Chartbook: Chart EUR/GBP: Cautious trade - monthly studies rising

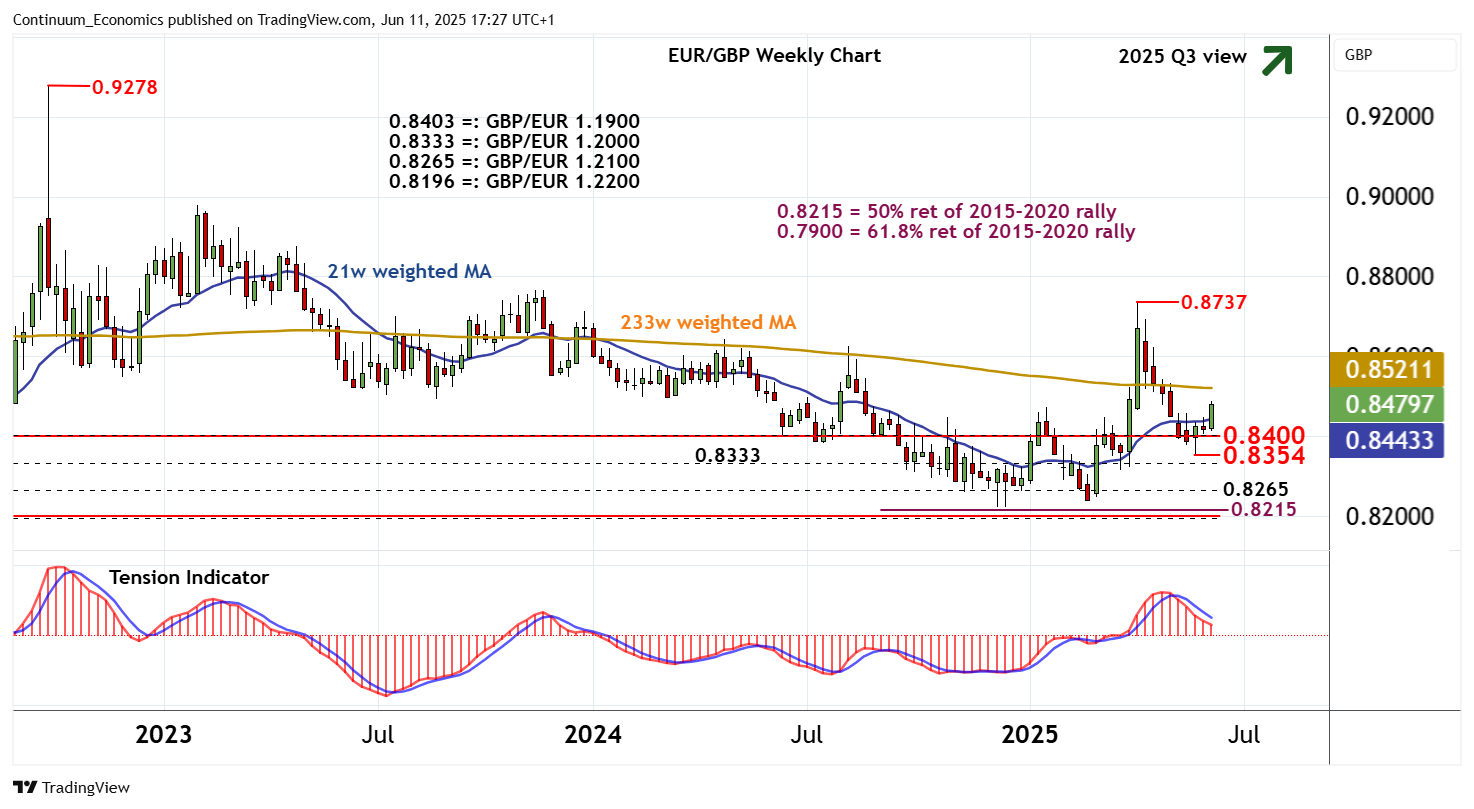

The anticipated test higher has met expected selling interest within congestion around 0.8700 and the 0.8765 monthly high of November 2023

The anticipated test higher has met expected selling interest within congestion around 0.8700 and the 0.8765 monthly high of November 2023,

with prices currently balanced in cautious trade beneath congestion resistance at 0.8500.

