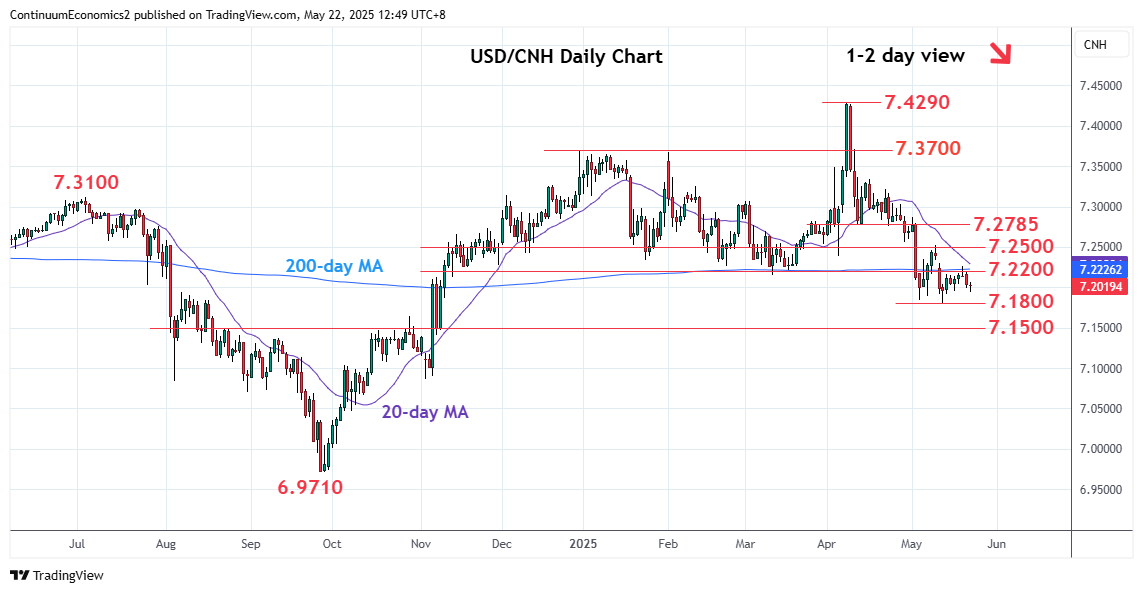

Limited above the 7.2200 resistance as prices turned down from the 7.2265 high and unwind overbought intraday studies

| Level | Imp | Comment | Level | Imp | Comment | |||

|---|---|---|---|---|---|---|---|---|

| R4 | 7.3000 | * | congestion | S1 | 7.1800/90 | ** | congestion, 13 May YTD low | |

| R3 | 7.2785 | ** | 14 Apr low, 38.2% | S2 | 7.1650 | * | Oct high | |

| R2 | 7.2500/65 | * | congestion, 29 Apr low | S3 | 7.1500 | * | congestion | |

| R1 | 7.2200 | * | congestion | S4 | 7.1460 | * | 61.8% Sep/Apr rally |

Asterisk denotes strength of level

05:50 GMT - Limited above the 7.2200 resistance as prices turned down from the 7.2265 high and unwind overbought intraday studies. break of the 7.2000 level expose the 7.1800/7.1790 low to retest. Break here will extend losses from the 7.4290, April current year high, and see room to the 7.1650 high of October. Lower will see extension to the 7.1500 congestion and 7.1460, 61.8% Fibonacci level. Meanwhile, resistance remains at 7.2200 congestion which is expected to cap and sustain losses from the April YTD high.