Published: 2025-09-10T00:39:52.000Z

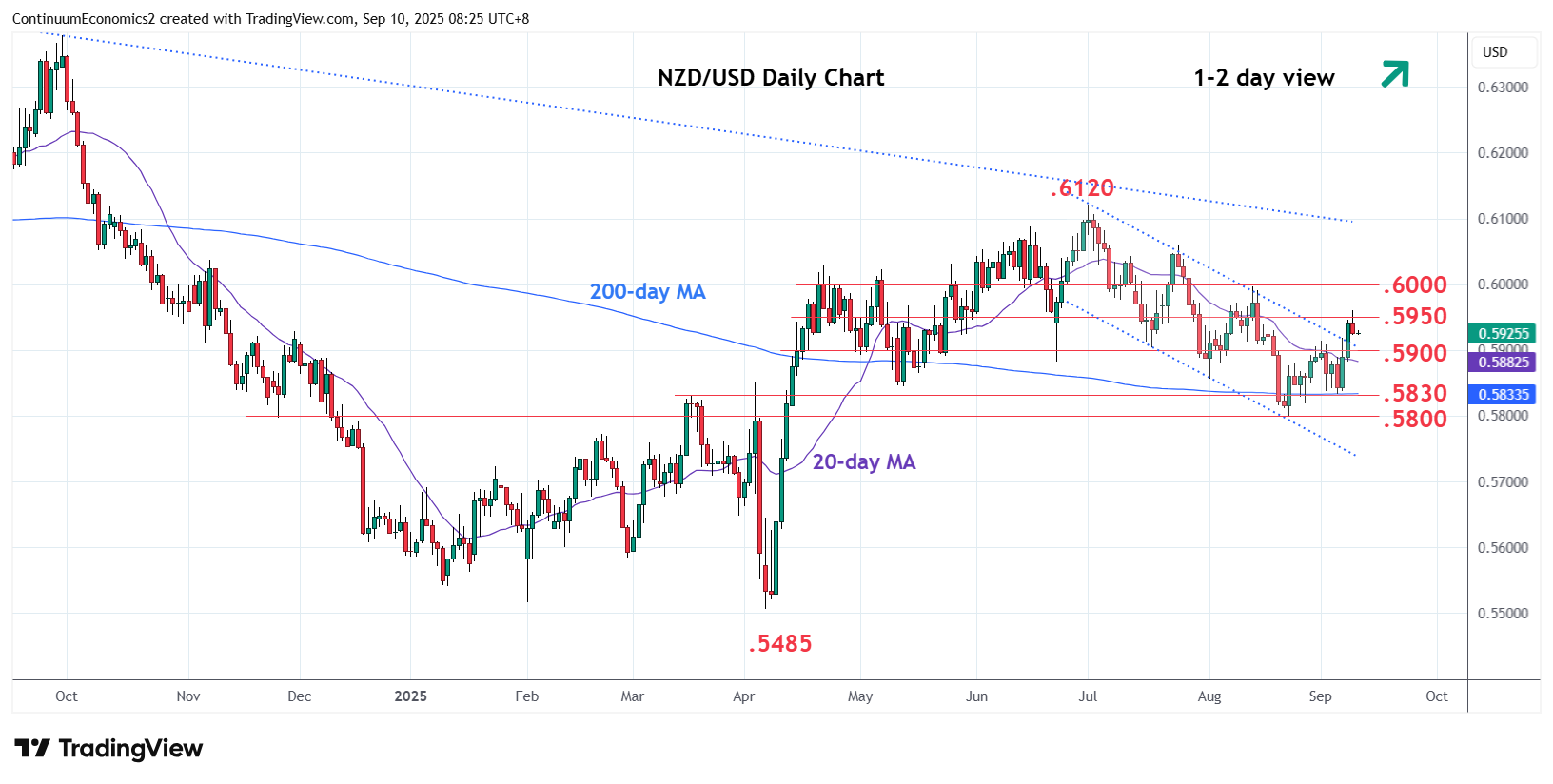

Chart NZD/USD Update: Consolidating test of .5950, romm for higher later

0

-

Limited on break of resistance at the .5950 congestion as prices gave way to selling pressure to unwind overbought intraday studies

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | .6100 | figure | S1 | .5915/00 | * | 1 Sep high, congestion | ||

| R3 | .6050/60 | ** | congestion, 24 Jul high | S2 | .5850/30 | * | congestion, Mar high | |

| R2 | .5995/00 | ** | Aug high, congestion | S3 | .5800 | ** | Aug low, 50% | |

| R1 | .5950 | * | congestion | S4 | .5772 | * | Feb high |

Asterisk denotes strength of level

00:30 GMT - Limited on break of resistance at the .5950 congestion as prices gave way to selling pressure to unwind overbought intraday studies. Pullback see resistance turned support at the .5900/15 area now expected to underpin and limit corrective pullback. Positive daily and weekly studies suggest correction to give way to renewed buying interest later to further retrace the July/August losses. Clearing the .5950 resistance will open up room for retest of the August high at .5995 and the 6000 level.