Published: 2025-06-11T11:21:49.000Z

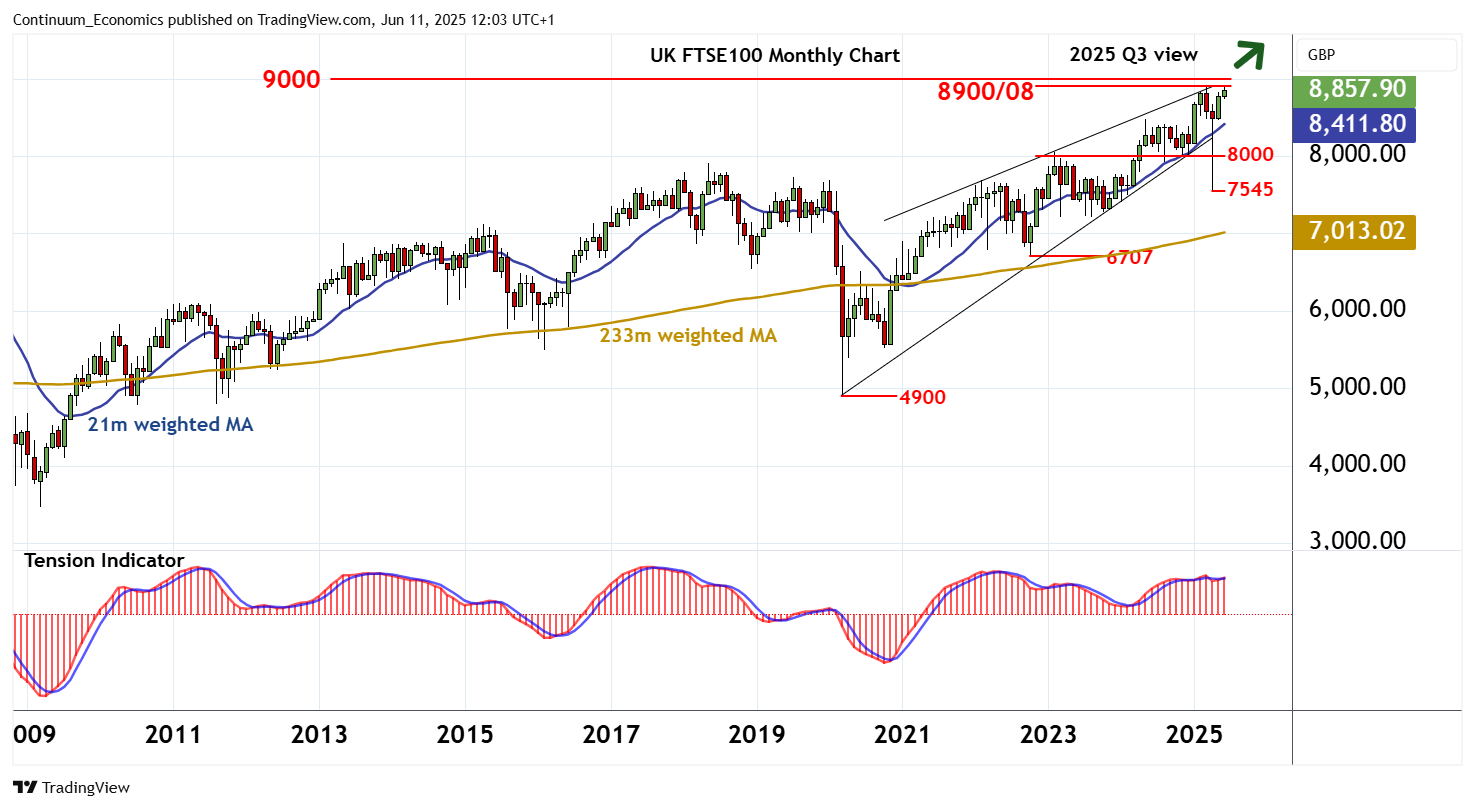

Chartbook: UK Chart FTSE 100 Update: Back at highs following April volatility

0

4

The anticipated pullback extended below 8000 in highly volatile early-April trade

The anticipated pullback extended below 8000 in highly volatile early-April trade,

with prices extending to 7545 before bouncing sharply.

