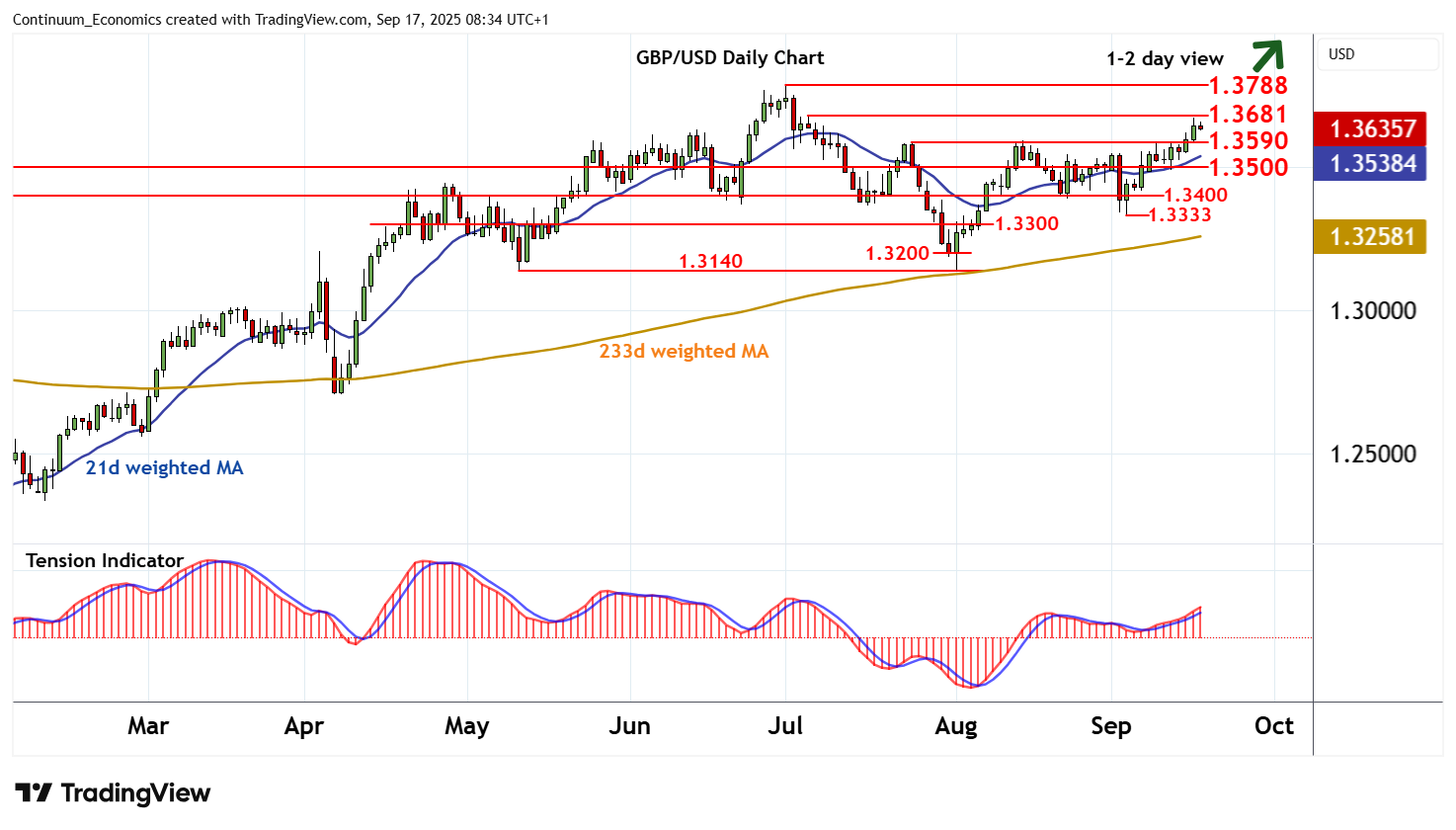

Chart GBP/USD Update: Consolidating August gains - background studies rising

The run towards resistance at the 1.3681 high of 4 July is giving way to a minor pullback

| Level | Comment | Level | Comment | |||||

|---|---|---|---|---|---|---|---|---|

| R4 | 1.3835 | October 2021 high | S1 | 1.3590/00 | ** | 24 Jul (w) high; cong | ||

| R3 | 1.3800 | * | historic congestion | S2 | 1.3500 | ** | congestion | |

| R2 | 1.3788 | ** | 1 Jul YTD high | S3 | 1.3400 | * | congestion | |

| R1 | 1.3681 | 4 Jul high | S4 | 1.3333 | * | 3 Sep low |

Asterisk denotes strength of level

08:10 BST - The run towards resistance at the 1.3681 high of 4 July is giving way to a minor pullback, as intraday studies turn down and overbought daily stochastics flatten, with prices currently trading around 1.3835. Focus is turning to support at the 1.3590 weekly high of 24 July and congestion around 1.3600. But the rising daily Tension Indicator and improving weekly charts are expected to limit any tests in renewed buying interest. A close beneath here, if seen, will turn sentiment neutral and prompt consolidation above congestion support at 1.3500. Following corrective trade, fresh gains are looked for. A later break above 1.3681 will improve price action and extend August gains towards critical resistance at the 1.3788 current year high of 1 July.