Published: 2025-07-30T08:10:49.000Z

Chart USD Index DXY Update: Consolidating - studies continue to rise

Senior Technical Strategist

2

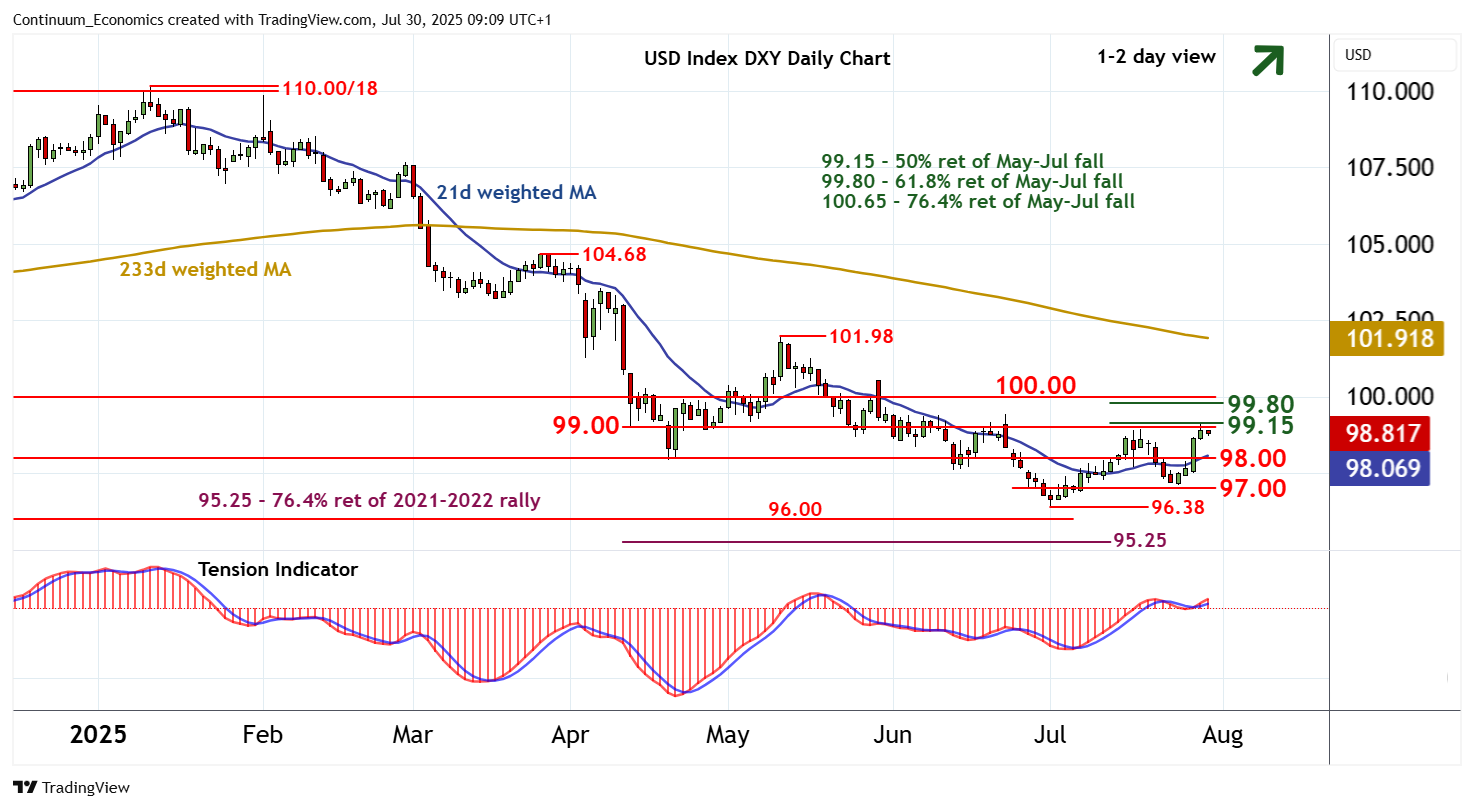

The test of resistance within 99.00/15 is giving way to consolidation

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 100.54 | ** | 29 May (w) high | S1 | 98.00 | * | congestion | |

| R3 | 99.80/00 | ** | 61.8% ret; congestion | S2 | 97.00 | * | congestion | |

| R2 | 99.15 | ** | 50% ret of May-Jul fall | S3 | 96.50 | * | congestion | |

| R1 | 99.00 | break level | S4 | 96.38 | ** | 1 Jul YTD low |

Asterisk denotes strength of level

09:00 BST - The test of resistance within 99.00/15 is giving way to consolidation, as intraday studies turn down, with prices currently balanced around 98.85. Daily readings continue to rise and broader weekly charts are also improving, highlighting room for still further gains in the coming sessions. A close above 99.00/15 will improve sentiment and confirm a near-term low in place at the 96.38 current year low of 1 July. Focus will then turn to strong resistance within 99.80-100.00. Meanwhile, support remains at congestion around 98.00. A close beneath here, if seen, will turn sentiment neutral and give way to consolidation above further congestion around 97.00.