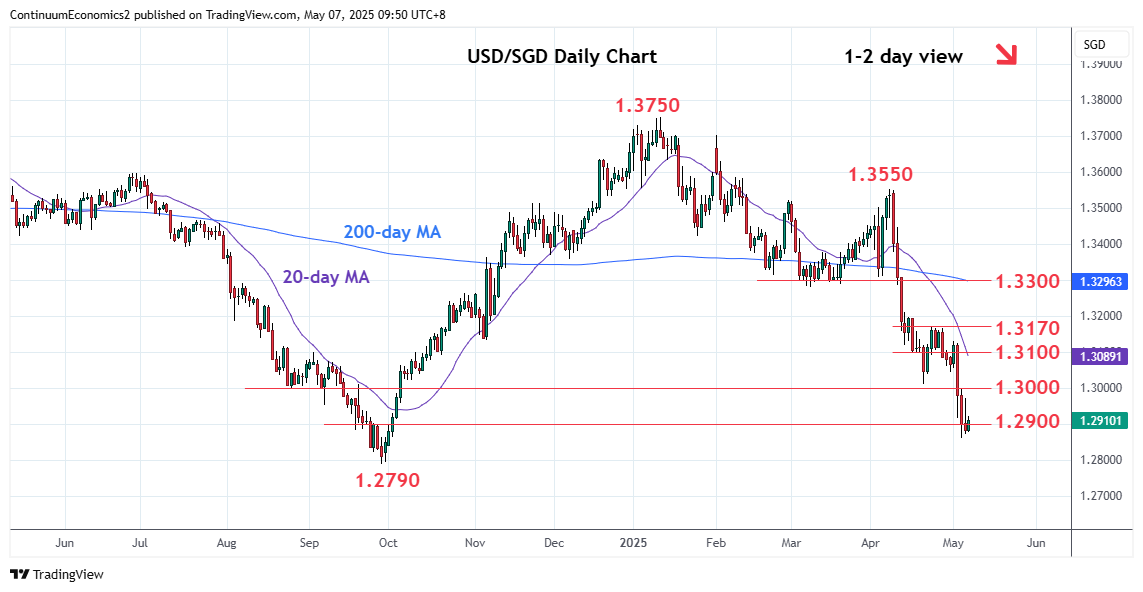

Turned up from the 1.2861 low to consolidate recent sharp losses

| Level | Comment | Level | Comment | ||||

|---|---|---|---|---|---|---|---|

| R4 | 1.3170 | ** | 23 Apr high | S1 | 1.2861 | ** | 5 May YTD low |

| R3 | 1.3100/30 | * | congestion, 1 May high | S2 | 1.2790 | ** | Sep 2024 multi-year low |

| R2 | 1.3050 | * | congestion | S3 | 1.2705 | * | 29 Oct 2014 low |

| R1 | 1.3000/10 | ** | congestion, Apr low | S4 | 1.2676 | * | 9 Oct 2014 low |

Asterisk denotes strength of level

01:55 GMT - Turned up from the 1.2861 low to consolidate recent sharp losses as prices unwind the oversold intraday studies. However, further losses cannot be ruled out and lower will see scope to target the 1.2790, September 2024 multi-year low. Would expect reaction on retest of the latter as weekly studies are oversold and caution corrective bounce to retrace steep drop from the 1.3550, April high. Meanwhile, resistance is at the 1.3000/10 congestion and April low. Above here will open up room for stronger corrective bounce to the 1.3050 congestion and 1.3100/30 resistance.