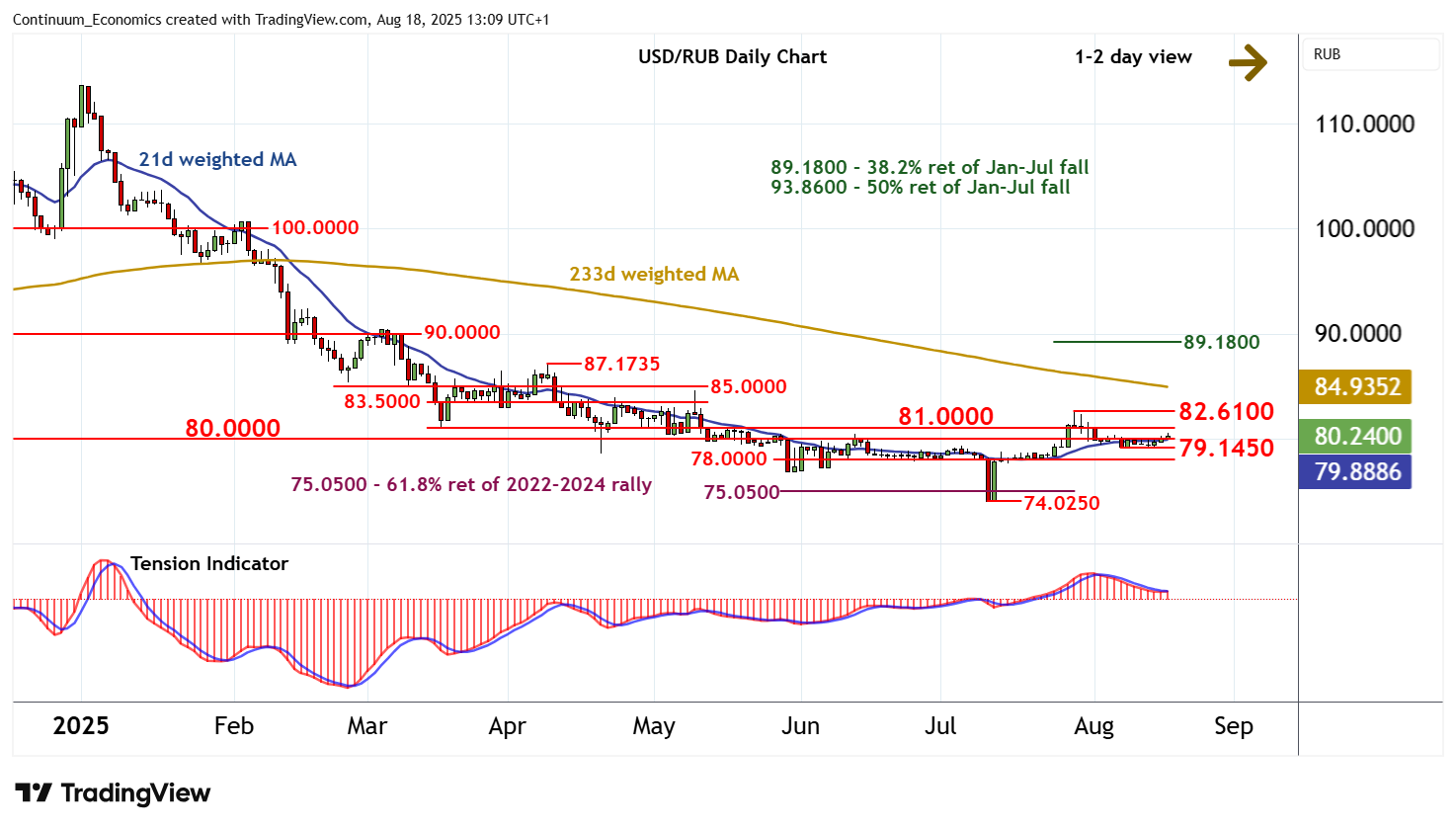

Chart USD/RUB Update: Higher into range

The anticipated break below 80.0000 has given way to range extension above 79.1450

| Levels | Comment | Levels | Comment | |||||

| R4 | 85.0000 | ** | congestion | S1 | 80.0000 | ** | congestion | |

| R3 | 83.5000 | * | congestion | S2 | 79.1450 | ** | 7 Aug (w) range low | |

| R2 | 82.6100 | * | 29 Jul (m) high | S3 | 78.0000 | congestion lows | ||

| R1 | 81.0000 | * | break level | S4 | 75.0500 | ** | 61.8% ret of 2022-2024 rally |

Asterisk denotes strength of level

12:50 BST - The anticipated break below 80.0000 has given way to range extension above 79.1450, before turning higher once again to trade back above congestion support at 80.0000. Oversold daily stochastics are unwinding and the flat daily Tension Indicator is turning up, suggesting room for continuation towards resistance at 81.0000. The rising weekly Tension Indicator highlights scope for a test above here. But flat overbought weekly stochastics and mixed longer-term charts should limit scope in fresh consolidation beneath critical resistance at the 82.6100 monthly high of 29 July. Meanwhile, a close below 79.1450, if seen, will turn sentiment negative and extend late-July losses towards congestion around 78.0000.