious

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.3788 | ** | 1 Jul YTD high | S1 | 1.3500 | ** | congestion | |

| R3 | 1.3681 | 4 Jul high | S2 | 1.3400 | * | congestion | ||

| R2 | 1.3635 | ** | 76.4% ret of Jul-Aug fall | S3 | 1.3333 | * | 3 Sep low | |

| R1 | 1.3590/00 | ** | 24 Jul (w) high; cong | S4 | 1.3300 | * | congestion |

Asterisk denotes strength of level

08:10 BST - Little change, as mixed intraday studies keep near-term sentiment cautious and extend consolidation just shy of resistance at the 1.3590 weekly high of 24 July and congestion around 1.3600. Daily readings are rising and broader weekly stochastics have also ticked up, suggesting room for a later break towards the 1.3635 Fibonacci retracement. Already overbought daily stochastics could limit any initial tests in consolidation, before the improving weekly Tension Indicator prompts a break and extends August gains towards the 1.3681 high of 4 July. Meanwhile, support remains at congestion around 1.3500. A close beneath here, if seen, will add weight to sentiment and open up further congestion around 1.3400, where renewed consolidation is expected to appear.