Chartbook: US Chart Gold (XAU): Poised for retest of 3500 record high

Saw rally to fresh high in early April with gains reaching record high at 3500

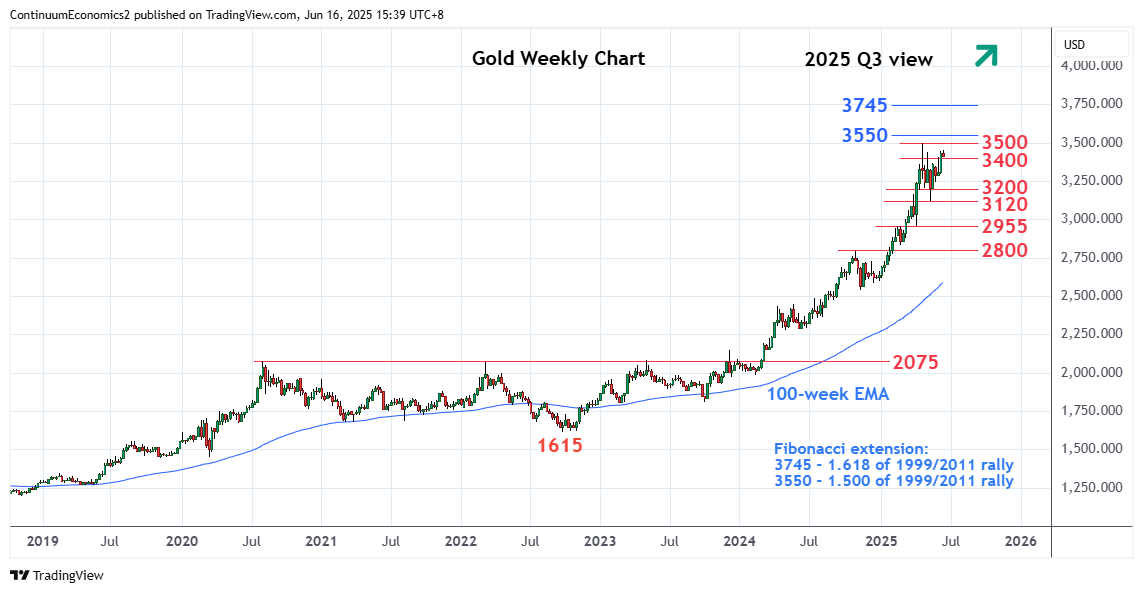

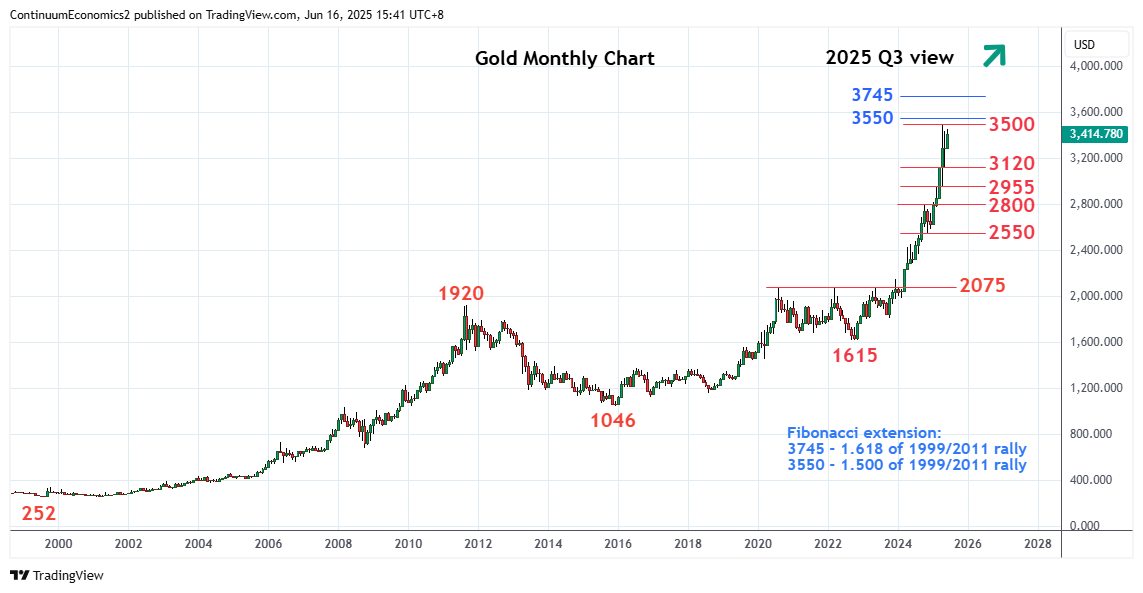

Saw rally to fresh high in early April with gains reaching record high at 3500 before turning lower to consolidate strong gains from the January low. Subsequent bounce from the May swing low at 3120 to regain the 3400 level return focus to the 3500 high.

Retest of this high likely to struggle on initial test though the bullish price action highlights potential for break to further extend the underlying bull trend. Weekly studies remains positive and clearance will see room to Fibonacci extension target at 3550. Beyond this will see scope for stronger gains to 3745, 1.618 Fibonacci extension of the 1999/2011 rally measured from 2015 low. Above here will turn focus to the 4000 psychological level.

However, stretched monthly studies following steep gains from October 2023 caution corrective pullback. Meanwhile, support is at the 3200 congestion which extend to the 3120 low of 15 May, a 10% corrective pullback from the 3500 high. Failure to hold this will open up room for deeper pullback to the 2955 (coincident of April low and February high) and extending to 2800 (October high), a 15-20% correction from 3500 high.