Published: 13/03/25 at 01:59 UTC

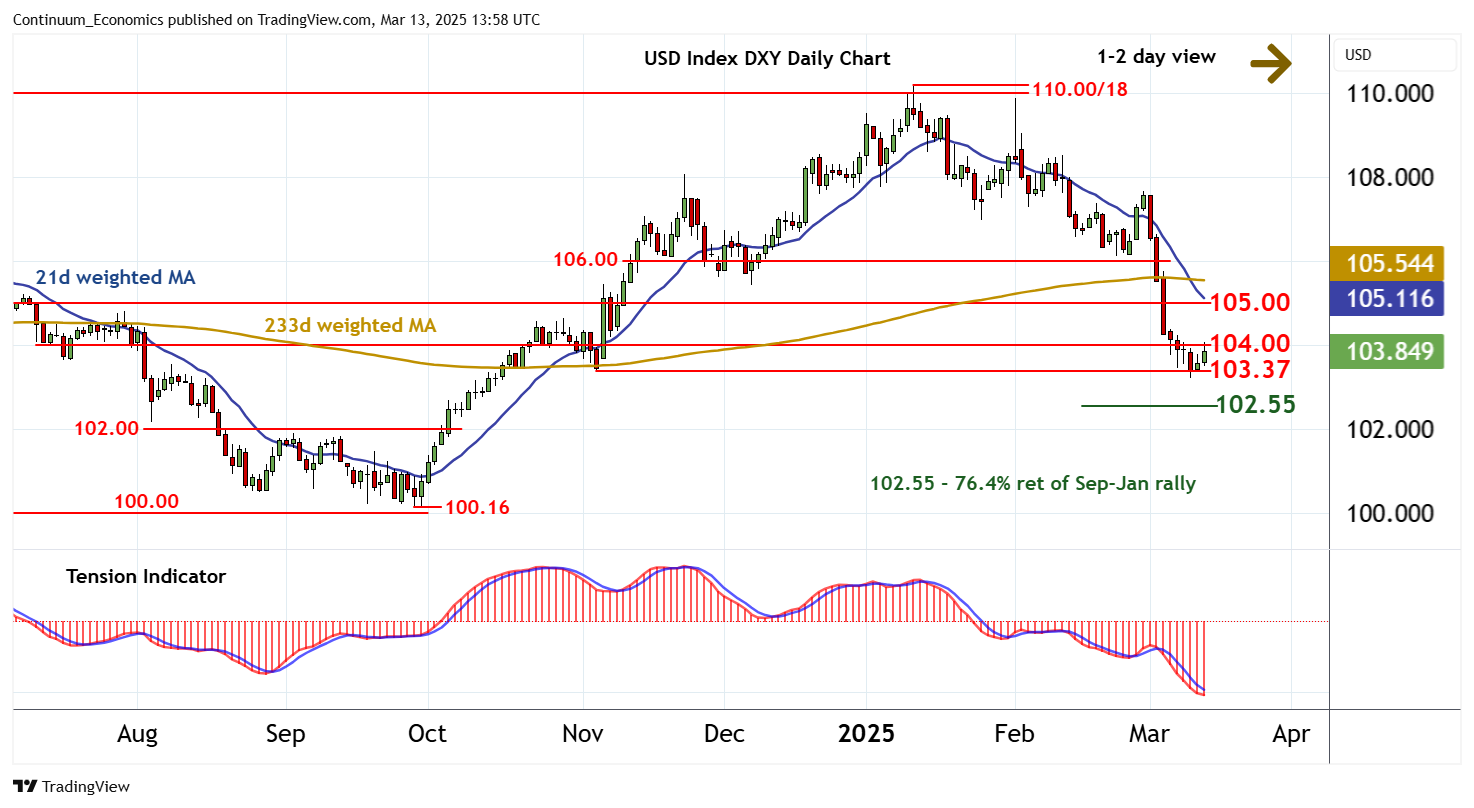

Chart USD Index DXY Update: Consolidating - limited scope above 104.00

Senior Technical Strategist

-

Cautious trade has given way to a test of congestion resistance at 104.00

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 107.00 | ** | break level | S1 | 103.37 | ** | 5 Nov (m) low | |

| R3 | 106.00 | ** | congestion | S2 | 103.00 | * | congestion | |

| R2 | 105.00 | break level | S3 | 102.55 | ** | 76.4% ret of Sep-Jan rally | ||

| R1 | 104.00 | * | congestion | S4 | 102.00 | ** | congestion |

Asterisk denotes strength of level

13:45 GMT - Cautious trade has given way to a test of congestion resistance at 104.00, with prices currently trading around 103.85. Intraday studies are rising and oversold daily stochastics are ticking up, suggesting potential for a test above here in the coming sessions. But the bearish daily Tension Indicator and negative weekly charts are expected to limit scope in consolidation beneath resistance at 105.00. Meanwhile, support remains at the 103.37 monthly low of 5 November. A close beneath here, not yet seen, will add weight to sentiment and extend January losses towards congestion around 103.00. Still lower is the 102.55 retracement, where short-covering/consolidation could develop.