Published: 2025-09-18T13:27:15.000Z

Chart USD/JPY Update: Sharp bounce in both USD- and JPY-driven trade

2

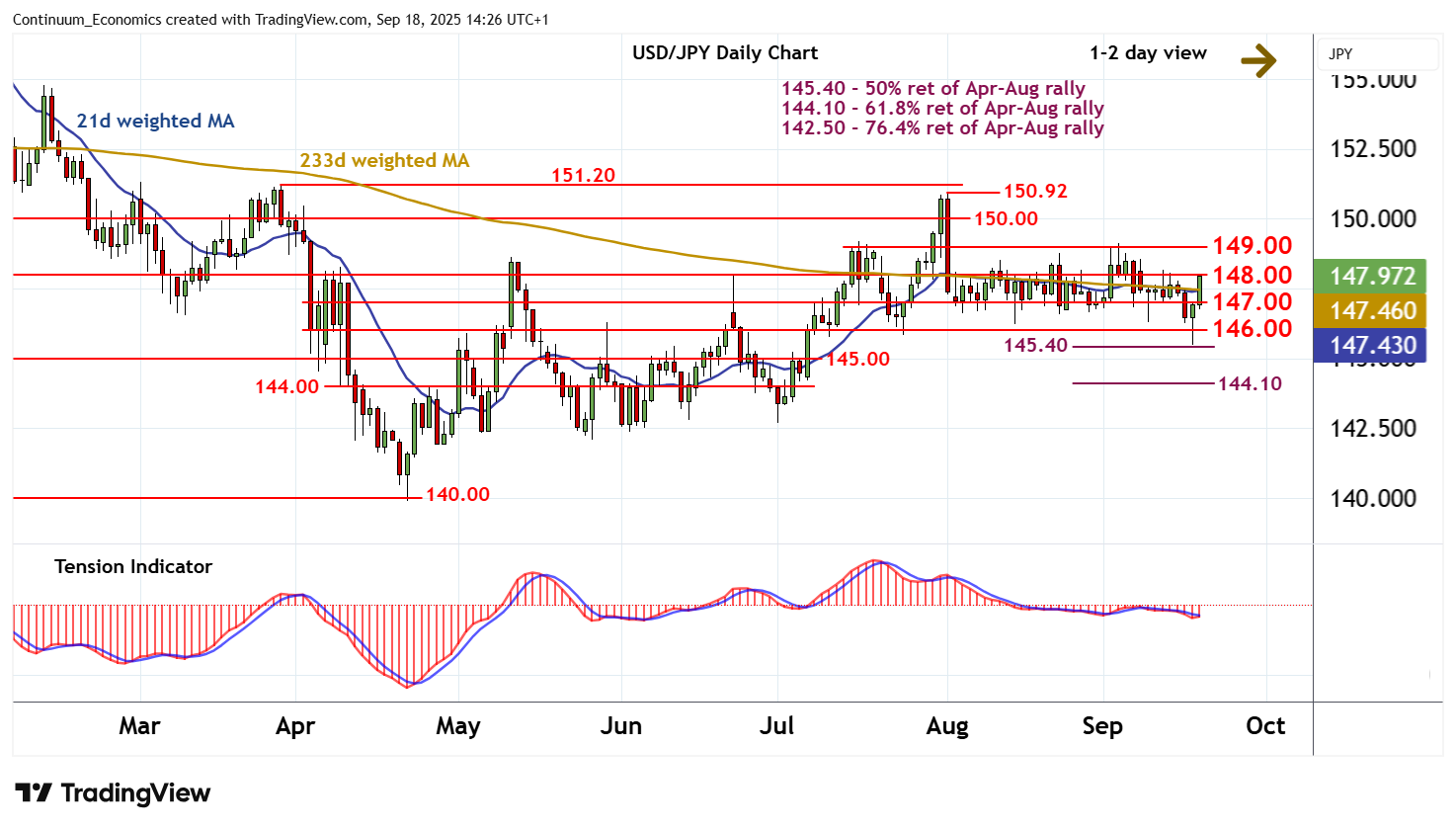

The anticipated break below 146.00 has bounced sharply from the 145.40 Fibonacci retracement in both USD- and JPY-driven trade

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 150.92 | ** | 1 Aug (m) high | S1 | 147.00 | ** | range lows | |

| R3 | 150.00 | ** | congestion | S2 | 146.00 | ** | break level | |

| R2 | 149.00 | congestion | S3 | 145.40 | ** | 50% ret of Apr-Aug rally | ||

| R1 | 148.00 | * | break level | S4 | 145.00 | * | congestion |

Asterisk denotes strength of level

13:55 BST - The anticipated break below 146.00 has bounced sharply from the 145.40 Fibonacci retracement in both USD- and JPY-driven trade, with prices currently pressuring resistance at 148.00. Oversold daily stochastics are unwinding and the negative daily Tension Indicator is turning up, highlighting room for still further gains in the coming sessions. A break above 148.00 will open up congestion around 149.00, where mixed weekly charts could prompt fresh consolidation. Meanwhile, a close back below 147.00 should give way to consolidation above 146.00.