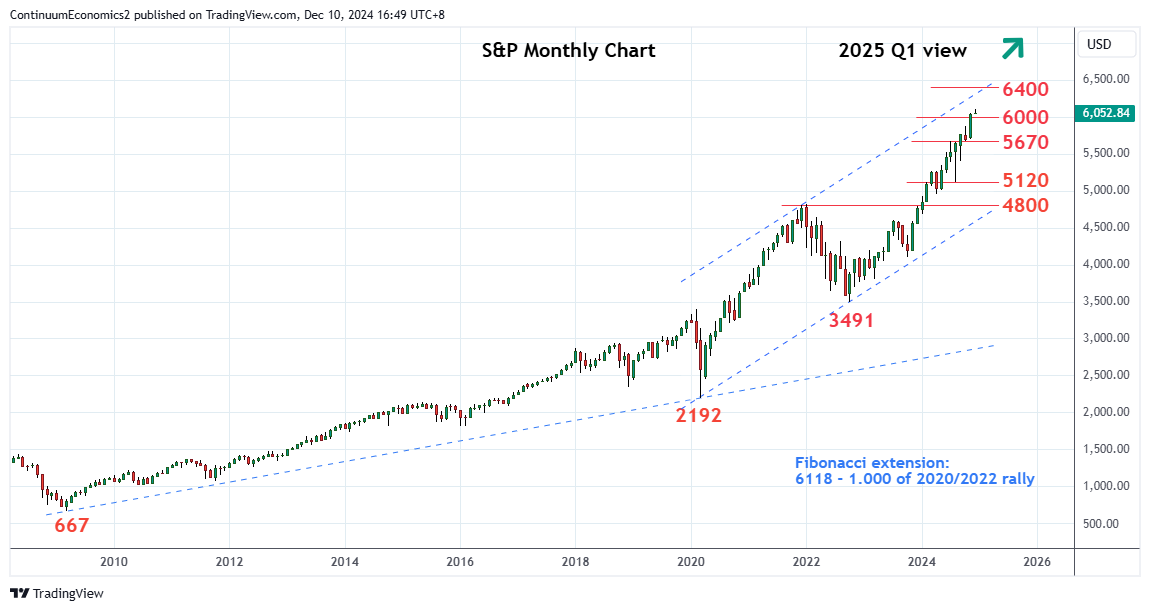

Chartbook: U.S. Chart S&P 500: Extend gains within the bullish channel from 2020 year low

Break above the 5670 July high has seen bullish extension to reach multiple record highs in Q4

Break above the 5670 July high has seen bullish extension to reach multiple record highs in Q4. A brief pause at the 6000 level has since given way to renewed buying pressure to reach towards equality target of the 2020/2022 rally at 6118.

Consolidation below the latter see prices unwinding overbought daily and weekly studies but this is expected to give way to further gains later. Clearance will see room to extend gains within the bullish channel from the March 2020 year low towards the upper channel area which extends to the 6350/6400 area going into Q1 of 2025. Would expect reaction at the latter to correct strong gains from the 3491, the 2022 year low and channel support.

Pullback below the 6000 level will see room for deeper correction to unwind overbought weekly and monthly studies and see scope to the 5700/5670 congestion and July high. This area is expected to underpin and limit corrective pullback. Failure here will fade the upside pressure and see room for deeper correction to support at the 5400 level which extend to the 5265, Q1 high. Lower still will see scope to 5120 support and 5000 figure.