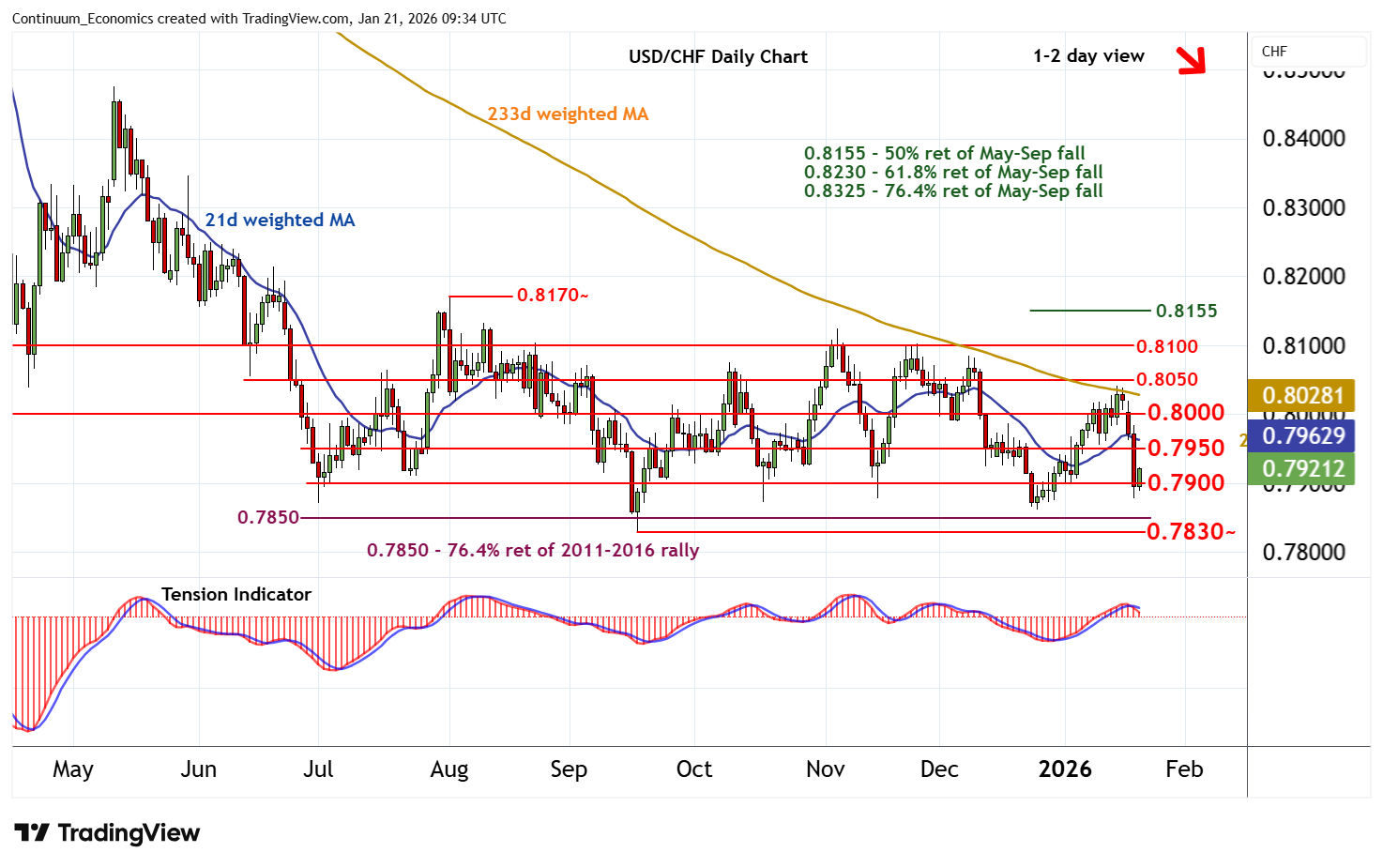

Chart USD/CHF Update: Consolidating sharp losses - daily studies under pressure

The anticipated break below 0.7900 has bounced from 0.7880~

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8100 | ** | break level | S1 | 0.7900 | * | congestion | |

| R3 | 0.8050 | break level | S2 | 0.7850 | ** | 76.4% ret of 2011-2016 rally | ||

| R2 | 0.8000 | ** | congestion | S3 | 0.7830~ | ** | 17 Sep 2025 (y) low | |

| R1 | 0.7950 | * | congestion | S4 | 0.7800 | * | figure |

Asterisk denotes strength of level

09:20 GMT - The anticipated break below 0.7900 has bounced from 0.7880~, with prices currently consolidating above 0.7900. Rising intraday studies are unwinding oversold areas, suggesting room for a bounce. But negative daily studies and mixed/negative weekly charts should limit scope in renewed selling interest towards congestion resistance at 0.7950. In the coming sessions, cautious trade is expected to give way to fresh losses. A later break back below congestion support at 0.7900 will open up critical support at the 0.7850 Fibonacci retracement and the 0.7830~ year low of 17 September 2025. A further close beneath here will add weight to sentiment and extend December 2016 losses initially to 0.7800.