Published: 2026-01-30T06:39:10.000Z

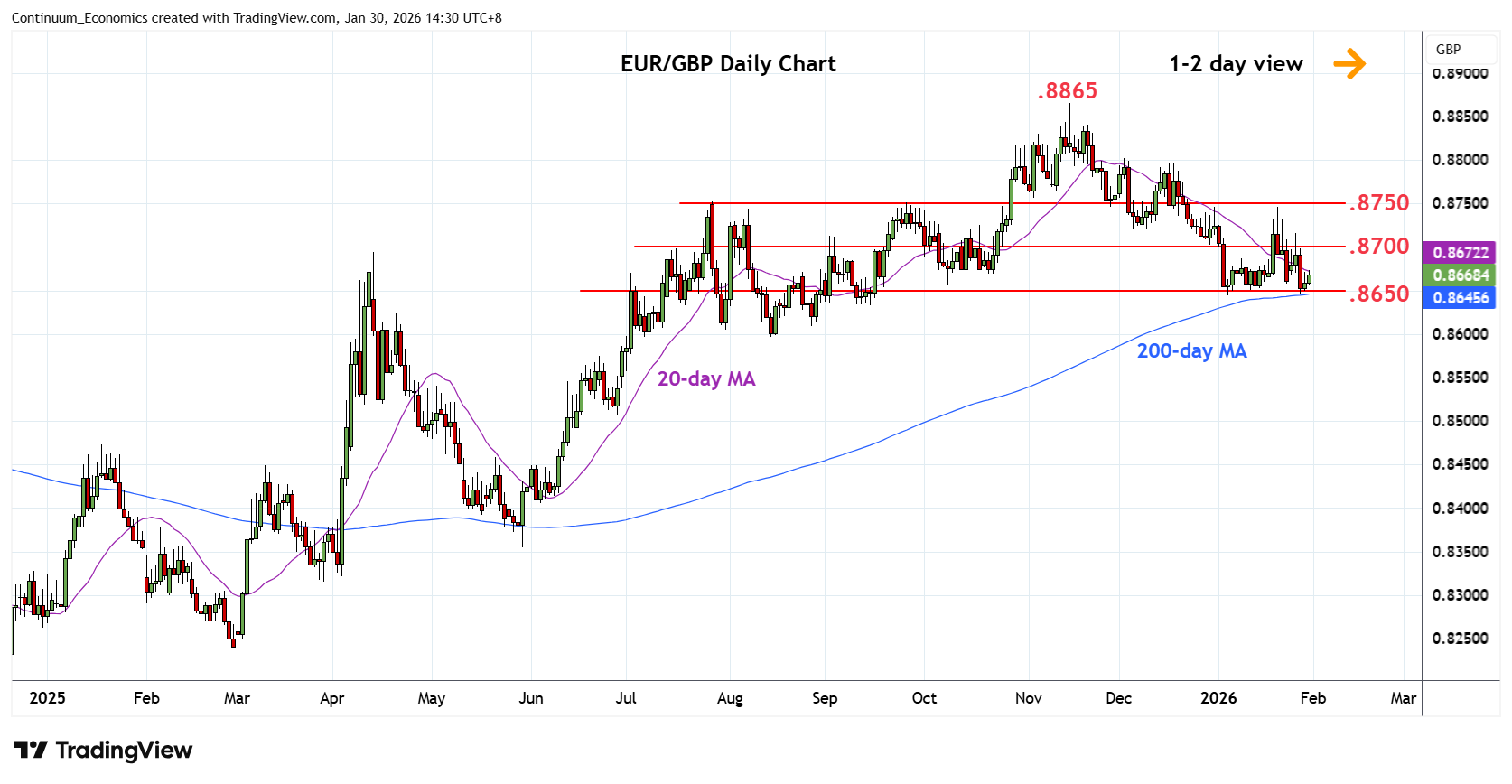

Chart EUR/GBP Update: Extend consolidation at .8650/45 support

3

Little change, as prices turned up from the .8650/45 support to consolidate rejection from the .8745 high of last week

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.8840 | 20 Nov high | S1 | 0.8645 | ** | 6 Jan YTD low, 200-day MA | ||

| R3 | 0.8800 | ** | congestion | S2 | 0.8620 | * | 38.2% 2024/2025 rally | |

| R2 | 0.8750 | ** | Jul/Sep highs | S3 | 0.8600 | * | congestion | |

| R1 | 0.8700 | * | congestion | S4 | 0.8550/45 | * | congestion, 50% |

Asterisk denotes strength of level

06:35 GMT - Little change, as prices turned up from the .8650/45 support to consolidate rejection from the .8745 high of last week. Bullish divergence on daily studies suggest scope for bounce to extend consolidation above the 200-day MA. However, strong resistance at the .8700/.8750 congestion and July/September highs are expected to cap. Consolidation is expected to give way to fresh selling pressure later and lower will extend the broader losses from the .8865 November 2025 year high to support at .8620/00, 38.2% Fibonacci level and congestion area.