Published: 2025-05-28T08:14:06.000Z

Chart USD/CHF Update: Consolidating

Senior Technical Strategist

-

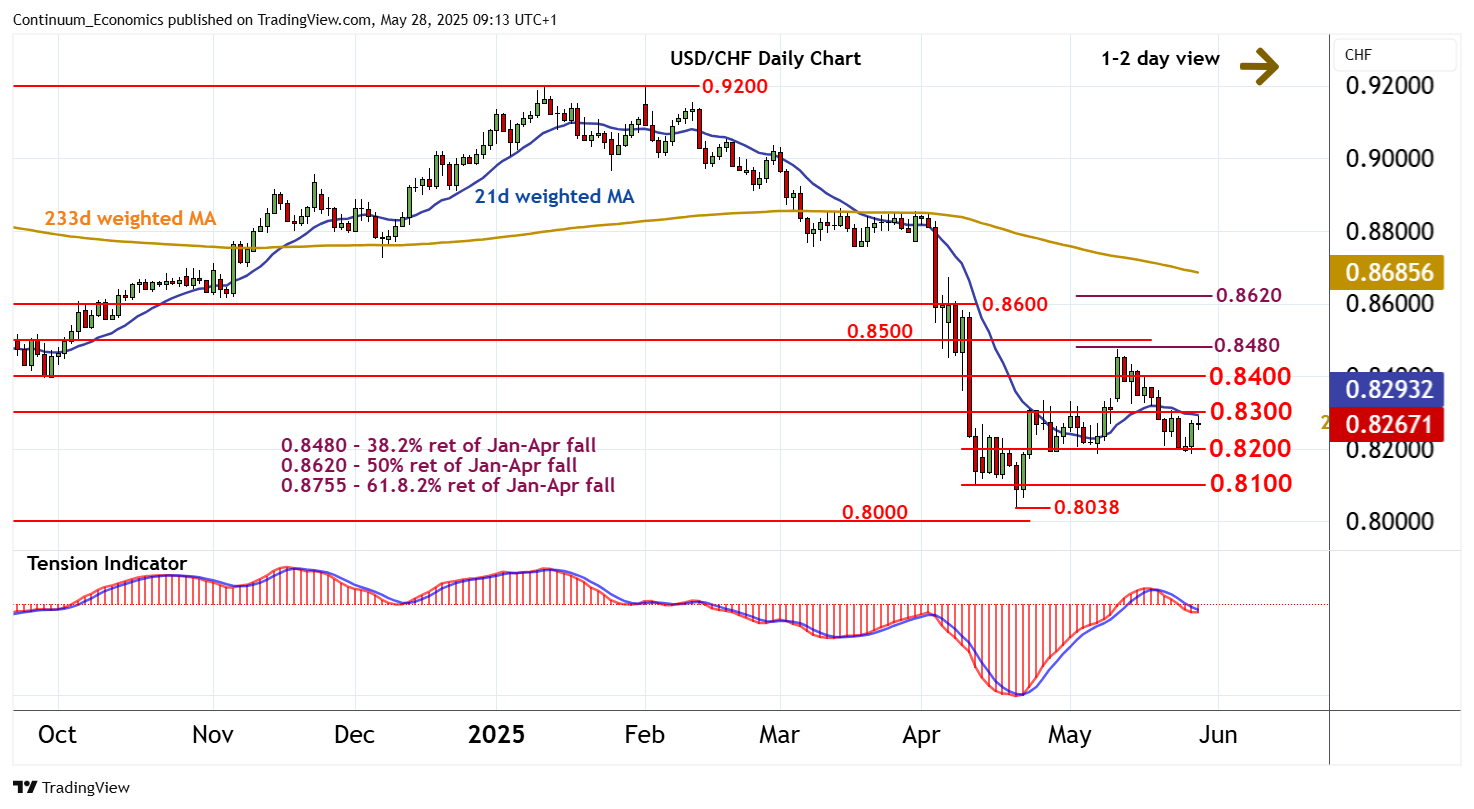

The anticipated test of congestion resistance at 0.8300 has met selling interest around 0.8290

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8500 | ** | congestion | S1 | 0.8200 | * | congestion | |

| R3 | 0.8480 | ** | 38.2% ret of Jan-Apr fall | S2 | 0.8100 | minor congestion | ||

| R2 | 0.8400 | * | congestion | S3 | 0.8038 | ** | 21 Apr YTD low | |

| R1 | 0.8300 | ** | congestion | S4 | 0.8000 | ** | figure |

Asterisk denotes strength of level

09:00 BST - The anticipated test of congestion resistance at 0.8300 has met selling interest around 0.8290, as overbought intraday studies unwind, with prices currently trading around 0.8265. Oversold daily stochastics are unwinding and the negative daily Tension Indicator is flattening, suggesting room for a test above 0.8300. But mixed weekly charts are expected to limit scope in renewed consolidation beneath further congestion around 0.8400. Meanwhile, support remains at congestion around 0.8200. A close beneath here, if seen, will give way to renewed consolidation above further congestion around 0.8100.