Published: 2025-02-18T09:14:49.000Z

Chart EUR/CHF Update: Consolidating - studies under pressure

Senior Technical Strategist

-

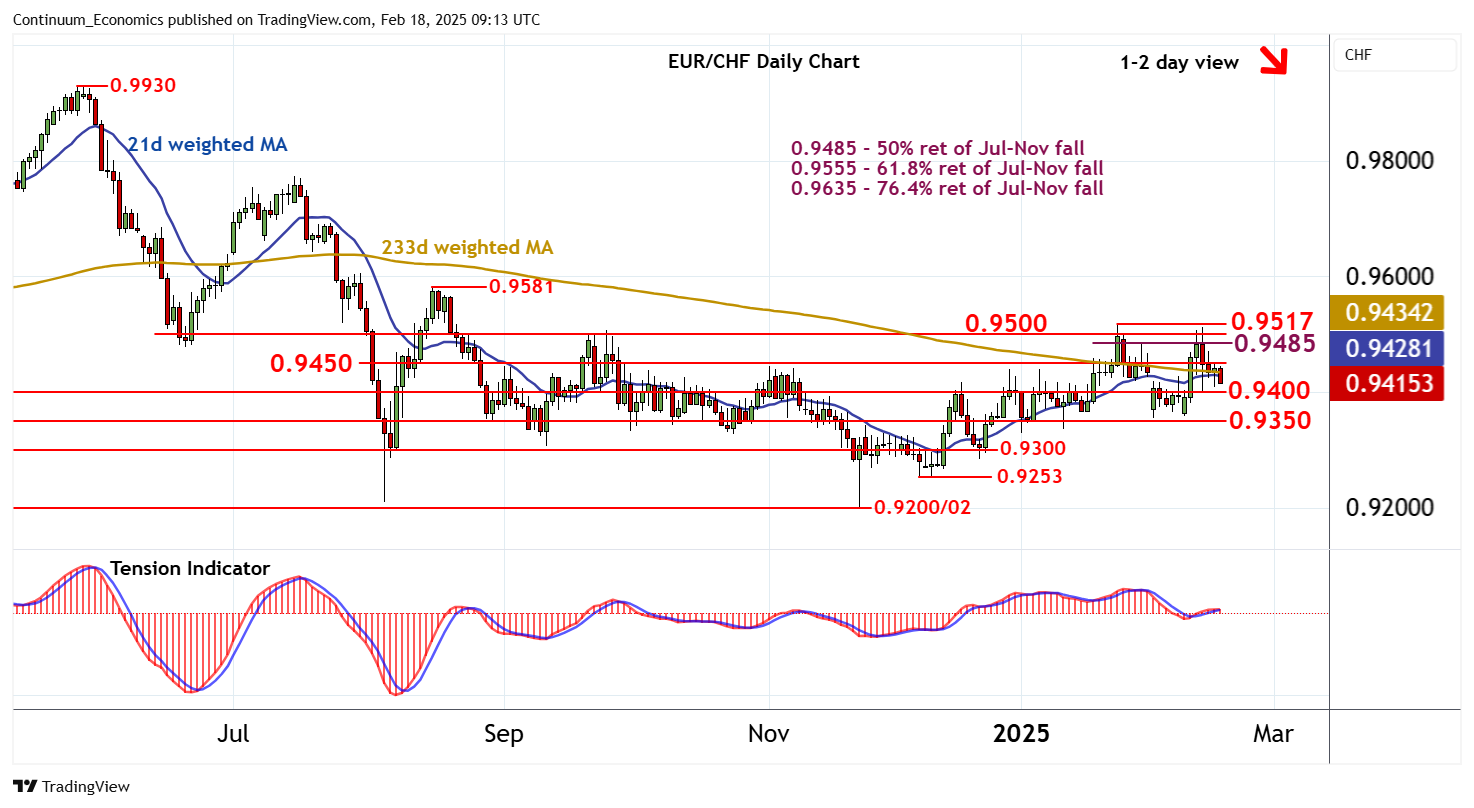

Little change, as prices extend cautious trade within the 0.9400 - 0.9450 range

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 0.9517 | ** | 24 Jan YTD high | S1 | 0.9400 | ** | congestion | |

| R3 | 0.9500 | ** | break level | S2 | 0.9350 | * | congestion | |

| R2 | 0.9485 | ** | 50% ret of Jul-Nov fall | S3 | 0.9300 | * | congestion | |

| R1 | 0.9450 | * | break level | S4 | 0.9253 | ** | 6 Dec (m) low |

Asterisk denotes strength of level

09:10 GMT - Little change, as prices extend cautious trade within the 0.9400 - 0.9450 range. Intraday studies have turned down and daily readings remain bearish, highlighting room for renewed losses in the coming sessions. A break below congestion support at 0.9400 will add weight to sentiment and extend January losses towards further congestion around 0.9350. A close beneath here will signal a near-term top in place at the 0.9517 current year high of 24 January, and open up 0.9300. Meanwhile, a close above resistance at the 0.9450 break level, if seen, will turn sentiment neutral and prompt consolidation beneath strong resistance within the 0.9485 - 0.9517 area.