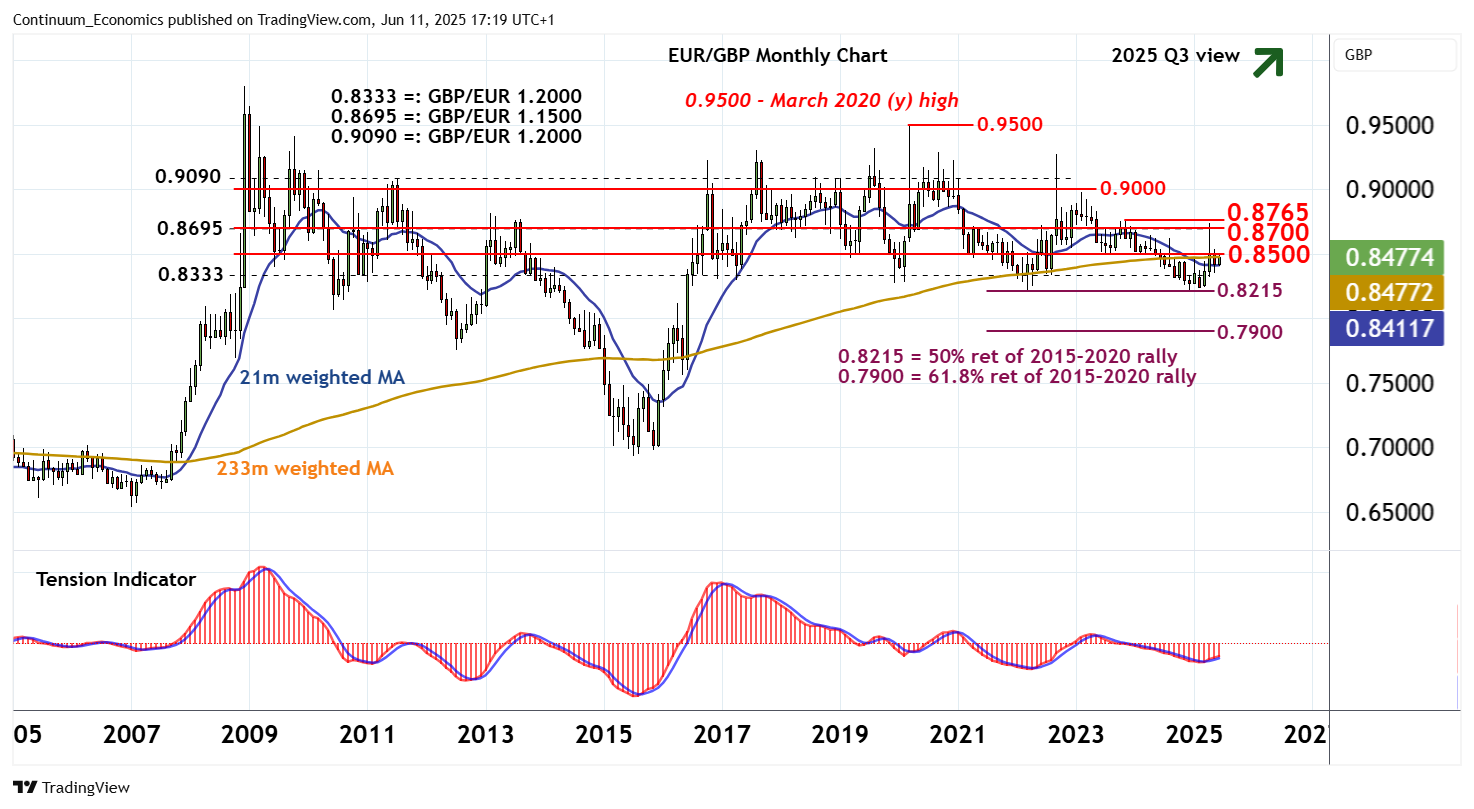

Monthly stochastics are rising and the monthly Tension Indicator is also improving, highlighting signs of a more constructive tone and potential for fresh gains in the coming months.

A close above 0.8500 will improve sentiment and put focus back on 0.8700/65.

But already overbought monthly stochastics and mixed longer-term readings are expected to limit any initial tests in renewed consolidation.

A further close above 0.8700/65 would turn sentiment positive and December 2024 gains towards strong resistance at congestion around 0.9000 and 0.9090, (GBP/EUR 1.2000).

Meanwhile, support is at congestion around 0.8400 and extends to the 0.8354 monthly low of 29 May.

A close beneath here, if seen, would add weight to sentiment and extend losses from the 0.8737 high of April towards 0.8333, (GBP/EUR 1.2000). A further close beneath here would open up 0.8265, (GBP/EUR 1.2100). But critical support at the 0.8215 Fibonacci retracement and the 0.8222 year low of December 2024 should underpin any initial tests. An unexpected close beneath here would turn sentiment negative and extend March 2020 losses towards strong support at congestion around 0.8000 and the 0.7900 retracement.