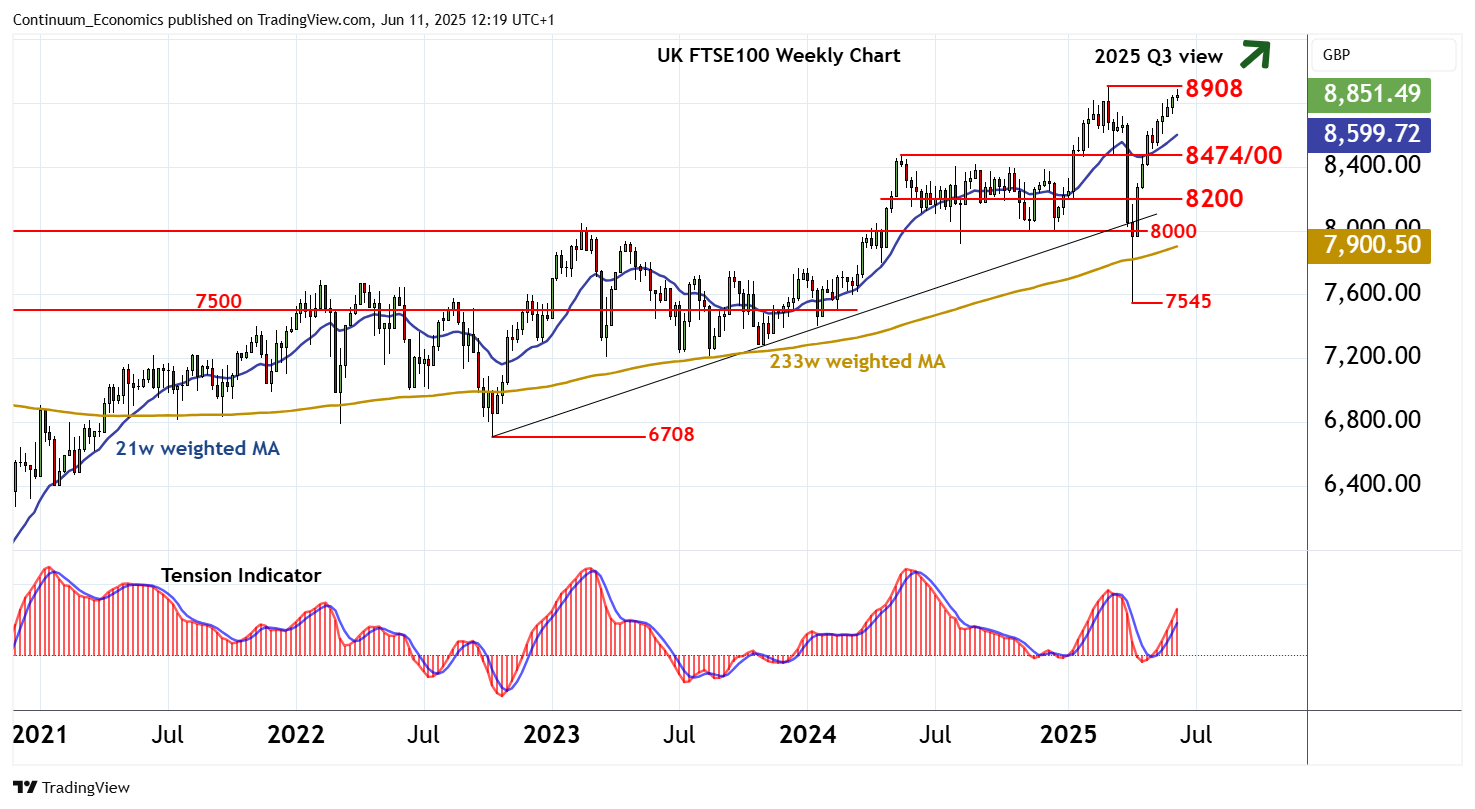

Steady buying interest has pushed prices back to critical resistance at the 8908 current all-time high of 3 March within the multi-year rising wedge.

Monthly studies are mixed, suggesting any initial tests could give way to consolidation. But longer-term readings are positive, suggesting room for a later break and fresh contract highs towards psychological resistance at 9000.

A further close above here would likely negate the rising wedge formation - and implied downside risks - as fresh buying interest then opens up the 9500 psychological level.

Meanwhile, support is at the 8474 year high of May 2024 and congestion around 8500.

Rising weekly studies are expected to limit any immediate pullbacks in fresh consolidation/buying interest above here.

But if broken, any higher levels will be delayed as prices settle into consolidation above congestion around 8200.