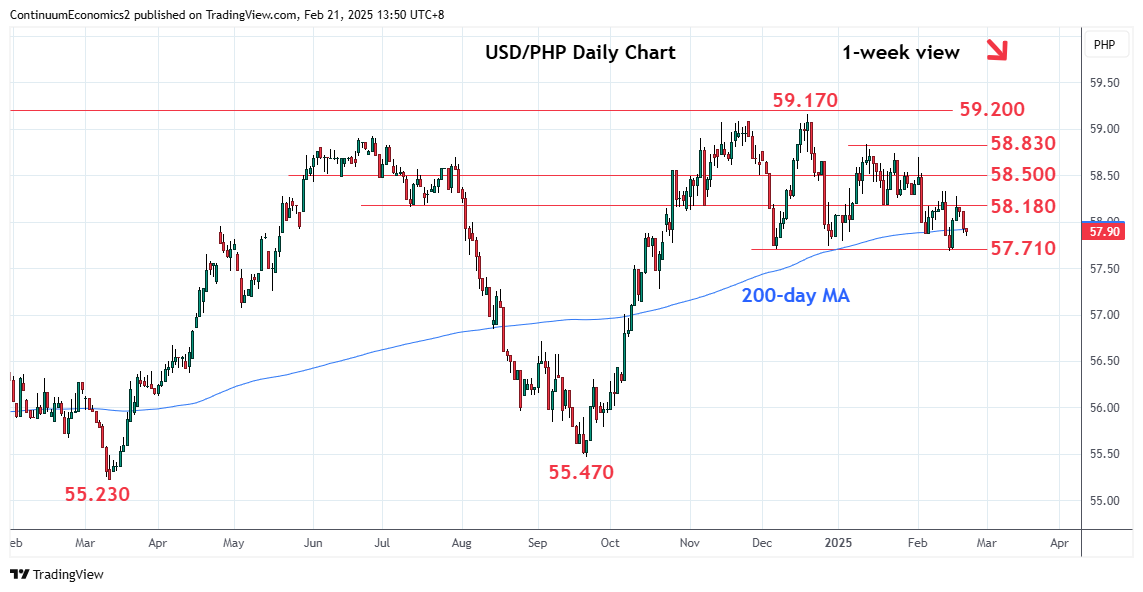

Failure to hold above the 58.000 level return focus to the downside for retest of the 57.710, December low

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 58.500 | * | congestion | S1 | 57.710 | ** | Dec low | |

| R3 | 58.330 | ** | 12 Feb high | S2 | 57.500 | * | congestion | |

| R2 | 58.180 | * | 20 Jan low | S3 | 57.320 | * | 50% Sep/Dec rally | |

| R1 | 58.000 | * | congestion | S4 | 57.270 | * | 21 Oct low |

Asterisk denotes strength of level

05:50 GMT - Failure to hold above the 58.000 level return focus to the downside for retest of the 57.710, December low. Negative daily studies suggest scope for break here to extend losses from the December high to retrace the rally from the September low. Lower will see room to the 57.500 congestion then the 57.320, 50% Fibonacci level. Meanwhile, resistance is lowered to the 58.000/58.180 congestion area which is expected to cap and sustain losses from the 58.270/58.330 lower highs. Only break above the latter will fade the downside pressure and see room for stronger bounce.