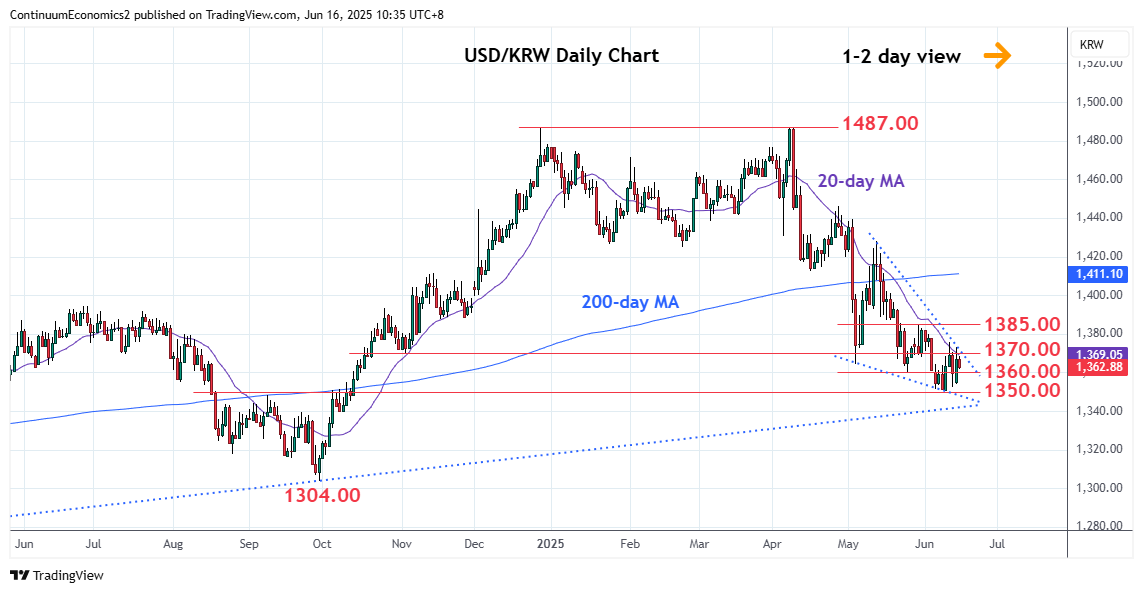

Little change, as prices extend choppy trade above the 1351.00/1352.00 lows

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 1395.00 | * | Jun 2024 high | S1 | 1351.00 | ** | 10 Jun YTD low, 50% | |

| R3 | 1385.00 | ** | 29 May high | S2 | 1340.00 | * | congestion, 8 Oct low | |

| R2 | 1375.00 | * | 11 Jun high | S3 | 1330.00 | * | congestion | |

| R1 | 1370.00 | * | congestion | S4 | 1320.00 | * | 61.8% 2023/2025 rally |

Asterisk denotes strength of level

02:35 GMT - Little change, as prices extend choppy trade above the 1351.00/1352.00 lows. However, the resulting wedge pattern suggest scope for stronger bounce to retrace losses from the 13 May high at 1428.00. Above the 1370.00/1375.00 resistance will open up room for stronger corrective bounce to the 1385.00/1395.00 area. Meanwhile, support is raised to the 1360.00 congestion which should sustain bounce from the 1351.00 low. Failure here will further extend losses from the 1487.00 December/April double top and see room to 1340.00 support.