Published: 2025-03-14T11:41:44.000Z

Chart USD/ZAR Update: Lower in range

Senior Technical Strategist

-

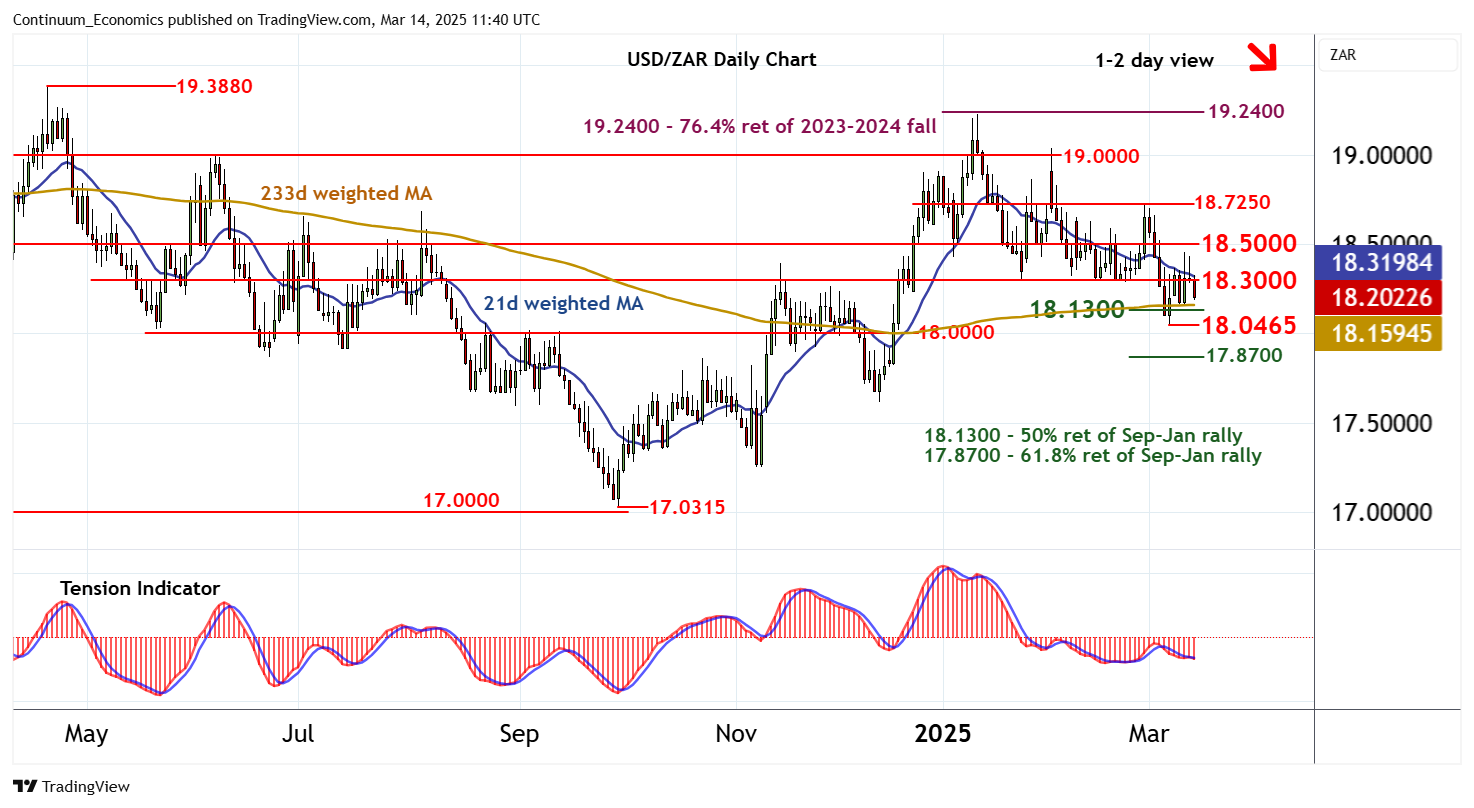

Cautious trade above 18.3000 has given way to a break lower

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 18.8500 | break level | S1 | 18.1300 | * | 50% ret of Sep-Jan rally | ||

| R3 | 18.7250 | * | congestion | S2 | 18.0465 | ** | 7 Mar YTD low | |

| R2 | 18.5000 | ** | break level | S3 | 18.0000 | ** | congestion | |

| R1 | 18.3000 | ** | break level | S4 | 17.8700 | ** | 61.8% ret of Sep-Jan rally |

Asterisk denotes strength of level

11:30 GMT - Cautious trade above 18.3000 has given way to a break lower, as intraday studies turn down once again, with immediate focus on support at the 18.1300 Fibonacci retracement. Just lower is the 18.0465 current year low of 7 March, but mixed/positive daily readings are expected to limit any immediate tests of this range in consolidation, before negative weekly charts extend losses still further. A later close beneath here will add weight to sentiment and open up the 17.8700 retracement. Meanwhile, a close back above 18.3000, if seen, will turn sentiment neutral and give way to consolidation beneath 18.5000.