Published: 2025-06-27T08:13:25.000Z

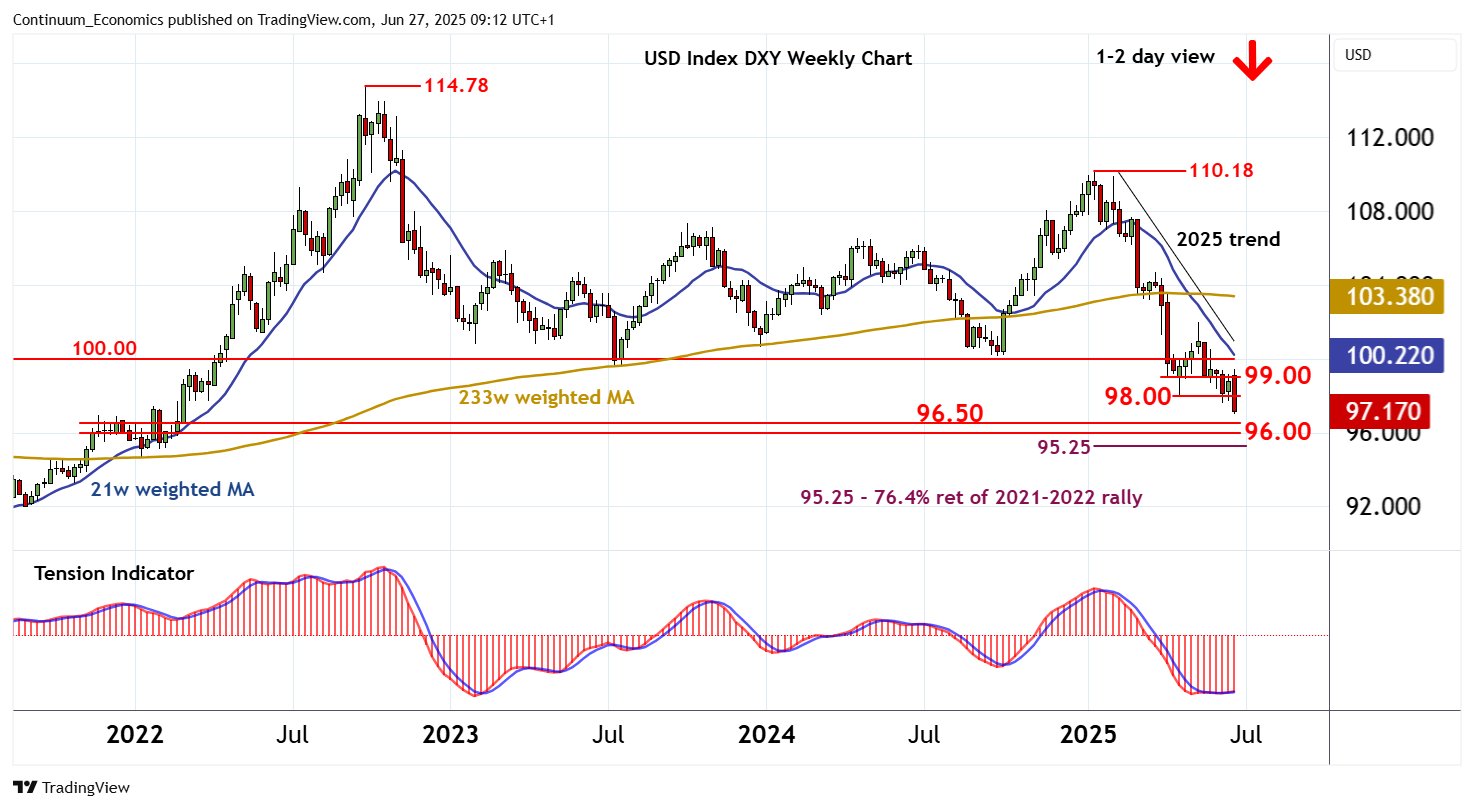

Chart USD Index DXY Update: Balanced above year lows - studies under pressure

Senior Technical Strategist

4

Little change, as mixed intraday studies keep near-term sentiment cautious

| Levels | Imp | Comment | Levels | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 99.50 | congestion | S1 | 97.00 | 26 Jun YTD low | |||

| R3 | 99.00 | break level | S2 | 96.50 | * | congestion | ||

| R2 | 98.00 | * | congestion | S3 | 96.00 | ** | congestion | |

| R1 | 97.60 | * | 12 Jun (w) low | S4 | 95.25 | ** | 76.4% ret of 2021-2022 rally |

Asterisk denotes strength of level

09:00 BST - Little change, as mixed intraday studies keep near-term sentiment cautious and prompt consolidation above the 97.00 fresh year low of 26 June. Daily readings continue to track lower and broader weekly studies are under pressure, highlighting room for further losses in the coming sessions. A break below 97.00 will put focus on congestion around 96.50, with room for continuation down to further congestion around 96.00. Extension to the 95.25 Fibonacci retracement cannot be ruled out, but already oversold weekly studies could limit any initial tests in consolidation. Meanwhile, resistance is up to congestion around 98.00. A close above here, if seen, will help to stabilise price action and prompt consolidation beneath 99.00.