Published: 2025-08-28T01:04:04.000Z

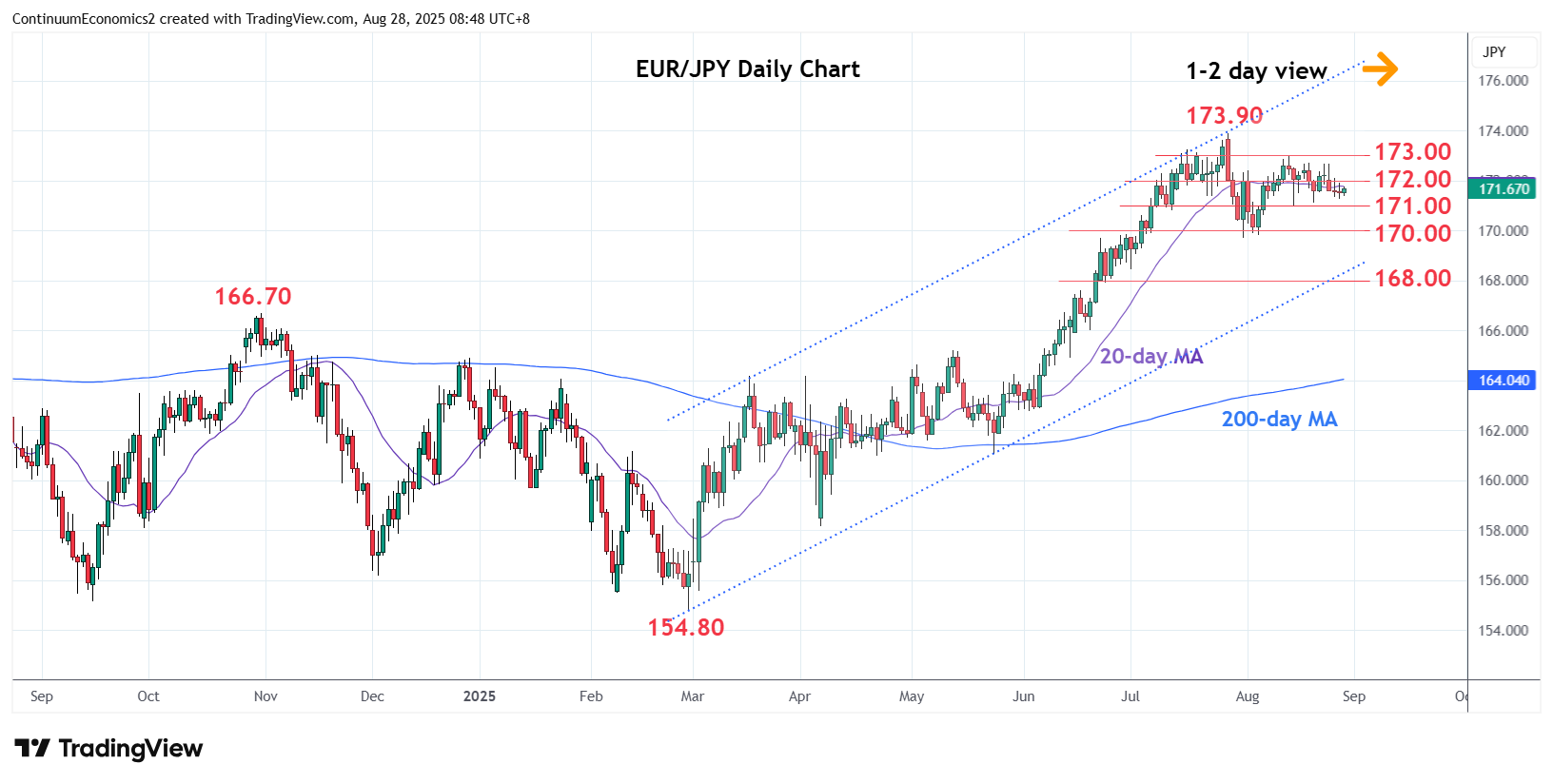

Chart EUR/JPY Update: Leaning lower towards 171.00 support

0

-

Little change, as prices drift narrowly within the 172.00/171.00 area

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 174.50 | * | congestion | S1 | 171.00 | ** | 14 Aug low, congestion | |

| R3 | 173.90 | ** | 28 Jul YTD high | S2 | 170.00 | ** | congestion | |

| R2 | 173.00 | ** | congestion | S3 | 168.45 | 1 Jul low | ||

| R1 | 172.00 | * | congestion | S4 | 168.00 | * | congestion |

Asterisk denotes strength of level

01:00 GMT - Little change, as prices drift narrowly within the 172.00/171.00 area. However, the daily and weekly studies are tracking lower from overbought areas and suggest risk for break of the 171.00 support to open up room for retest of the 170.00 support. Below this will extend the broader losses from the 173.90 July current year high to support at the 168.45/168.00 area. Meanwhile, resistance is at the 172.00 level ahead of the 172.70/173.00 highs, now expected to cap.