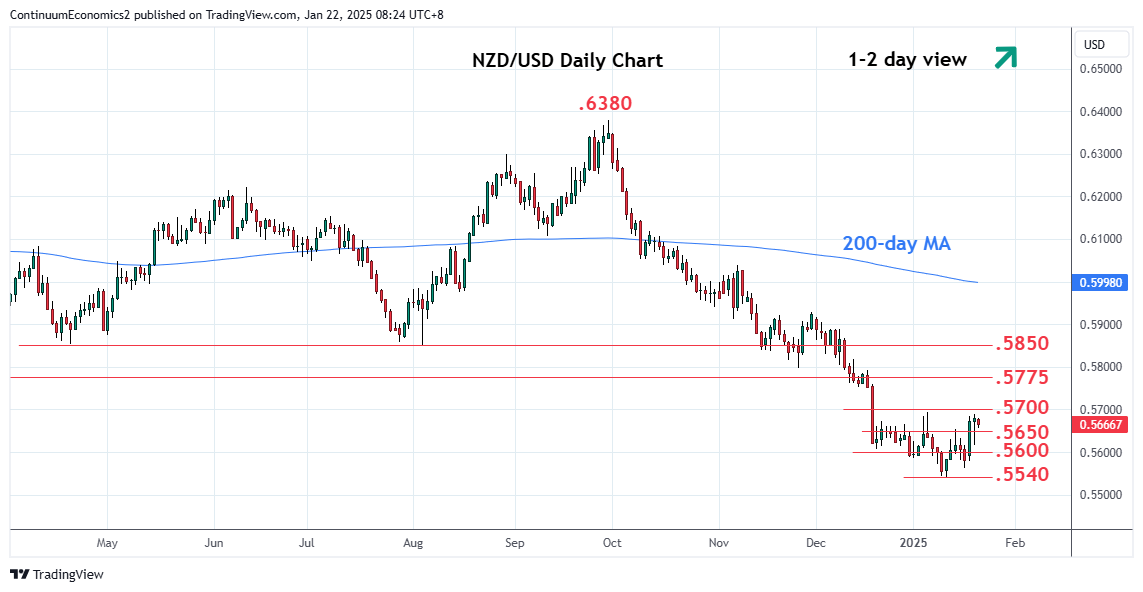

Extending consolidation beneath the .5700 level but pressure remains on the upside

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | .5850/60 | * | congestion, 38.2% | S1 | .5650/55 | * | congestion, 15 Jan high | |

| R3 | .5800 | * | congestion | S2 | .5600 | * | congestion | |

| R2 | .5775 | ** | 2023 year low | S3 | .5540 | ** | 13 Jan YTD low | |

| R1 | .5700 | * | congestion | S4 | .5512 | ** | 2022 year low |

Asterisk denotes strength of level

00:40 GMT - Extending consolidation beneath the .5700 level but pressure remains on the upside as prices trace out a potential 5-week bottom pattern at the .5540 low. Positive daily and weekly studies suggest consolidation to give way to break to open up stronger gains to retrace the steep losses from the September high. Clearance will see room to the strong resistance at the .5775/.5800 area. Beyond this will see extension to the .5860, 38.2% Fibonacci level. Meanwhile, support remains at the .5655/55 which extend to the .5600 level which should underpin and sustain gains from the .5540 low.