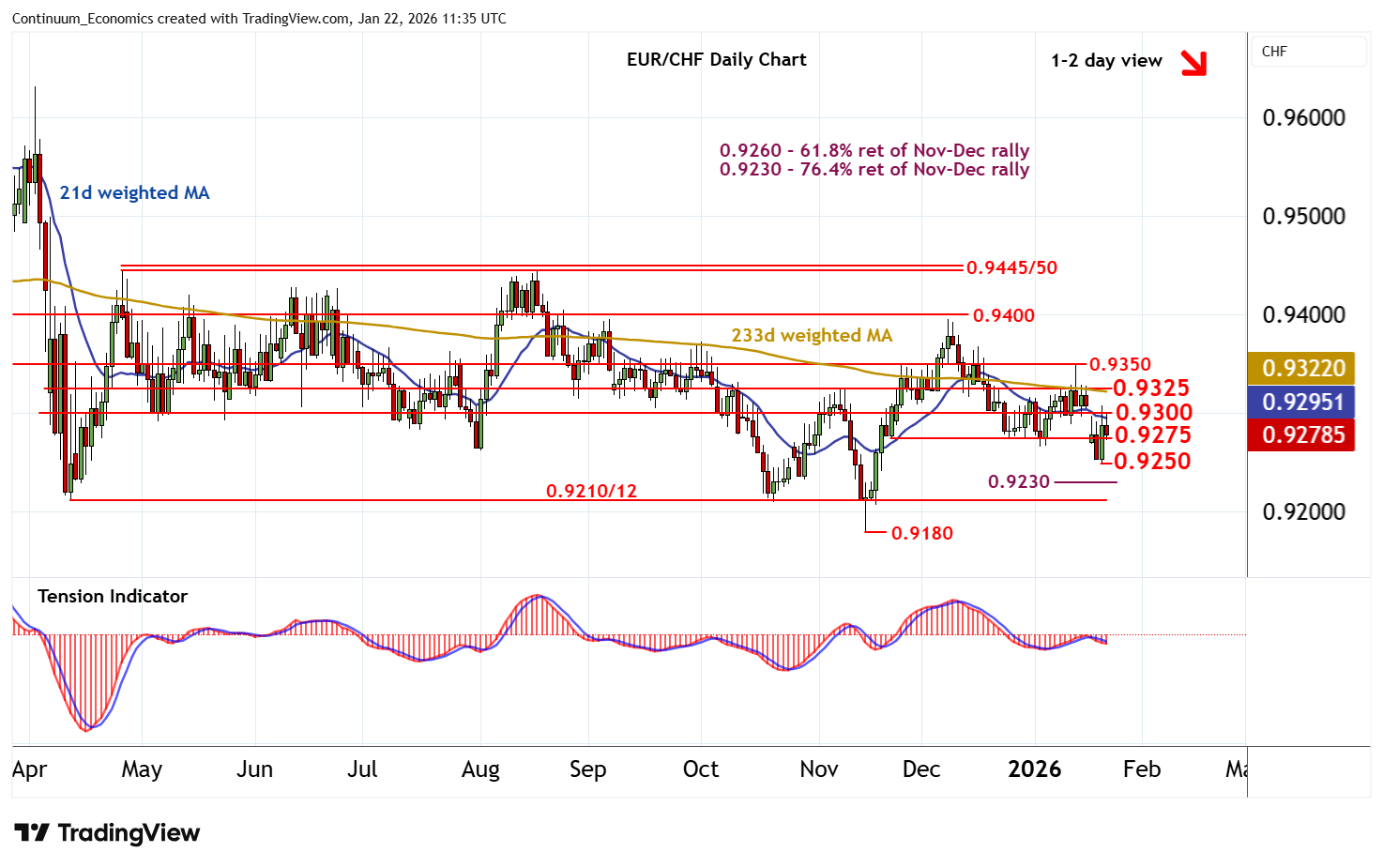

Chart EUR/CHF Update: Cautious trade - background studies under pressure

The retest above 0.9275 has been pushed back from congestion resistance at 0.9300

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.9400 | ** | congestion | S1 | 0.9275 | * | congestion lows | |

| R3 | 0.9350 | ** | congestion | S2 | 0.9250 | 21 Jan low | ||

| R2 | 0.9325 | congestion | S3 | 0.9230 | ** | 76.4% ret of Nov-Dec rally | ||

| R1 | 0.9300 | ** | congestion | S4 | 0.9210/12 | ** | Apr-Oct (y) lows |

Asterisk denotes strength of level

11:10 GMT - The retest above 0.9275 has been pushed back from congestion resistance at 0.9300, as intraday studies turn down, with prices currently balanced around 0.9280. A break back below 0.9275 cannot be ruled out. But mixed daily readings are expected to limit initial scope in consolidation above the 0.9250 low of 21 January, before deteriorating weekly charts prompt further losses towards the 0.9230 Fibonacci retracement. By-then oversold daily stochastics could promote short-covering/consolidation. Meanwhile, a break back above 0.9300, if seen, is expected to give way to consolidation beneath further congestion around 0.9325.